S&P 500 Index bull-trap set-off, drops into the bear's lair as bank's earnings get underway

- Volatility in US stocks are catching the market off guard today, but there is a trade-off to that.

- Trapped committed bulls hoping 21-DMA holds for a second crack at the whip.

The fact that JP Morgan's share price cannot hold onto the gains post a very solid and surprisingly positive second-quarter earnings report speaks volumes. As does the inability of the NDX to hold onto a 2% rally to all-time highs.

Trapped bulls may get a second crack at the whip, but the path of least resistance could now be to the downside on a break of a certain structure.

In such an instance, the less committed bulls will flip over and join sides with the bears where far greater opportunities would evolve if their bearish thesis is correct.

JPMorgan Chase smashed expectations for its second-quarter earnings, however, there are bearish nuggets in here too, mostly pertaining to guidance and the threat of the coronavirus ramifications and limitations in the ability for banks to monetise their asset bases.

Moreover, the Federal Reserve has signalled that zero interest rates aren't going away anytime soon.

Bad debt write-offs will undoubtedly be a factor anticipated in this week's guidance owing to a cash-constrained market place and mass unemployment.

In fact, profit was down more than 50% from a year earlier as JPMorgan Chase added to its loan loss reserves to guard against potential loan defaults, but results were helped by record trading revenue.

Despite some recent positive macroeconomic data and significant, decisive government action, we still face much uncertainty regarding the future path of the economy,”

Chase CEO Jamie Dimon said in a statement.

However, we are prepared for all eventualities as our fortress balance sheet allows us to remain a port in the storm.

However, his guidance in the following statement is probably the most alarming for investors:

This is not a normal recession. The recessionary part of this you're going to see down the road... You will see the effect of this recession. You're just not going to see it right away because of all the stimulus.

JPMorgan Chase, the nation's biggest bank in terms of assets, is setting aside $8.9 billion for expected losses but was posting better-than-expected income of $4.69 billion.

Meanwhile, Barr Citi's exceptional trading results, theirs and Wells Fargo's reports were not so rosy.

Wells Fargo, which is under various banking restrictions after a fake accounts scandal in 2016, posted its first quarterly loss since 2008, setting aside $8.4 billion for anticipated defaults.

The biggest driver of shrinking profits or outright losses, in Wells Fargo's case is the fact that banks are preparing to deal with a pile of toxic loans caused by the pandemic

However, Citigroup also beat expectations despite a decline in its net income from $4.8 billion to $1.3 billion.

Should such results as Wells Fargo's or signs of uncertainty appear habitual in the rest of the large banks with a similar mix of businesses that are due to report earnings in coming days, the week could turn out to be a win for the bears.

S&P Global Ratings warned last week that banks around the world will ultimately suffer credit losses of about $2.1 trillion between this year and next.

Bank stocks have been slammed in 2020 so far

That's why bank stocks have been slammed this year.

The KBW Bank Index (BKX) has lost more than one-third of its value this year, badly trailing the 2% drop for the S&P 500 in 2020.

The SPDR S&P Bank ETF, or the KBE which finished the up 4.8% on Friday, the best-gaining sector for the end of the week, is down today by over 2.6%.

To date, KBE is down 37% from 2020 highs.

Looking ahead, Goldman Sachs reports on pre-market Wednesday, and Bank of America and Morgan Stanley both report pre-market on Thursday.

