Twitter Stock News and Forecast: TWTR still waiting for Musk deal to go through

- TWTR stock falls sharply on Friday morning in pre-market.

- Elon Musk chatter spikes based on Bloomberg reporter tweet.

- Twitter deal still set to complete on Friday, October 28.

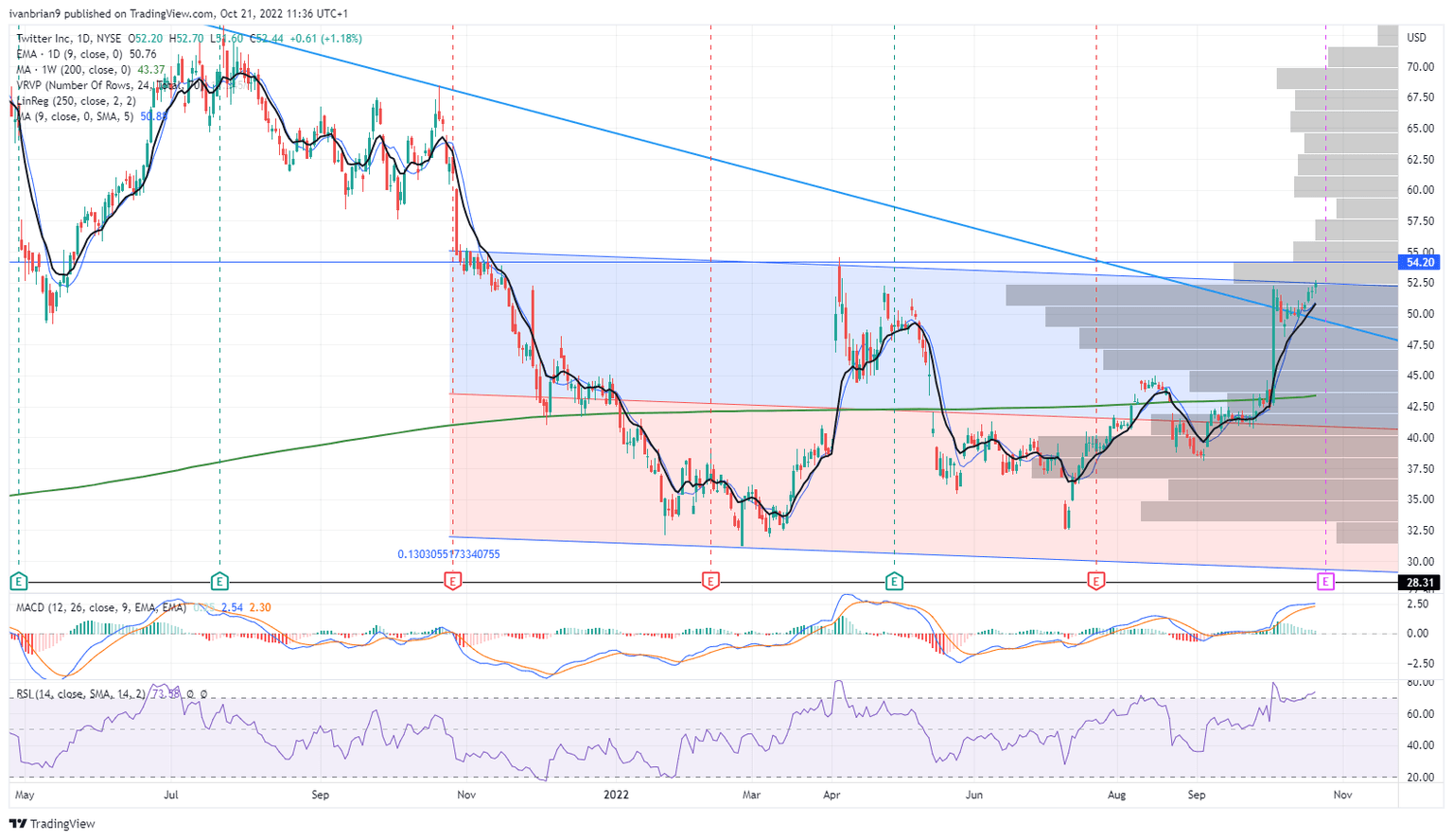

Twitter (TWTR) is once again frustrating merger arb players but perhaps offering up another opportunity to some who shied away from the trade. When the deal was first announced, I wrote about how the risk-reward seemed skewed lower when Twitter had spiked to north of $52. There was a potential gain of $2.20 (the deal price is $54.20) versus a larger downside if the deal did not push through. In recent weeks Twitter stock has pushed back above $50 as it seemed the parties were set to finally see the deal through. News this morning sees TWTR once again sell off sharply, and at the time of writing it is trading at $48.25 in Friday's premarket.

Twitter stock news

One must assume the reason for the sell-off is fear the deal once again gets delayed or falls through. A tweet from Jennifer Jacobs, a Bloomberg White House reporter, seems to be the cause for concern. We have to give kudos to the reply from Musk himself.

Musk has previously said he thinks that he and his fellow investors are overpaying for Twitter. "Although obviously myself and the other investors are obviously overpaying for Twitter, the long term potential for Twitter in my view is in an order of magnitude greater than its current value", Musk said during the latest Tesla earnings call. Overpaying in the short term to get long-term potential seems to be the theory. The Washington Post reports that Musk is planning to take tough action.

NEW: Elon Musk said he would cut nearly 75 percent of Twitter's staff if he takes control, far deeper cuts than the company's current leadership has proposed. The initial cuts would target lower performers, who scored less than a 3 on performance reviews. https://t.co/xcd8nQdw15

— Faiz Siddiqui (@faizsays) October 20, 2022

Twitter stock forecast

Never a dull moment here. The deal is supposed to close one week from now on Friday, October 28. Not long to go, but now Twitter is trading at $6.10 below the deal price at the time of writing. For merger arb players, that is a premium of 12%-plus for the space of a week if the deal goes through. That would usually be more than enough to tempt arbitrage players into the market.

This is not a technical analysis play. It is a deal play. $54.20 is the deal price. Support is at $43 from the 200-week moving average. On the previous occasion when it looked like the deal was off, Twitter settled around $40. These levels can perhaps be looked at as support zones, but this is a deal play, plain and simple.

TWTR stock, daily

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ivan Brian

FXStreet

Ivan Brian started his career with AIB Bank in corporate finance and then worked for seven years at Baxter. He started as a macro analyst before becoming Head of Research and then CFO.

-638019493757344745.png&w=1536&q=95)