S&P 500 rallied to our first target area of 4203

Recap 8/25 - The S&P opened with a 12 handle gap up, rallied another 4 handles and then pulled back 9 handles into a 9:35 AM low of the day. From that low, the S&P rallied 36 handles into a 10:46 AM high. From that high, the S&P declined 29 handles into a 12:50 PM low. From that low, the S&P rallied 45 handles into the close.

8/25 – The major indices had a big up day to finish with the following closes: DJIA + 322.55; S&P 500 + 58.35; and the Nasdaq Comp. + 207.74.

Looking Ahead – The S&P followed thru on the upside on Thursday, which was our preferred scenario. Technically, the S&P rallied to our first target area of 4203, which is a Fibonacci /.382 retracement of the last decline. The next target, if the rally continues is 4229, and then 4254. The ideal scenario is for the rally to continue into the weekend, when we have our next major change in trend window. This would indicate a probable high for Monday. However, if there is a substantial decline on Friday, then we would expect a low on Monday. Please see details below.

The Now Index is in the NEUTRAL ZONE.

Coming events

(Stocks potentially respond to all events).

4. A. 8/26 AC – New Moon in Virgo. Major change in trend Financials, Grains, Precious Metals, Soybeans.

B. 8/26 AC – Saturn 150 US Mars. Moderate change in trend US Stocks, T-Bonds, US Dollar.

C. 8/26 AC – Mercury Maximum Elongation East. Major change in trend Corn, Oats, Soybeans, Wheat.

D. 8/26 AC - Moon’s North Node Contra-Parallel US MC. Major change in trend US Stocks, T-Bonds, US Dollar.

Stock market key dates

Market math

8/28 = 8,192 music days > 3/24/2000 major high.

Astro – 8/26 AC.

Please see below the S&P 500 10 minute chart.

Support - 4180, 4120 Resistance – 4203, 4229, 4254.

Please see below the S&P 500 Daily chart.

Support - 4180, 4120 Resistance – 4203, 4229, 4254.

