Stocks to watch after December's CPI report: CARS, CVNA, TSN

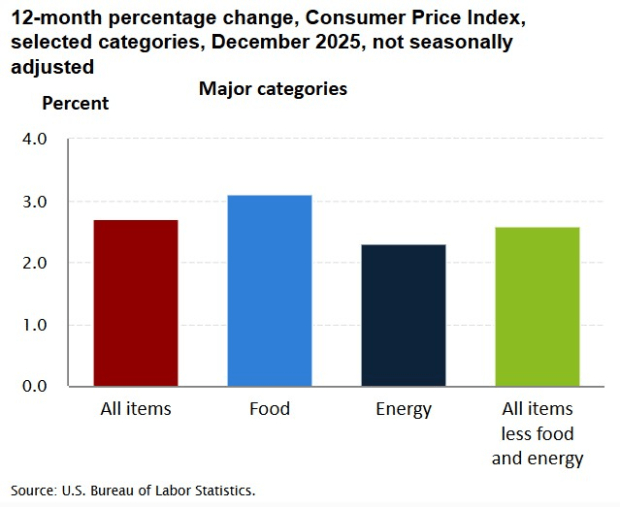

December’s CPI report showed inflation is stable but not necessarily improving in the way markets and the Federal Reserve may prefer. Still, when excluding the volatile categories of food and energy, core consumer prices rose at the slowest pace since March 2021, with a 0.2% monthly uptick and 2.6% yearly increase.

When including all categories, CPI was up 0.3% over the last month and 2.7% annually, with higher food prices standing out in particular, registering a 0.7% monthly uptick and a 3.1% annual increase. Although inflation has remained above the Fed’s preferred target of 2%, Core CPI cooled more than most economists anticipated.

That said, here are two stocks that are intriguing after December’s CPI report and one that may need to be avoided for now.

Image Source: U.S. Bureau of Labor Statistics

Cars.com and Carvana could benefit from lower used car prices

Although used cars and trucks prices remained 1.6% higher over the last year, they saw the biggest drop among all items, excluding food and energy, with a 1.7% unadjusted monthly decrease and a 1.1% monthly drop on a seasonally adjusted basis. Considering this may draw more buyers into the used car market, Cars.com (CARS - Free Report) and Carvana (CVNA - Free Report) could be beneficiaries as two of the largest online marketplaces for used cars in the U.S.

Cars.com’s stock sticks out with an attractive price of $12 a share and a cheap forward earnings multiple of just 5X. Starting to make the case for being undervalued, Cars.com stock currently lands a Zacks Rank #3 (Hold).

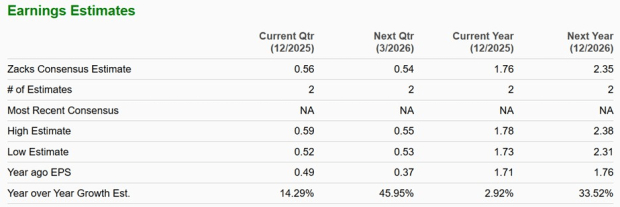

Leadership changes and insider selling have pressured Cars.com's stock, and while investor uncertainty remains high, CARS could be set for a nice rebound if the company starts to fulfill its intriguing EPS targets. To that point, Cars.com’s EPS is projected to leap another 33% in fiscal 2026 to $2.35, but it has been prone to missing quarterly earnings expectations, although the risk-to-reward is tempting.

*Cars.com will be reporting its Q4 2025 results on Thursday, February 26th.

Image Source: Zacks Investment Research

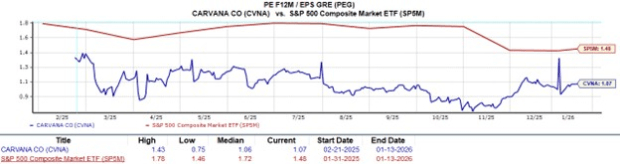

Carvana, on the other hand, has been more consistent in hitting its lofty growth targets as the self-described “fastest-growing used car retailer.” Becoming one of the leading platforms for buying and selling cars, Carvana stock has skyrocketed a mind boggling +6,000% in the last three years.

At over $450 a share and 64X forward earnings, CVNA is far from cheap but has justified a premium with FY25 EPS now expected to come in at $5.49, a 245% increase from $1.59 in 2024. Furthermore, FY26 EPS is projected to leap another 33% to $7.31.

It’s also noteworthy that Carvana’s PEG ratio is near 1X, with a mark at this level or lower, suggesting a stock may actually be undervalued when considering its long-term growth rate as the denominator to the P/E ratio. CVNA lands a Zacks Rank #3 (Hold) after soaring another +30% in the last three months.

*Carvana is scheduled to report Q4 2025 results on Wednesday, February 18th.

Image Source: Zacks Investment Research

December CPI Highlights Tyson Foods’ Struggles

Notably, meat, poultry, and fish prices were up nearly 7% YoY, attributed to a 16% uptick in beef and veal costs, which rose 1% monthly. Lower livestock has the price of ground beef edging toward $7 per pound, and higher food prices don’t automatically translate into higher profits for packaged-food companies or meat processors.

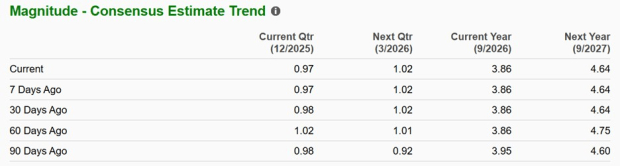

To that point, Tyson Foods (TSN - Free Report) is a prime example as the meat producer has been grappling with deeper losses within its beef segment due to severe cattle shortages and escalating input costs. When cattle supplies are tight, Tyson pays more for livestock, but can’t fully pass those costs to consumers.

This may eventually lead to better long-term buying opportunities once Tyson moves past the beef shortage, but TSN currently lands a Zacks Rank #4 (Sell) as EPS revisions could trend lower and are already modestly down over the last quarter for FY26 and FY27 EPS estimates have retracted again in the last 60 days.

Image Source: Zacks Investment Research

Want the latest recommendations from Zacks Investment Research? Download 7 Best Stocks for the Next 30 Days. Click to get this free report

Author

Zacks

Zacks Investment Research

Zacks Investment Research provides unbiased investment research and tools to help individuals and institutional investors make confident investing decisions.