US Dollar stabilizes at104.00 in the DXY just hours before Trump's announcement

- The Greenback starts to loose ground against most major peers on Wednesday.

- US President Trump is set to announce reciprocal tariffs on Wednesday.

- The US Dollar Index trades stable around 104.10, while looking for any sort of driver.

The US Dollar Index (DXY), which tracks the performance of the US Dollar (USD) against six major currencies, starts to turn red and dips below 104.00 at the time of writing on Wednesday, while equities sell off and bond yields drop. The Greenback remains sidelined just hours before United States (US) President Donald Trump announces the reciprocal tariff implementation at the White House at 20:00 GMT. The White House and the Trump administration are very sketchy in details, and until now, it remains unclear what the tariffs will mean for markets.

On the economic data releases, this Wednesday’s main event was the Automatic Data Processing (ADP) private sector employment data. As per usual in the Nonfarm Payrolls (NFP) week, the ADP number precedes the official NFP number from the Bureau of Labor Statistics (BLS). Although there is no real correlation between the NFP and the ADP numbers for the private sector, this Wednesday's upbeat numer sets the tone for expectations for Friday.

Daily digest market movers: All ignored

- The ADP Employment Change data for March jumped to 155,000, beating the 105,000 expectation in new employment compared to 77,000 in February.

- At 14:00 GMT, the February Factory Orders data will be released. Expectations are for a softer increase of 0.5% compared to the previous 1.7% seen in January.

- At 20:00 GMT, the main event for this Wednesday, US President Donald Trump will announce wide-ranging tariffs in an event he named "Liberation Day." The moves could significantly affect global trade and financial assets.

- US equities are showing their resilience and are on the brink of turning green while European equities are stuck with a loss.

- According to the CME Fedwatch Tool, the probability of interest rates remaining at the current range of 4.25%-4.50% in May’s meeting is 85.5%. For June’s meeting, the odds for borrowing costs being lower stand at 74.4%.

- The US 10-year yield trades around 4.14%, just above its fresh monthly low of 4.10 as bonds are bid as safe haven resort.

