Stock market bottom? Here’s what this seasonality chart says [Video]

![Stock market bottom? Here’s what this seasonality chart says [Video]](https://editorial.fxstreet.com/images/Markets/Equities/SP500/wall_street_nyse4-637299025173341169_XtraLarge.jpg)

Based on this seasonality chart of the U.S. midterm elections for the past 72 years, the stock market could be already entering into the bottoming process. Seasonality or cyclical charts are often used in analogue comparison in the Wyckoff trading method although history doesn’t repeat itself, but it often rhymes.

It is really uncanny to see how S&P 500 moved as per this seasonality chart in the first half of 2022. Click and watch the video below on YouTube (Pro Tip: adjust the speed to 1.5–2X).

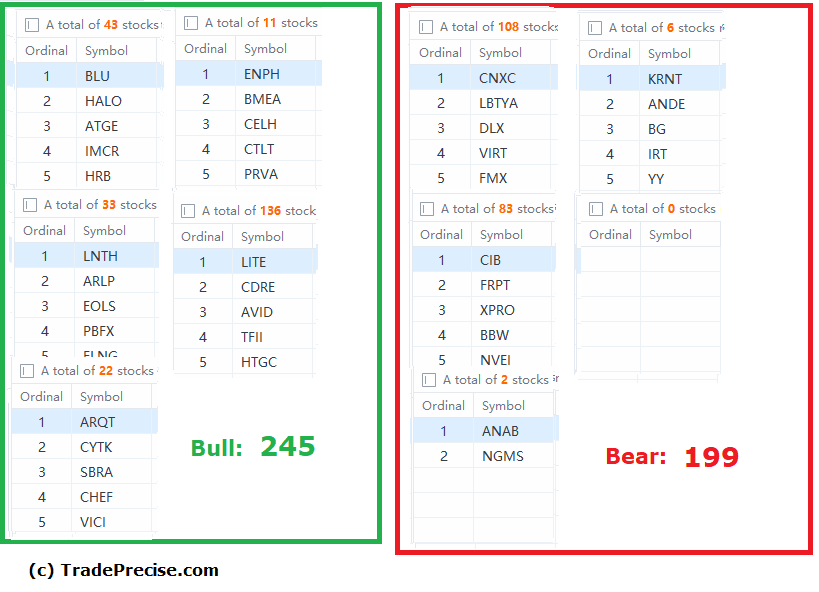

The bullish setup vs. the bearish setup is 245 to 199 from the screenshot of my stock screener below. The sharp drop in the bearish setup and mild increase in the bullish setup from last week are encouraging signs for the bullish scenario, which is also reflected in the improvement of the market breadth as explained last week.

Should the bottoming process unfold like the seasonality chart as shown in the video, outperforming stocks will start to move up and could be the future leadership in the next bull run. Visit TradePrecise.com to get more stock market insights in email for free.

Author

Ming Jong Tey

Independent Analyst

Ming Jong Tey has been trading since 2008. He started his learning journey from technical analysis (indicators, Fibonacci, etc...) to value investing. Throughout his journey, he develops an interest in price action with chart pattern trading.