SPDR S&P 500 ETF Trust (SPY) Forecast: Netflix adds to earnings beats

- So far so good for earnings as Netflix surges afterhours.

- Tesla earnings come out after the close on Wednesday.

- Tuesday's rally stalled as investors remain scarred from recent buy-the-dip purges.

The equity market remains poised on Wednesday as it digests a strong showing from Netflix (NFLX) and waits for the next FANGT named Tesla (TSLA). Tesla earnings are out after the close and will be closely watched.

Tuesday saw an attempt for another strong rally to build on Monday's gains, but the move stalled. Bond markets remain stubborn, and Oil and Bitcoin also look like they are sitting out this rally for now. That is increasingly clouding the view, but so far the earnings side of the equation has held up reasonably well. Predictions that Q2 would see the earnings washout quickly evaporate were pushed into Q3. So far Q3 is holding up.

Pepsi (PEP) and Domino's (DPZ) showed that consumers will still spend. The banking sector also held up reasonably well. Next up is tech, so that will be key. We may be currently in the inflationary phase of a recession, and those early stages can still see earnings hold up. Clouds are definitely on the horizon though. The more the equity market holds up, then the more employment and the economy holds up. This means the Fed will keep hiking rates and could push them as high as 5%. That would certainly hit high-growth tech, which has been the bedrock of the last three-year equity rally.

SPY news

As mentioned Netflix held and extended relief rally, which we outlined in our Netflix note on Monday. The bad news was in the price, so the risk-reward was to an upside surprise. Tesla could provide a similar template. Delivery data earlier this month was poor, and Tesla fell 9%. Elon Musk is due to take part in the call, and he is nothing if not optimistic and a great marketer for Tesla bulls. Again I feel the risk-reward is skewed higher.

Fed watching and inflation watching have taken a back seat for now, and equity markets have ignored the 30-year yield breaking above 4%. That may come back to bite, but for now equities are more focused on earnings.

