Stocks to fall on Israel-Iran escalation

The S&P 500 is set to extend its consolidation: Is this a topping pattern?

Stock prices advanced on Thursday despite an initial pullback, with the S&P 500 closing 0.38% higher and extending its short-term fluctuations. However, this morning, the S&P 500 is expected to open 0.9% lower amid overnight news of the Iran-Israel conflict escalation. The market has since retraced a large part of its declines, however.

Investor sentiment has improved, as reflected in Wednesday’s AAII Investor Sentiment Survey, which reported that 36.7% of individual investors are bullish, while 33.6% are bearish.

The S&P 500 has extended its consolidation above the 6,000 level.

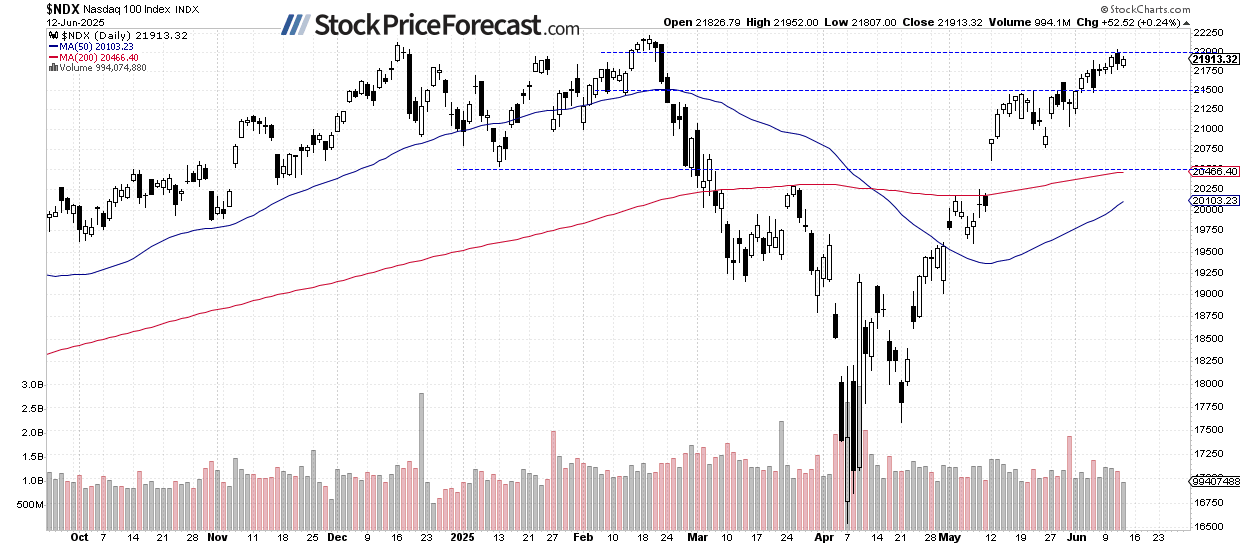

Nasdaq 100 pulls back from 22,000

The Nasdaq 100 closed 0.24% higher on Thursday, and today, it is set to open 1.1% lower. Today's trading is driven by Middle East developments, so the market is likely to be news-driven. However, the rebound from overnight lows may be considered a positive signal.

Support is around 21,700, while resistance remains at 22,000-22,200.

