S&P 500 pullback update: Are we nearing the light at the end of the tunnel? [Video]

-

The demand and the support zone for short-term movement.

-

At what point can we consider a reversal of the upswing.

-

Why and how a bullish case is likely to unfold.

-

What did the spike in the volume on Monday mean?

-

And a lot more.

![S&P 500 pullback update: Are we nearing the light at the end of the tunnel? [Video]](https://editorial.fxstreet.com/images/Markets/Equities/SP500/wall_street_nyse3-637299021683820849_XtraLarge.jpg)

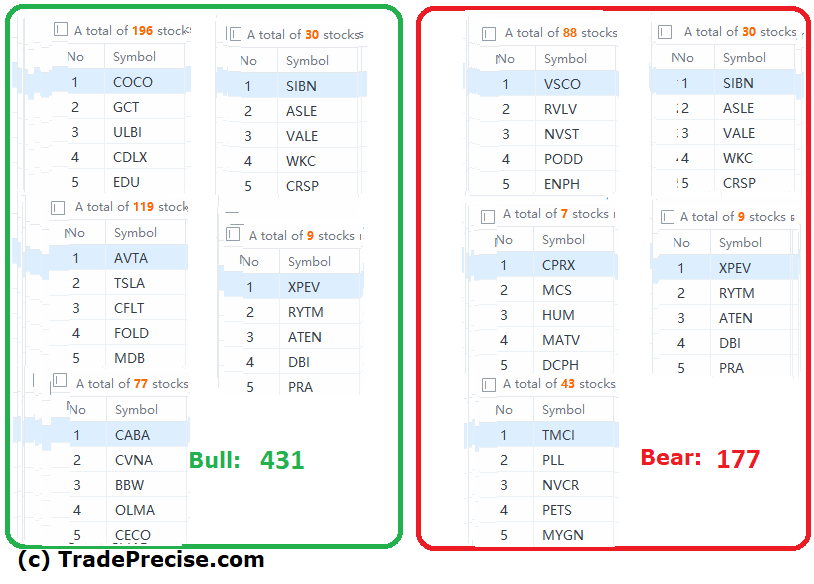

The bullish vs. bearish setup is 431 to 177 from the screenshot of my stock screener below pointing to a positive market environment.

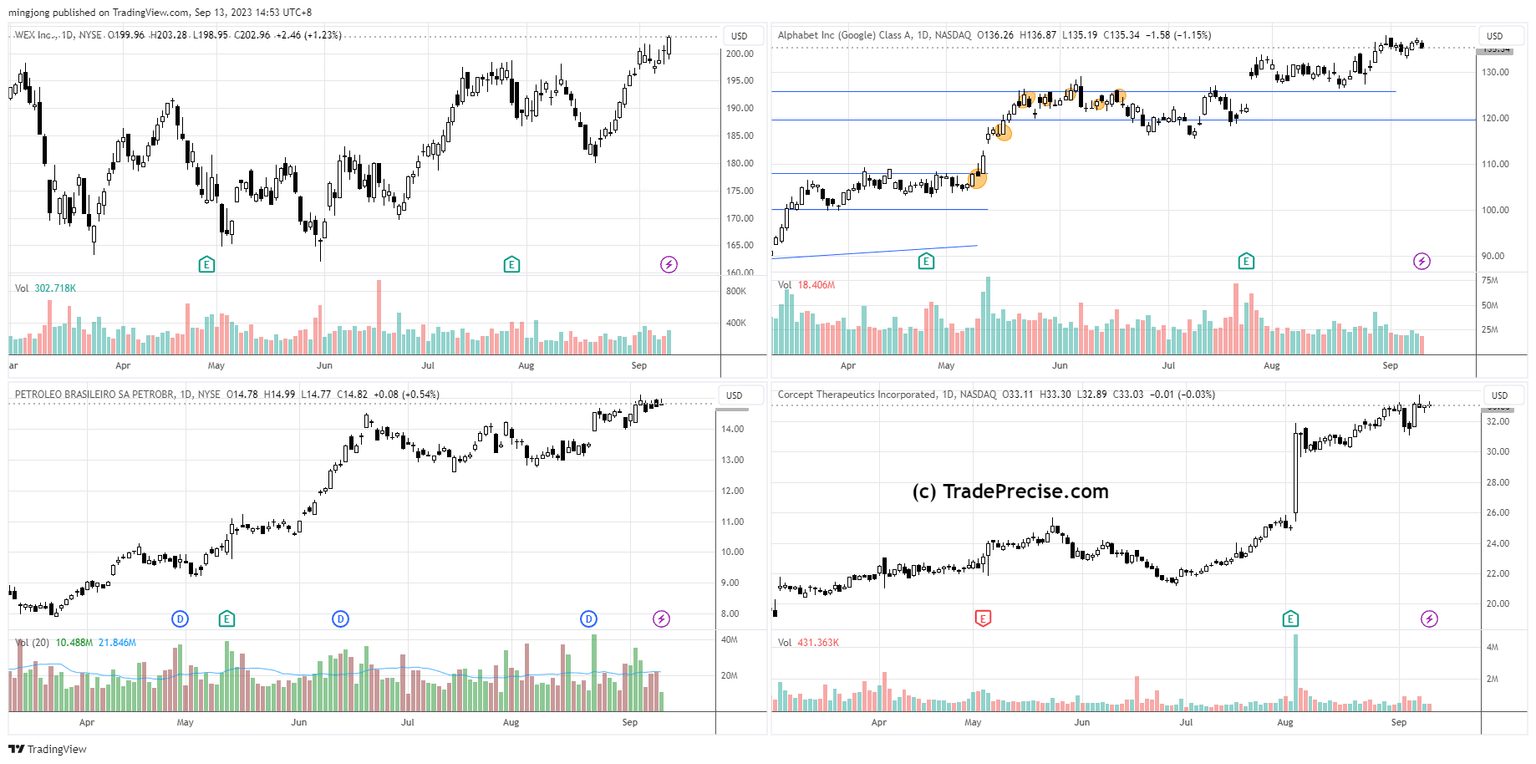

8 “low hanging fruits” (WEX, PBR, etc…) trade entries setup + 19 others (GOOGL, CORT, etc…) plus 15 “wait and hold” candidates have been discussed during the live session.

Supply absorption in crude oil last week as discussed yesterday followed by a breakout is constructive for oil and gas stocks. However, many of them have been extended since covered 2-3 weeks ago, which are now on the’ Wait and Hold” list.

Author

Ming Jong Tey

Independent Analyst

Ming Jong Tey has been trading since 2008. He started his learning journey from technical analysis (indicators, Fibonacci, etc...) to value investing. Throughout his journey, he develops an interest in price action with chart pattern trading.