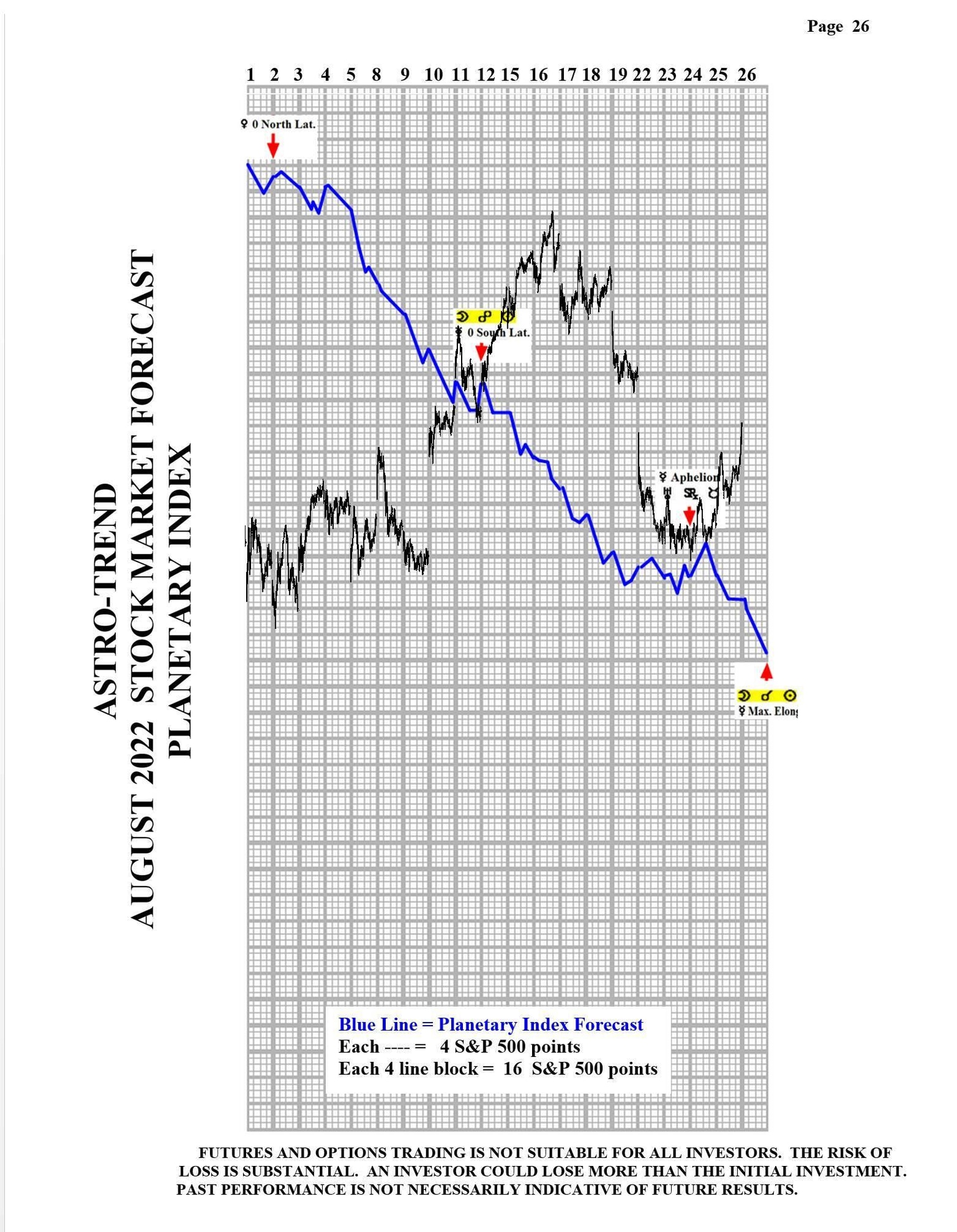

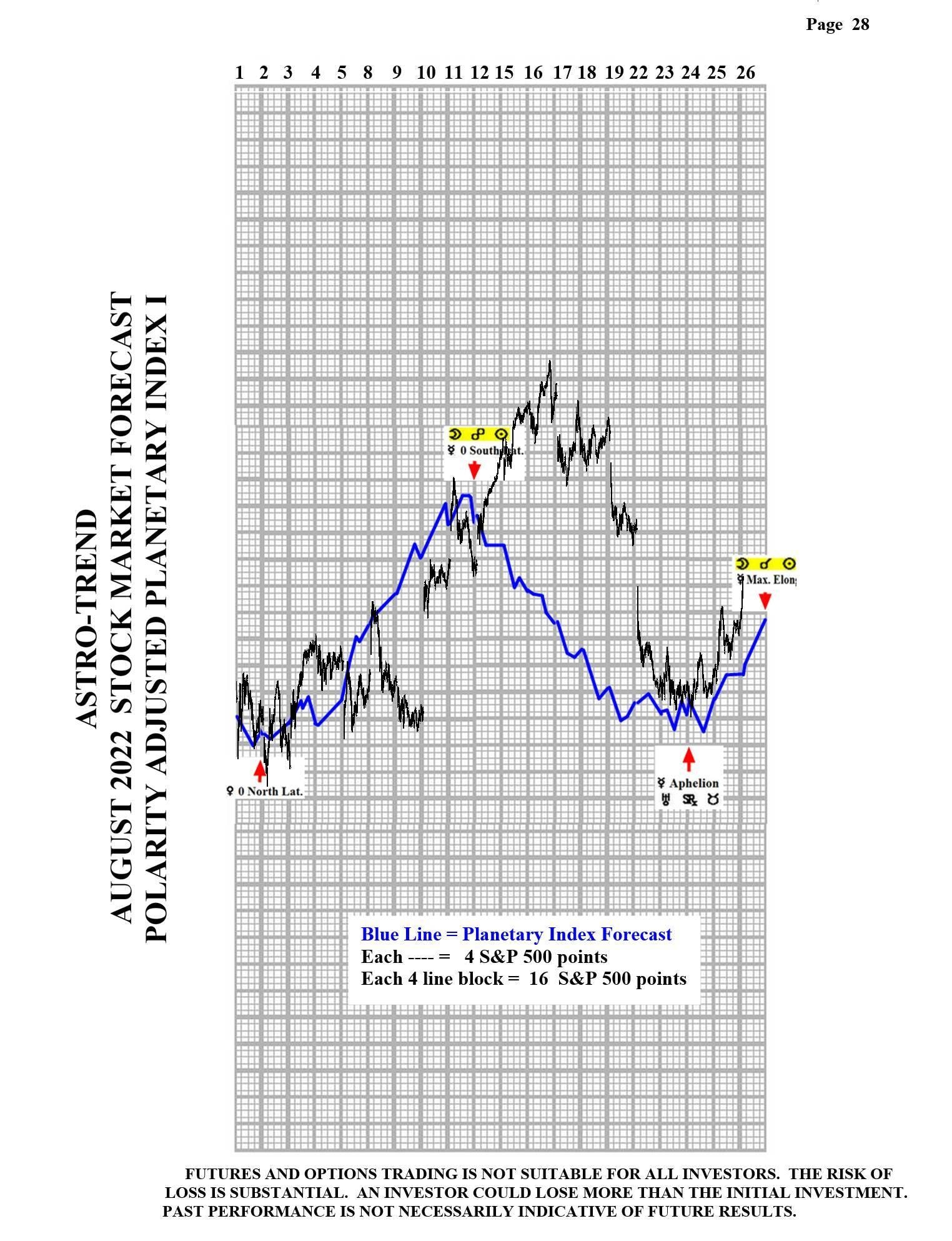

Please see below the August Planetary Index chart with S&P 500 10 minute bars for results. As of 8/23, I am dropping Planetary Index pages 27 and 29.

Author

Norm Winski

Independent Analyst

www.astro-trend.com