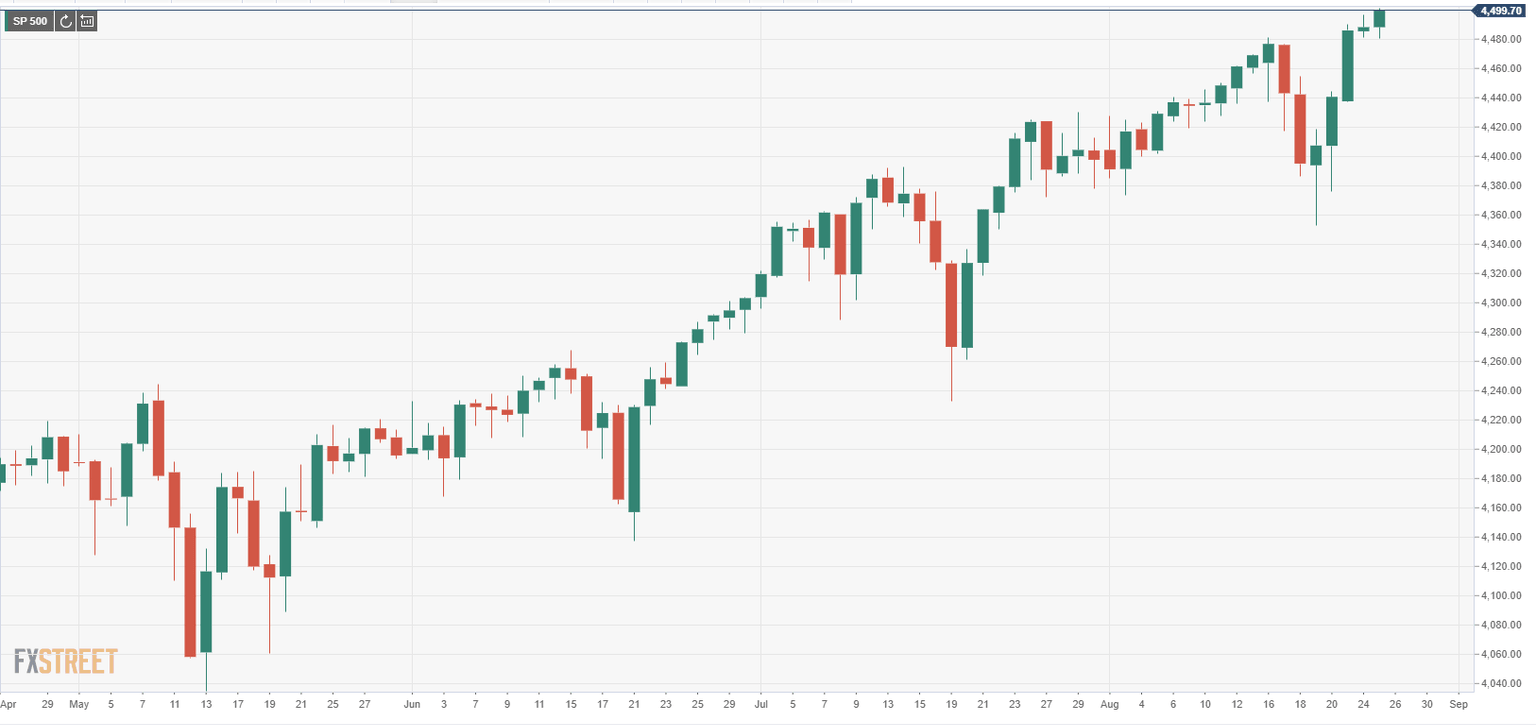

S&P 500 Index sets new all-time high above 4,500

- S&P 500 Index notched a new all-time high following Tuesday's choppy session.

- Financial and energy stocks lead the rally on Wednesday.

After closing virtually unchanged on Tuesday, the S&P 500 Index started the day in a calm manner on Wednesday and spent the first couple of hours moving sideways in a narrow band. However, with financial stocks gaining traction and posting strong gains, the S&P 500 turned north and reached a new record high of 4,501 in the last hour. As of writing, the SPX was up 0.27% on the day at 4,498.

The rate-sensitive financial stocks seem to be capitalizing on surging US Treasury bond yields. At the moment, the benchmark 10-year US T-bond yield is rising 3.6% and trading at its highest level in more than 10 days at 1.344% and the S&P 500 Financials Index is gaining 1.6% as the top-performing major sector.

Earlier in the session, the US sold $61 billion 5-year Treasury notes at a high yield of 0.831%, compared to 0.71% previously, providing a boost to yields.

American Express, JPMorgan Chase and Goldman Sachs stocks are among the biggest gainers, rising between 2% and 3.2%.

Moreover, the modest increase witnessed in crude oil prices is helping energy stocks build on the gains they recorded on Monday and Tuesday. The barrel of West Texas Intermediate, which rose nearly 9% in the first two days of the week, is currently rising 0.6% at $68.05.

S&P 500 chart (daily)

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.