The next level I am buying Advanced Micro Devices

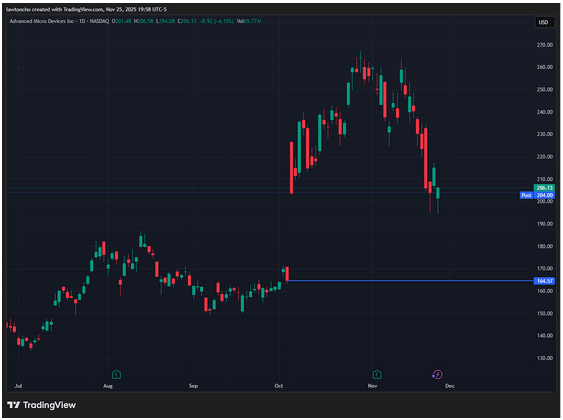

Advanced Micro Devices has been on my radar for years, and lately, I’ve been paying even closer attention as the stock has pulled back. AMD has fallen quite a bit as of late—down more than 23% from the all-time highs it reached back in October. Watching that kind of drop unfold in a relatively short period of time has reminded me how quickly momentum can shift, which is why I always lean heavily on my technicals to guide my next move.

Before getting into the specific level I’m watching, it’s worth stepping back and acknowledging AMD’s broader background. The company has built its name over decades as a major player in the semiconductor space, developing high-performance CPUs and GPUs that serve both consumer and enterprise markets. AMD’s long history of pushing innovation forward has allowed it to compete in areas ranging from personal computing to advanced data-center applications. That steady evolution is a big part of why I continue to follow the stock closely and why I’m patient when the market gives me opportunities to re-enter at more favorable levels.

During today’s trading session, AMD dropped more than 4% from yesterday’s close after reports that Google had developed its own chips. Headlines like this tend to shake sentiment in the short term, and as I watched the move unfold, I focused on where the stock was heading relative to the key technicals I’ve been tracking. For me, the next clear level of support sits around $164.50, which lines up with a previous gap fill from the beginning of October. If the stock continues to pull back, that’s the area I’m preparing for a potential buy. It’s the level where I’m anticipating a bounce, assuming the technical structure continues to hold.

As always, I’m approaching the trade with the same discipline I apply to everything in my portfolio: proper risk management comes first. No matter how strong a setup looks or how much I believe in a company long-term, I never ignore my rules. The chart gives me the levels, but risk management determines whether I take the trade.

Author

Lawton Ho

Verified Investing

A marketing expert sharing his journey to mastering the charts.