SP500 Elliott Wave update: An unexpected detour, but still on track

In our previous update about thew SP500 (SPX), we found that by using the Elliott Wave (EW) Principle

“…the index is most likely advancing in the 3rd of a 3rd wave (orange Wave-3 of gray W-iii) for the final 5th wave (green W-5) … contingent on price remaining above the warning levels. Here, the standard impulse pattern is shown; however, the green W-5 can also develop into an overlapping ending diagonal (ED), resulting in an overlapping rally to the lower end of the target zone (~7345).”

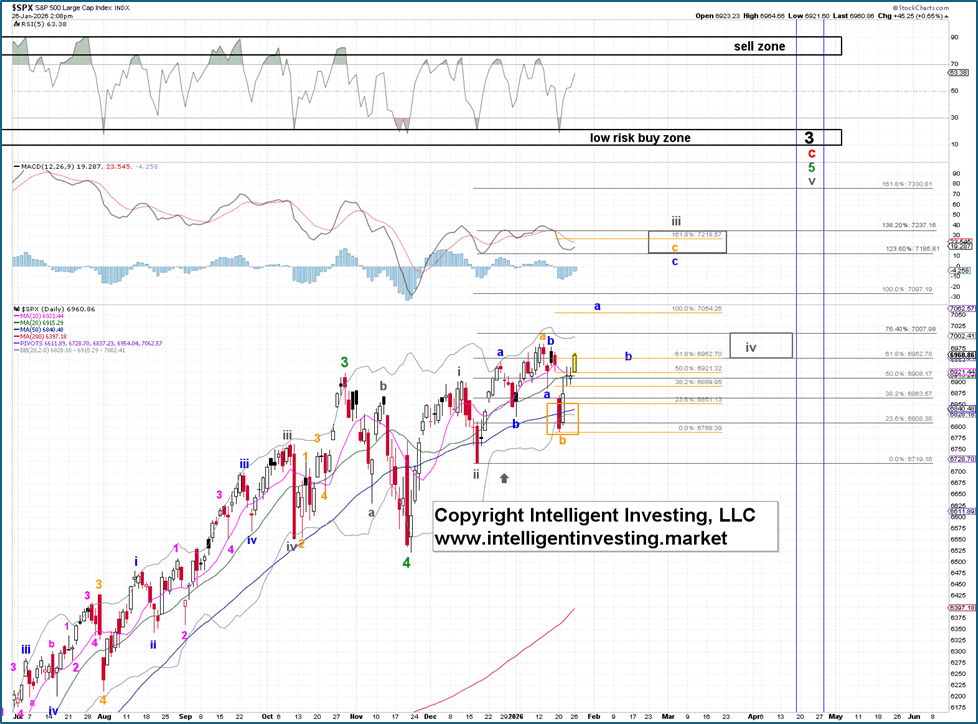

Fast forward to today. The index peaked at 6986 (orange W-a) on January 12 and unexpectedly dropped to 6789 on Tuesday (orange W-b), breaking below the 4th warning level we had set, which is right at the 76.4% retracement of the December-January rally (at the lower end of the orange Box). See Figure 1 below. Thus, the immediate 3rd of the 3rd-wave scenario was invalidated, turning the index into a more complex setup.

Figure 1. Short-term Elliott Wave count for the SPX

Namely, it appears that the index is morphing into a larger ending diagonal (ED), a 3-3-3-3-3 pattern, as the December-January rally (orange W-a) comprises three waves: blue W-a, -b, and -c. Moreover, W-a was between 0.618 and 0.764 times the prior one-degree-higher gray W-i, the November-December rally, a typical ratio.

Thus, the market took a detour but held above the critical warning levels we set, and if it can stay above the December low (6720) and especially the November low (6521), with a serious warning for the Bulls below last week’s low (6789), we can allow for the orange W-c of the 3rd wave (gray W-ii) to kick in. It will be confirmed on a break above the January 12 high and can then ideally target around 7200. In our last update, we had no indication that an ED would occur, but with three weeks' worth of additional data, it now appears to be the case. In an ED, the 3rd wave (gray W-iii) typically targets only the 123.6-138.2% extension of the 1st wave. In this case, that would be the 7185-7235 zone, which aligns with the orange 161.8% extension at 7218, assuming the W-iii subdivides into three smaller waves.

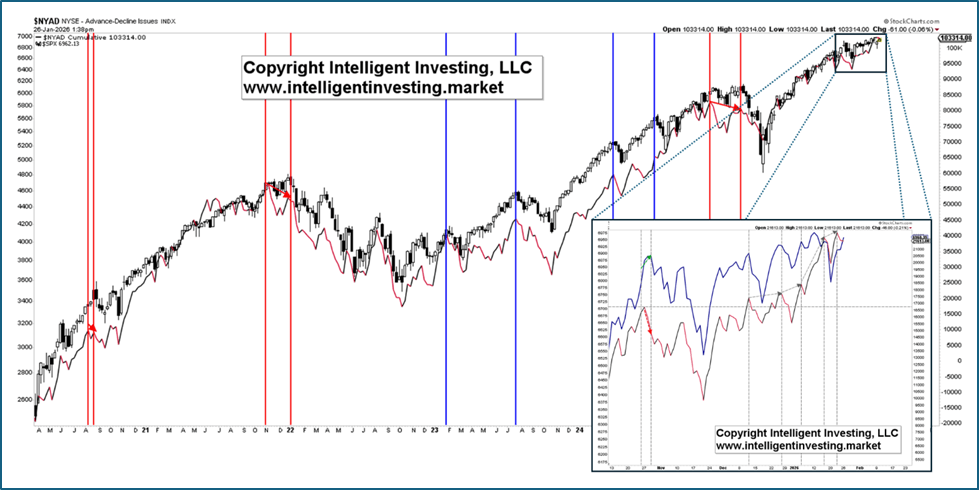

Lastly, while price is the final arbiter, we know that market breadth is critical for predicting larger corrections, such as those in 2022 and last year. See Figure 2 below. Specifically, the cumulative Advancing/Declining line (NYAD) made lower highs overall several weeks before these two events. That’s called negative divergence: the index moved higher while fewer stocks participated, i.e., advanced. See the red lines. However, without divergences, corrections can still occur, but they will be brief and lead to new ATHs. See the blue lines. Currently, there’s no divergence to speak of. See the insert.

Figure 2: The NYAD vs SP500 since the March 2020 low

Lastly, real bear markets like the dot-com bubble and the housing crisis in the early 2000s, as well as the 1970s and the infamous 1929-1932 crash, were all foreshadowed by months to years of negative divergences between the A/D line and price. Now? Nothing.

Bottom line: without any divergence between the A/D line and price, it’s hard to be bearish, even though the market is carving out an ending diagonal 5th wave, as in late 2024. Make no mistake, once the pattern completes, we expect a multi-month correction to 5800 +/- 300 before the next rally to ideally 8100+ can begin.

Author

Dr. Arnout Ter Schure

Intelligent Investing, LLC

After having worked for over ten years within the field of energy and the environment, Dr.