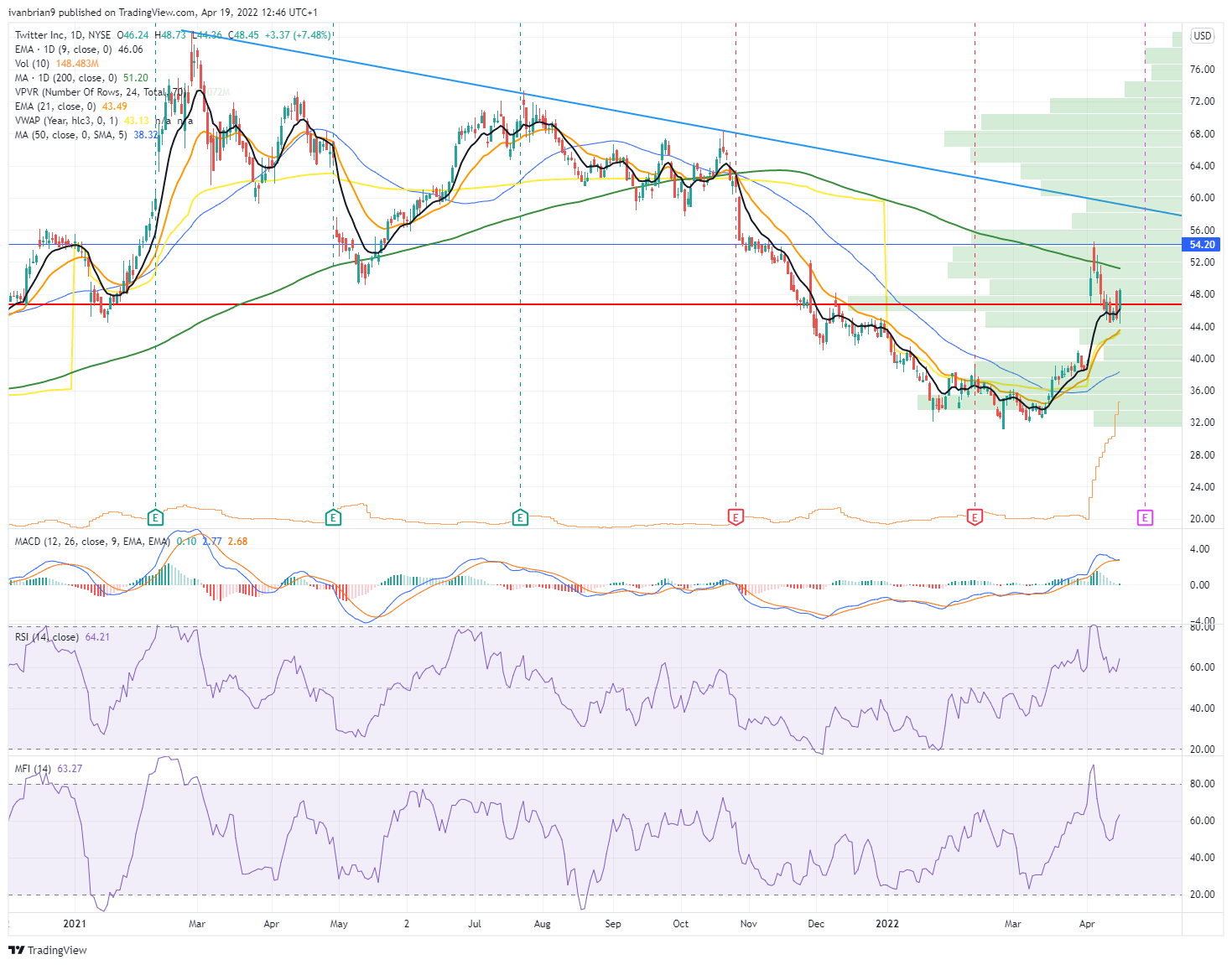

Twitter Stock News and Forecast: What is a poison pill for TWTR stock?

- Twitter stock rose over 7% on Monday to $48.45.

- Elon Musk previously tabled a $54.20 bid for TWTR.

- Twitter rejected Musk's offer and adopted a poison pill defense.

Twitter (TWTR) stock rallied sharply on Monday as speculation intensified over potential bidders for the company. Latest reports show the company appears to definitely be in play with multiple suitors lined up to challenge Musk's bid. If you have been living under a rock, Elon Musk unveiled a 9.2% stake in Twitter only a couple of weeks ago. The Twitter board offered Musk a seat, which he rejected. This was likely an attempt at a "keep your enemy closer" strategy as board members cannot launch a takeover bid for the company. The rejection put Twitter in play, and subsequently Elon Musk offered to buy the remainder of TWTR stock for $54.20 in cash. He stated it was his final offer.

Twitter Stock News

Twitter apparently decided to fight Elon Musk's offer using what is known as a poison pill mechanism. Just what is a poison pill? Basically, it is akin to money printing – companies just print new shares to defend themselves. This puts more shares in play, meaning any potential buyer is diluted. A poison pill means that all shareholders except Elon Musk can buy shares in a discounted issue. Elon Musk's stake would be diluted while other holders get the chance to maintain their holding. In this case, Twitter has set the level at 15%. It can begin issuing shares if Musk goes over this threshold.

Musk may be about to face competition in his quest to land Twitter if the latest reports are to be believed. Apollo Global is reportedly interested in some form of participation in the deal, according to The Wall Street Journal. The WSJ article elaborated that Apollo Global could be in line to provide financing for the deal. Whether that is to Musk or another bidder remains to be seen. The New York Post said in an article on April 15 that Musk was speaking to investors that could partner with him on any deal for Twitter. Musk has a large fortune, but it is largely due to his Tesla holding. So to pay up for Twitter he could sell some of his Tesla shares or seek financing from private equity or Wall Street Investment Banks. The New York Post article mentions Silver Lake as a potential partner. Silver Lake reportedly was involved in 2018 when Elon Musk was planning to take Tesla private. Back in 2018 was the origin of the "funding secured" tweet, which ended up with a slap on the wrist from the Securities & Exchange Commission and a Twitter check for Elon's future tweets.

There has also been talk that Thomas Bravo will enter the bidding. Thomas Bravo is a private equity firm and is looking at possibilities, according to Bloomberg and Reuters.

Twitter Stock Forecast

The spike from the initial announcement brought Twitter naturally up to Elon Musk's offer price at $54.20. Interestingly the price has never breached this level, meaning the market is not very confident that another buyer will emerge. It is not unusual for a stock to trade higher than a proposed takeover offer if the market believes other bidders will emerge. What we are witnessing here is the market's lack of confidence in Elon Musk getting his bid through as there are question marks over how he raises the cash. Twitter naturally went overbought on both Money Flow Index (MFI) and the Relative Strength Index (RSI) when the stock spiked. Now, these are back at normal levels. The stock remains in a classic downtrend, but short-term news flow will generate plenty of volatility, so traders need to keep aware of this.

Twitter (TWTR) stock chart, daily

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ivan Brian

FXStreet

Ivan Brian started his career with AIB Bank in corporate finance and then worked for seven years at Baxter. He started as a macro analyst before becoming Head of Research and then CFO.