S&P 500 Index levels

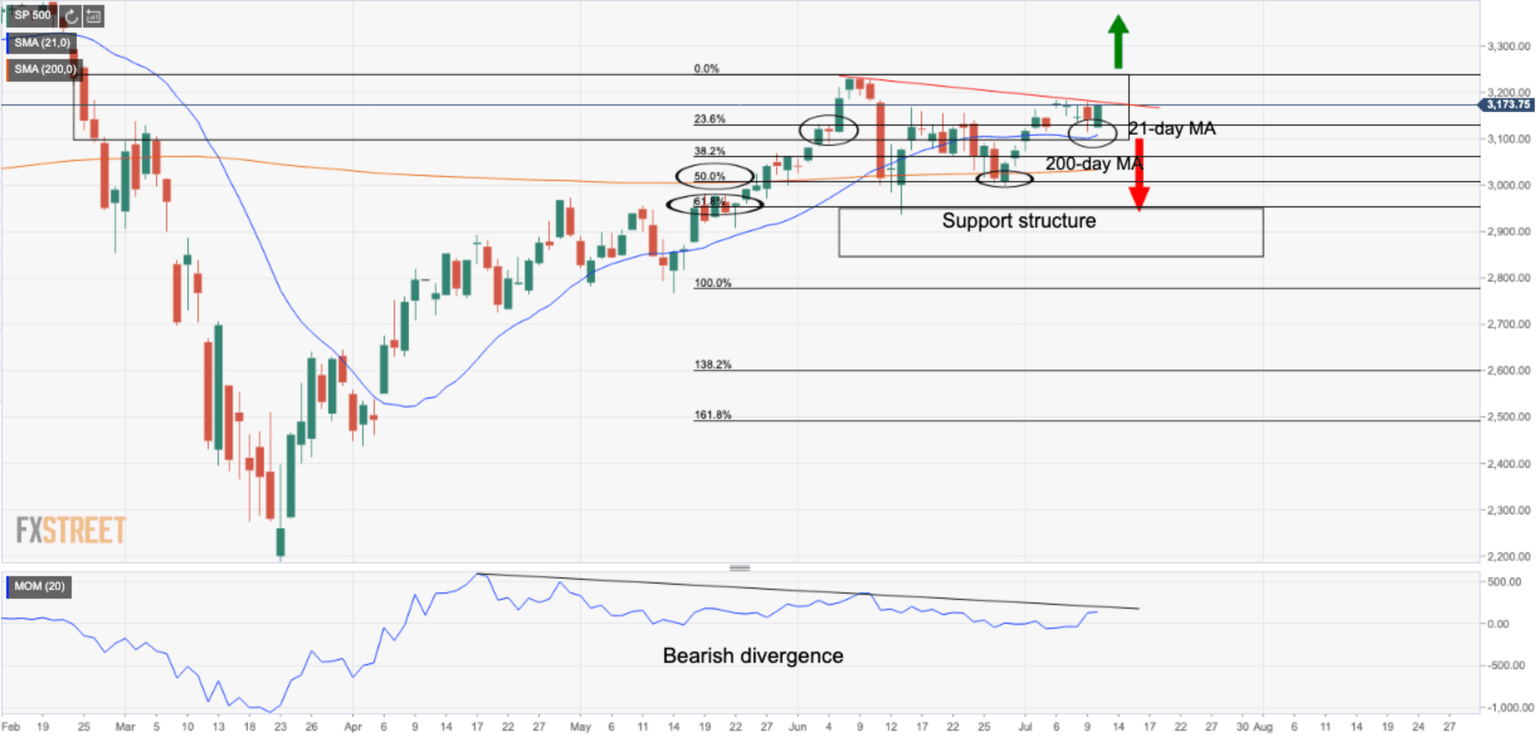

As per this week's S&P 500 Index Forecast, S&P 500 Index Forecast: Bank's earnings in focus, COVID-19 induced insolvency fears simmer away, the index has indeed struggled at the June highs.

The index momentarily scored fresh highs in a break of the counter trendline resistance only to trap the bulls in a bear trap and reverse course sharply back to the 21-day moving average.

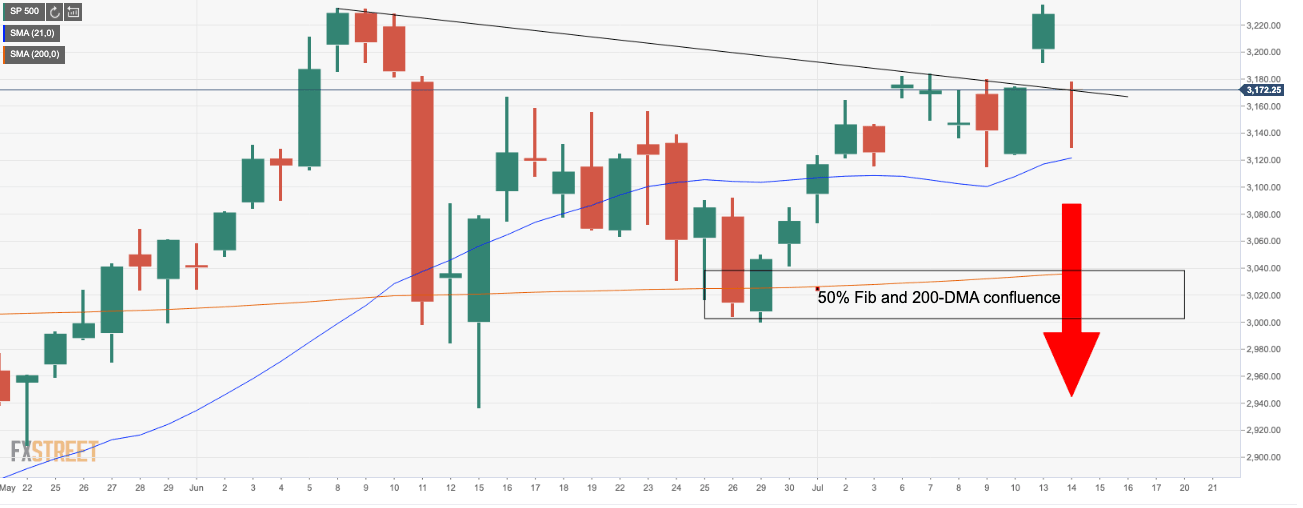

Here is the start of the week's outlook chart compared to today's to demonstrate a bearish case in the making:

Break below counter-trendline, a consequence of bull trap

Trapped bulls may get a second crack at the whip if the 21-day moving average holds and the price breaks back above the counter trendline and subsequently holds daily closes above there to form new support structure.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.