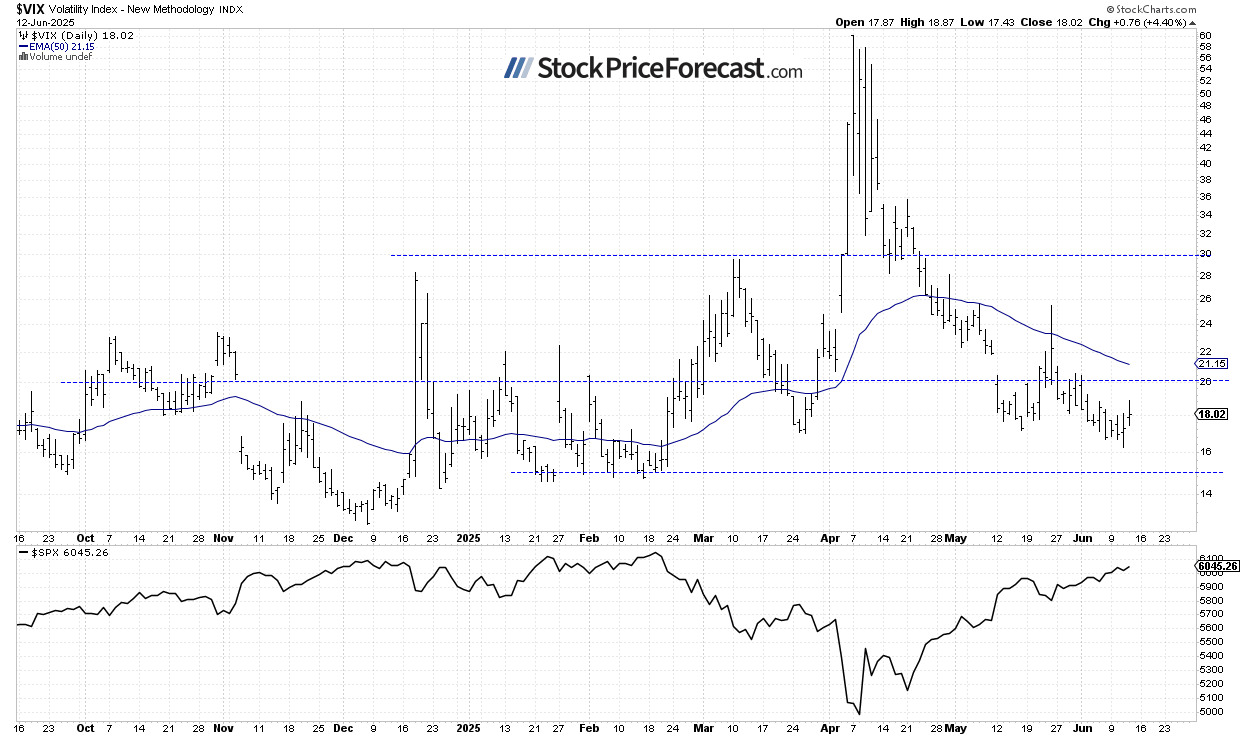

VIX remains below 20

The Volatility Index (VIX) fell to a local low of 16.23 on Wednesday, indicating reduced investor fear. Yesterday, it rebounded as stocks pulled back, but remained below the 20 level.

Historically, a dropping VIX indicates less fear in the market, and rising VIX accompanies stock market downturns. However, the lower the VIX, the higher the probability of the market’s downward reversal. Conversely, the higher the VIX, the higher the probability of the market’s upward reversal.

