TPR: Luxury fashion stock tapestry reacting higher from buying area

Tapestry, Inc. (formerly: Coach, Inc.) is a multinational luxury fashion holding company based in New York City, USA. The parent company owns three brands: Coach New York, Kate Spade New York and Stuart Weitzman. The stock of the company being a component of the S&P500 index can be traded under ticker $TPR at NYSE. Currently, we see cotton turning higher. Also, other soft commodities are moving up. Therefore, Tapestry being a heavy weight in the textile market should be a great opportunity for investors to diversify their portfolio by indirect investement in the rising prices of particularly soft commodities.

In the previous article from March 2022, we were providing next buying opportunity from 33.91-25.77 area. Now, reaction in 3 swings has happened already. Furthermore, we expect extension higher within a new cycle, Here, we provide an update discussing the targets.

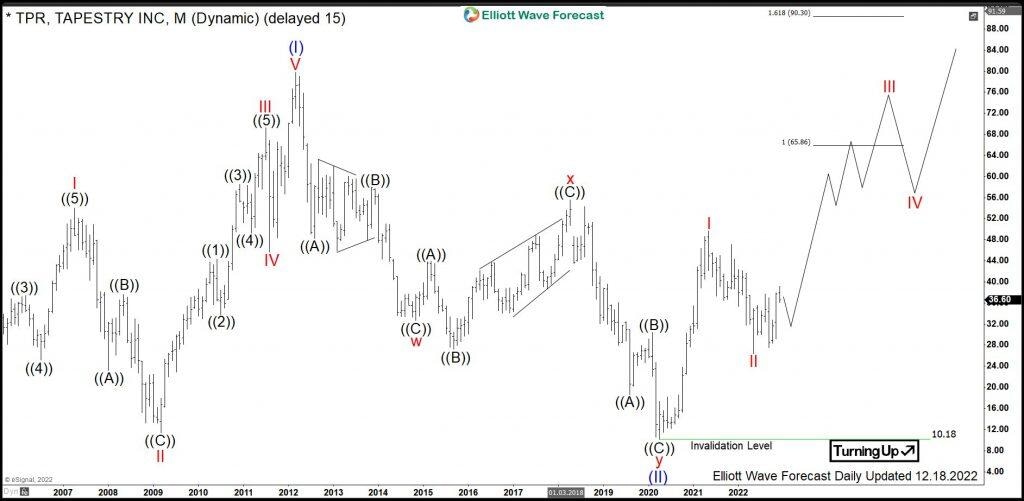

Tapestry monthly Elliott Wave analysis 12.18.2022

The Monthly chart below shows the Tapestry shares $TPR traded at NYSE. First, the stock price has developed a leading diagonal higher in blue wave (I) of super cycle degree. It has printed the all- time highs in March of 2012 at 79.70. From the highs, a correction lower in blue wave (II) has unfolded as an Elliott wave double three pattern. It has printed an important bottom in April of 2020 at 10.18. As a matter of fact, the stock price has lost 87% of its value in only 8 years. From the lows of April 2020, a nest comprising red waves I and II might be in place. While above 26.39 lows, the red wave III is in progress and can reach towards 65.86-90.30 area and even higher.

Tapestry daily Elliott Wave analysis 12.18.2022

The daily chart below shows the consolidation lower in red wave II correcting the cycle in red wave I from April 2020. Also, we see first stages of a new cycle in red wave III. From the May 2021 highs, correction in wave II was developing as a double three correction. Based on the connector from November 2021 at 47.05, we have explained previously 33.91-25.77 area. The stock price has reached it and reacted already in 3 swings. Traders should have taken partial profit already and be risk-free. Now, main view is more extension higher. Investors and traders should stay long from 33.91-25.77 area targeting 65.86-90.30 area in the medium term and 89.90-139.21 area and even higher in the long run.

Author

Elliott Wave Forecast Team

ElliottWave-Forecast.com