SPY forecast

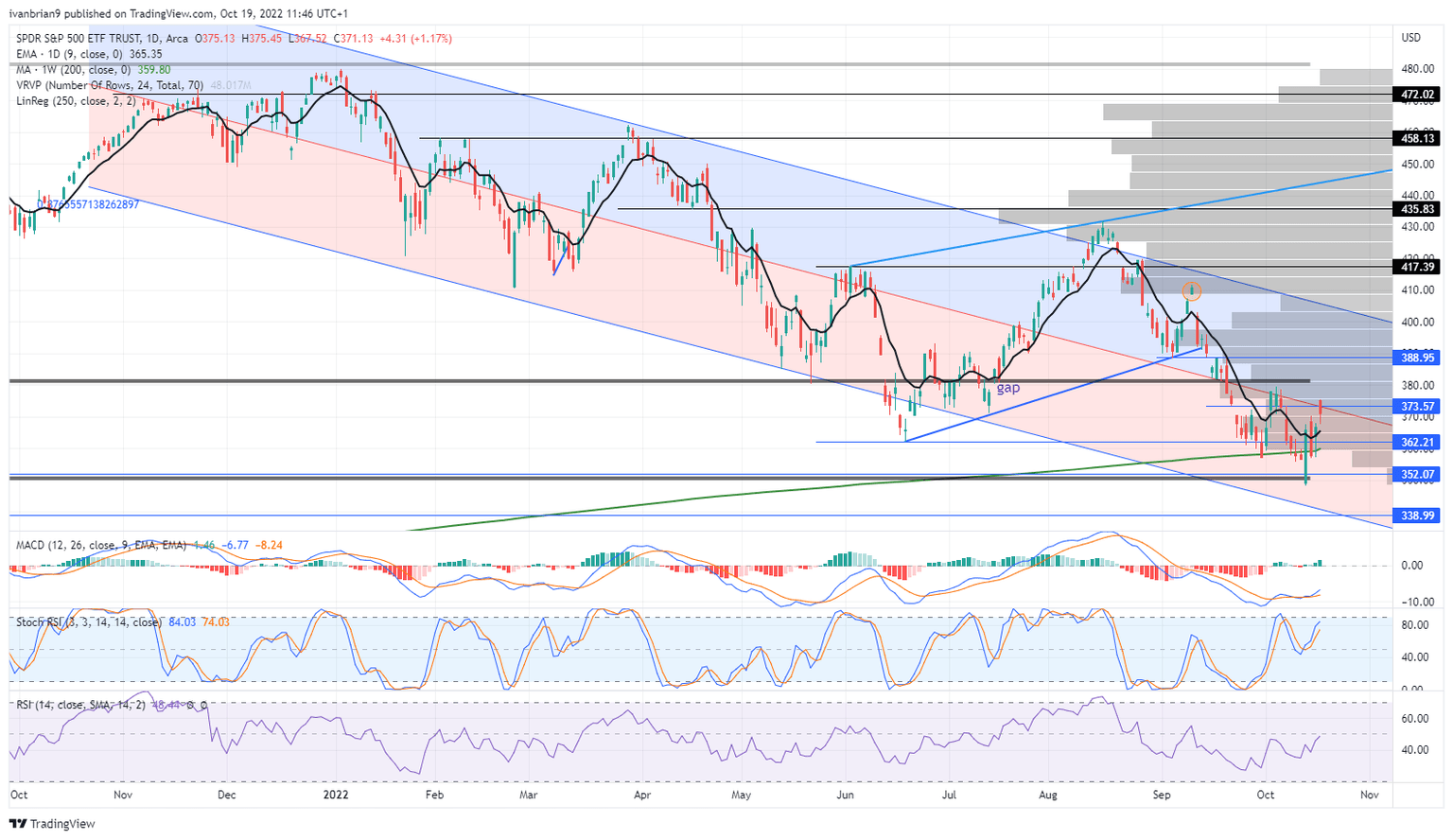

A brief look above my pivot at $373 before closing just below at $371. This remains my pivot for more gains. Above and a move to $388 is my base case. Remaining below would lead to new lows in my view.

SPY daily chart

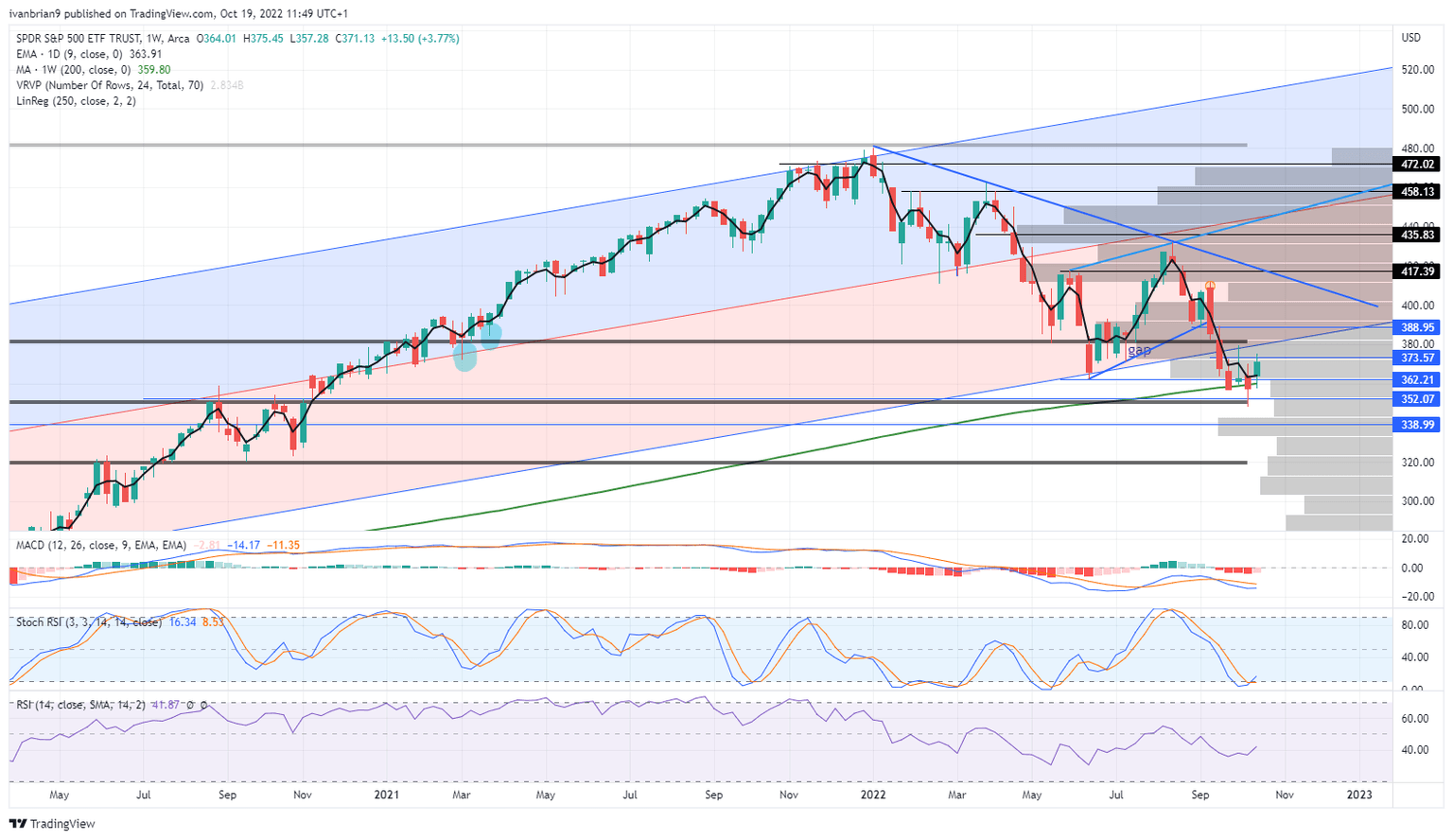

The weekly chart below shows us the $352 key support, a Fibonacci retracement and a pre-pandemic high.

SPY weekly chart

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ivan Brian

FXStreet

Ivan Brian started his career with AIB Bank in corporate finance and then worked for seven years at Baxter. He started as a macro analyst before becoming Head of Research and then CFO.