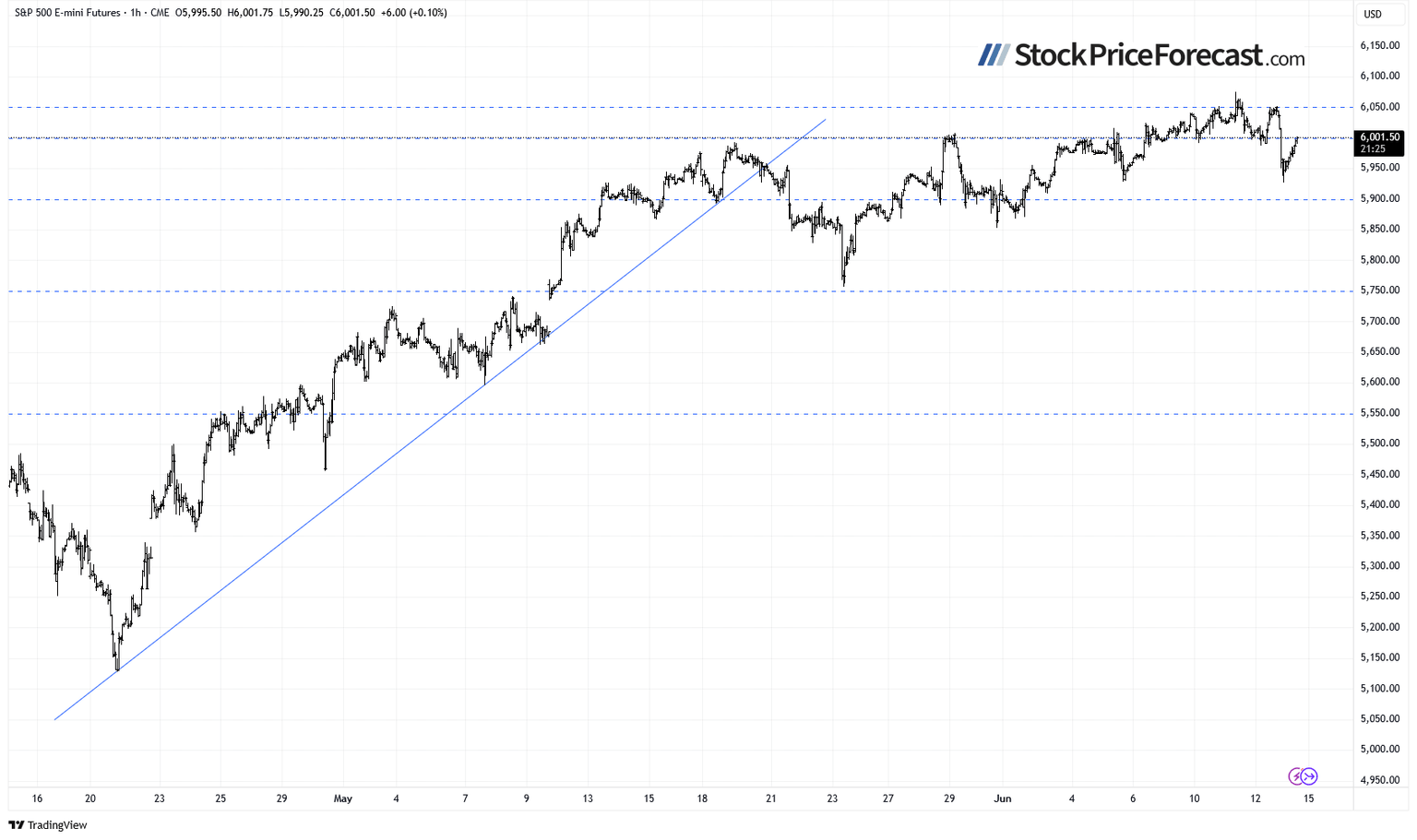

S&P 500 futures: Still around 6,000

This morning, the S&P 500 futures contract is rebounding from its overnight low of around 5,928, currently trading near the 6,000 level. It continues to fluctuate following its May advances. Support remains around 5,900-5,920, while resistance is at 6,050, among others.

Conclusion

Friday's trading session is likely to open on a negative note. However, sentiment has improved after the market rebounded from overnight lows. Investors will be waiting for key economic data this morning – the preliminary University of Michigan Consumer Sentiment reading along with University of Michigan Inflation Expectations. The market will also be paying attention to news concerning the Middle East conflict.

Here’s the breakdown:

- The S&P 500 is set to open lower due to Middle East crisis news.

- There are no clear bearish signals yet, but a deeper downward correction is not out of the question at some point.

Want free follow-ups to the above article and details not available to 99%+ investors? Sign up to our free newsletter today!

Author

Paul Rejczak

Sunshine Profits

Paul Rejczak is a stock market strategist who has been known for the quality of his technical and fundamental analysis since the late nineties.