TSLA Stock News and Forecast: Tesla raises prices in China

- Tesla stock finished Wednesday strongly, closing up 4.2%.

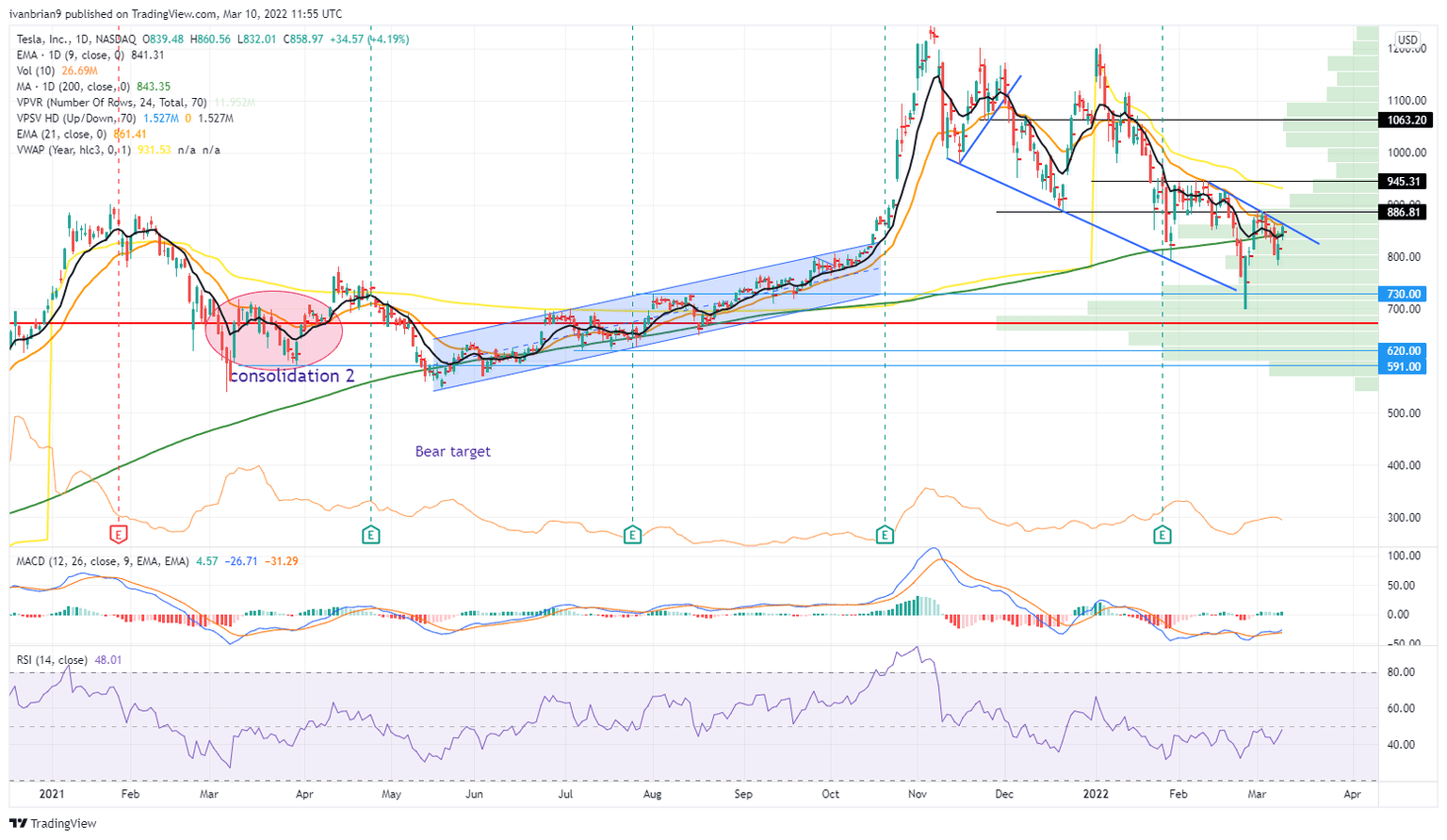

- TSLA stock remains in a downtrend until it can break $945.

- Tesla reportedly raising prices in China for its Model Y and Model 3 cars.

Tesla stock (TSLA) soared on Wednesday despite oil prices collapsing. Rising oil prices can be said to be advantageous for Tesla as they speed up consumers switching over to fully electric cars. Rising oil prices make Tesla's competitors more expensive. Recent web traffic data for electric car searches has increased since oil prices spiked, and this trend is not likely to change. The switch to EVs was evident beforehand, but this oil spike has merely sped up the process.

Ordinarily, that could be said to be advantageous to EV makers. The caveat is that most EV makers are high-growth stocks and trade on high multiples (P/E, etc). This is also true of Tesla. The current environment is not kind to high-growth stocks. Tesla should be an outperformer, but others in the sector such as Lucid (LCID) and Rivian (RIVN) have seen huge price falls this year. Tesla is down 18% year to date. LCID stock is down 34%, and Rivian stock is down a massive 58% year to date, so the sector is performing as it should. The more established and slightly less high growth Tesla is winning hands down, while the others are getting hammered.

Tesla Stock News

We live in an inflationary environment, and that is likely to get worse before it gets better. Inflation may have been on track to ease by the end of 2022, but now surging commodity and energy prices due to the Ukraine conflict have pushed that prospect out by at least a year and longer depending on how long the conflict and sanctions last. Tesla is not immune to such problems and has just announced it is raising prices in China for its Model 3 and Model Y cars.

According to CNEVPost, Tesla has increased Model Y and Model 3 prices by $1,582 for cars from its Giga Shanghai plant. Delivery dates were also pushed out by four weeks. This comes on the back of price rises of nearly $1,000 for some Tesla model variants in the US, reported by Electrek on Wednesday. Nickel, a key component in EV batteries, has soared in price. Tesla CEO Elon Musk had earlier mocked Rivian for raising prices, which it subsequently backtracked on. We also note that Porsche has suspended production of its fully electric Taycan due to supply issues, so this is far from solely a Tesla problem.

“The supply chains for the Porsche plants are affected, which means that in some cases orderly production is no longer possible,” a company spokesperson told Benzinga.

Tesla Stock Forecast

The rally on Wednesday was impressive but has only brought TSLA stock back up to the top trendline. The stock is still in a bearish formation and is trading just around its 200-day moving average. A move back below the 200-day will bring the spike low from the start of the Ukraine conflict into focus. This is at $700.

TSLA stock chart, daily

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ivan Brian

FXStreet

Ivan Brian started his career with AIB Bank in corporate finance and then worked for seven years at Baxter. He started as a macro analyst before becoming Head of Research and then CFO.