Stocks climb higher – Will they test February highs?

Will Friday’s advance continue today?

Stocks advanced on Friday, with the S&P 500 gaining 1.03% and closing slightly above the 6,000 level - its highest close since February 21. The market resumed its uptrend following Thursday’s pullback, as investors reacted positively to a better-than-expected Nonfarm Payrolls report.

Today, the S&P 500 is expected to open 0.1% higher. I anticipate potential consolidation around the 6,000 level. The index is currently testing the January - February range after nearly retracing its entire tariff-related decline.

Investor sentiment remained mixed, as reflected in the Wednesday’s AAII Investor Sentiment Survey, which reported that 32.7% of individual investors are bullish, while 41.4% are bearish.

The S&P 500 continues to trade near the resistance of around 6,000.

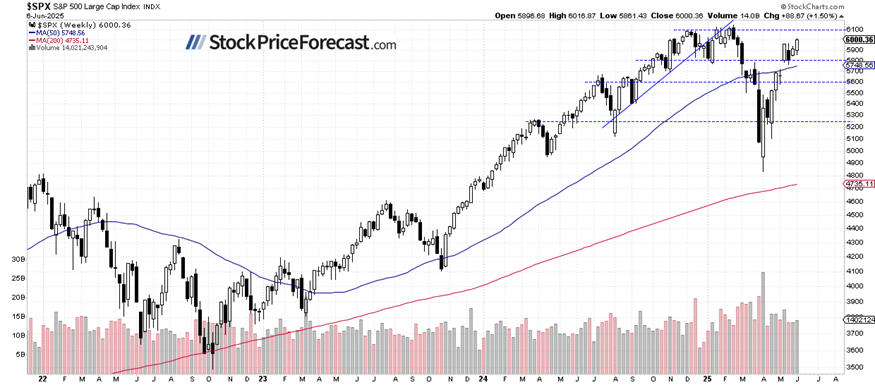

S&P 500: Another weekly advance

The S&P 500 ended the week 1.50% higher compared to the previous Friday. While the market extended its uptrend, gains were relatively modest.

The index is still trading above the early May weekly gap-up, which is a bullish technical signal. However, resistance is now around 6,100.

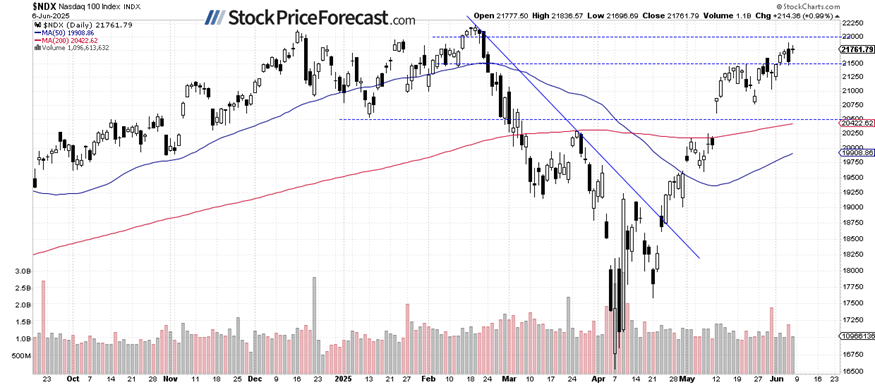

Nasdaq 100: Relatively weaker

The Nasdaq 100 gained 0.99% on Friday but remained below Thursday’s local high. The 0.8% drop on Thursday means Friday’s rebound was more of a consolidation move than a breakout. Today, the tech-heavy index is expected to open virtually flat.

Support is around 21,500, while resistance is at 22,000-22,200.

VIX dipped below 17

The Volatility Index (VIX) fell to a local low of 16.65 on Friday, indicating reduced investor fear.

Historically, a dropping VIX indicates less fear in the market, and rising VIX accompanies stock market downturns. However, the lower the VIX, the higher the probability of the market’s downward reversal. Conversely, the higher the VIX, the higher the probability of the market’s upward reversal.

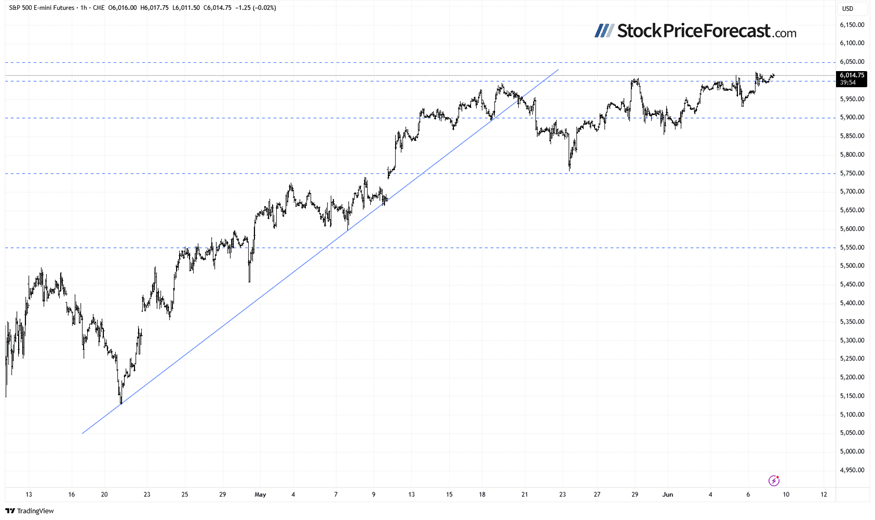

S&P 500 futures: Above 6,000

This morning, the S&P 500 futures contract is trading above 6,000, moving sideways after Friday’s strong session..

The nearest support is now near 5,950, while resistance is at 6,020, followed by 6,050.

Conclusion

The S&P 500 is set to open slightly higher today, continuing Friday’s positive sentiment. Investors are cautiously optimistic ahead of key economic data releases this week, including the Consumer Price Index (CPI) report on Wednesday.

Will the uptrend continue? There are currently no strong negative signals, but recent volatility suggests uncertainty. The market may "climb a wall of worry," or it may consolidate around the 6,000 level.

Here’s the breakdown:

-

The S&P 500 broke above the 6,000 level on Friday.

-

No clear bearish signals, but upside may be limited due to ongoing tariff concerns.

Want free follow-ups to the above article and details not available to 99%+ investors? Sign up to our free newsletter today!

Want free follow-ups to the above article and details not available to 99%+ investors? Sign up to our free newsletter today!

Author

Paul Rejczak

Sunshine Profits

Paul Rejczak is a stock market strategist who has been known for the quality of his technical and fundamental analysis since the late nineties.