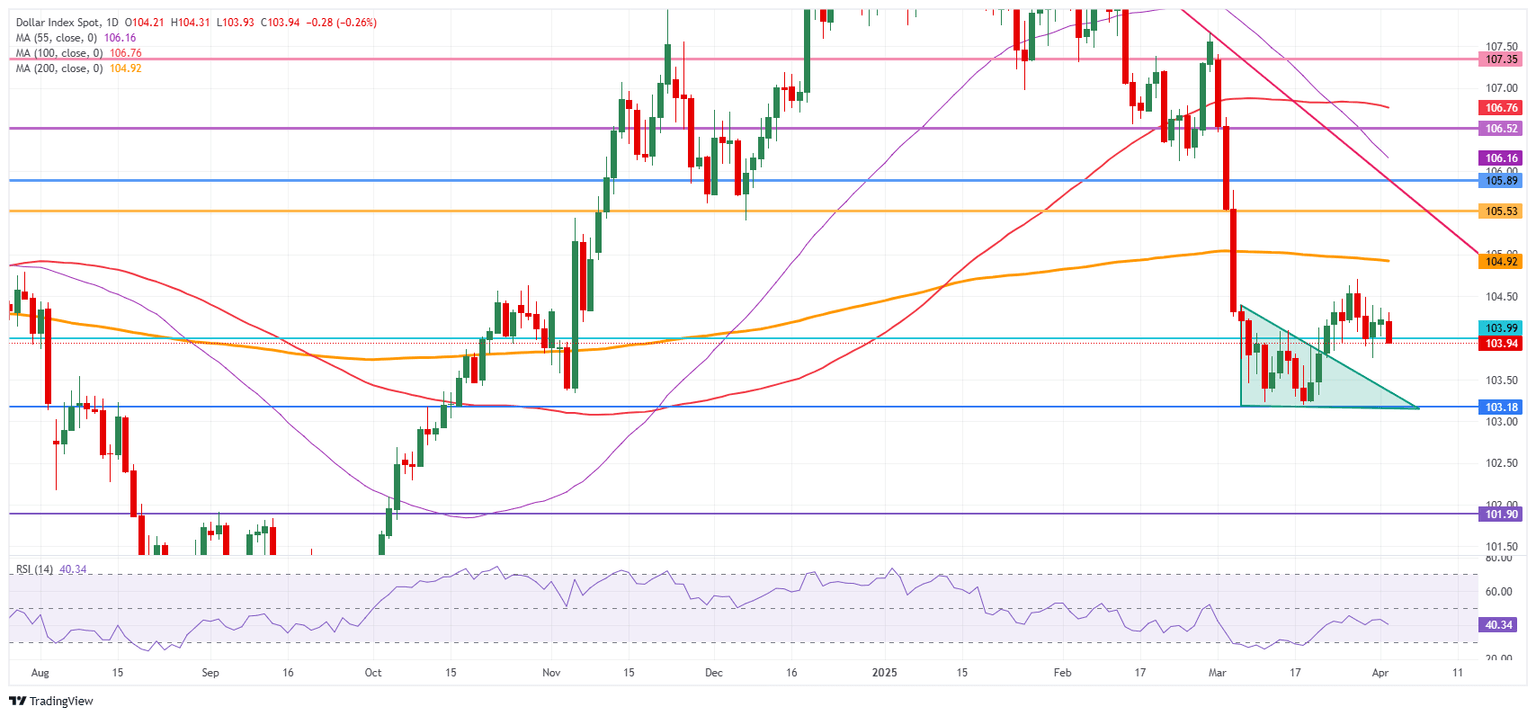

US Dollar Index Technical Analysis: False break, wait and see

The US Dollar Index (DXY) could see again no big moves or changes even after Trump’s announcement of “Liberation Day”. Traders are still left in the dark about the impact of all these levies and tariffs on the US and the global economy. While a local US recession would see a substantially lower US Dollar, a global slowdown would benefit and strengthen the Greenback as a safe haven asset.

In that case, a return to the 105.00 round level could still occur in the coming days, with the 200-day Simple Moving Average (SMA) roughly converging at that point and reinforcing this area as a strong resistance at 104.93. Once broken through that zone, a string of pivotal levels, such as 105.53 and 105.89, could limit the upward momentum.

On the downside, the 104.00 round level is the first nearby support, although it looks bleak after being tested since Friday. If that level does not hold, the DXY risks falling back into that March range between 104.00 and 103.00. Once the lower end at 103.00 gives way, watch out for 101.90 on the downside.

US Dollar Index: Daily Chart

Fed FAQs

Monetary policy in the US is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability and foster full employment. Its primary tool to achieve these goals is by adjusting interest rates. When prices are rising too quickly and inflation is above the Fed’s 2% target, it raises interest rates, increasing borrowing costs throughout the economy. This results in a stronger US Dollar (USD) as it makes the US a more attractive place for international investors to park their money. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates to encourage borrowing, which weighs on the Greenback.

The Federal Reserve (Fed) holds eight policy meetings a year, where the Federal Open Market Committee (FOMC) assesses economic conditions and makes monetary policy decisions. The FOMC is attended by twelve Fed officials – the seven members of the Board of Governors, the president of the Federal Reserve Bank of New York, and four of the remaining eleven regional Reserve Bank presidents, who serve one-year terms on a rotating basis.

In extreme situations, the Federal Reserve may resort to a policy named Quantitative Easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system. It is a non-standard policy measure used during crises or when inflation is extremely low. It was the Fed’s weapon of choice during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy high grade bonds from financial institutions. QE usually weakens the US Dollar.

Quantitative tightening (QT) is the reverse process of QE, whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing, to purchase new bonds. It is usually positive for the value of the US Dollar.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.