S&P 500 futures (ESM2025) gap-driven rally poised to propel S&P 500 futures above 5,960

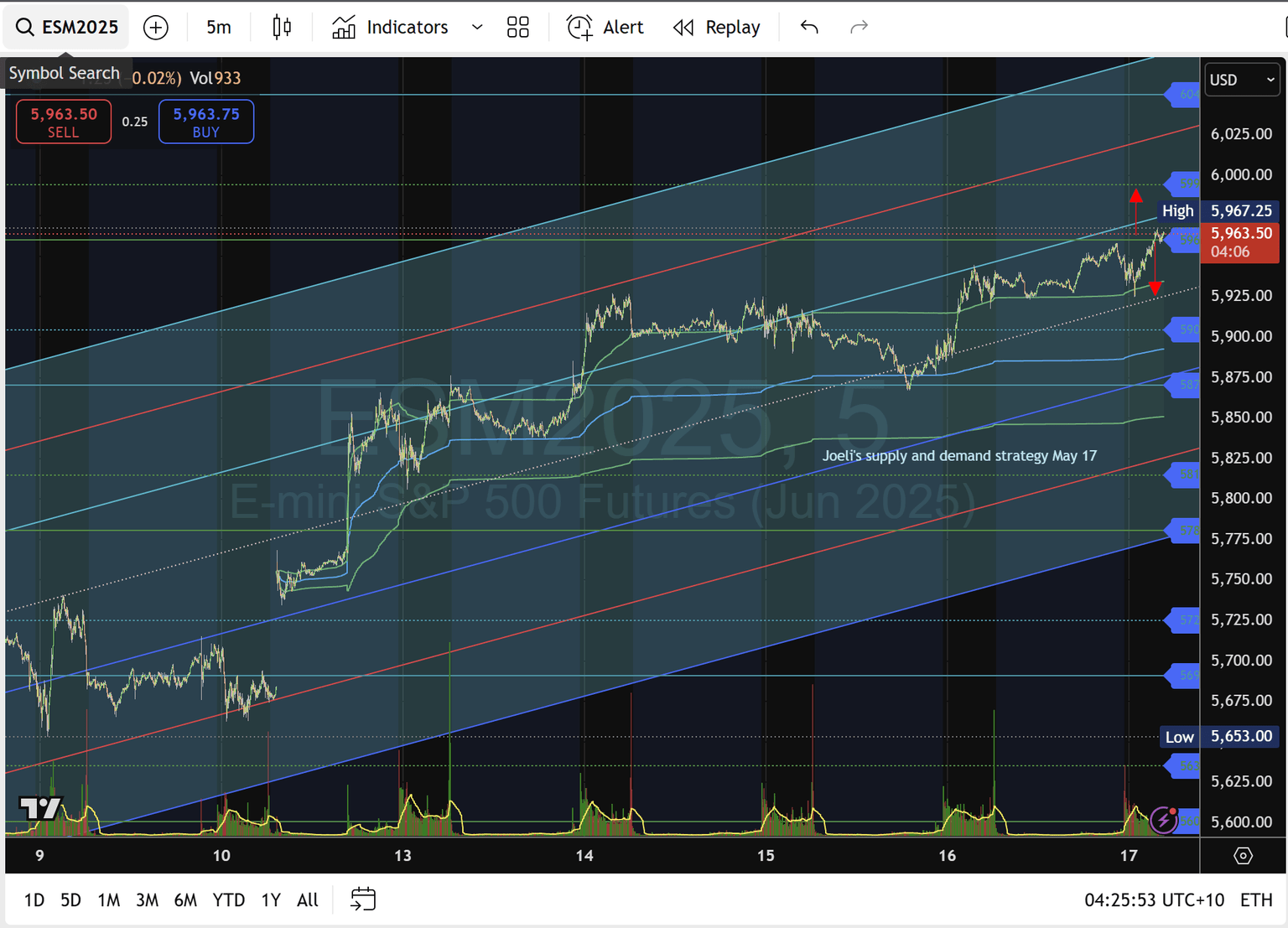

S&P 500 Futures (ESM2025) – 5 Min Chart Analysis (Week of May 12–17)

Market context

- Uptrend Resilient: Following the sharp gap higher on May 13, ES has maintained a consistent up-channel formation, confirming bullish order flow into the end of the week.

- VWAP Alignment: Price remains above the VWAP mid-line (blue), indicating institutional buyers have underpinned rallies throughout the week.

- Volume Profile: Noticeable spikes at the 5,845–5,860 area (long liquidation) have now turned into value-area lows, shifting support higher toward 5,880–5,900.

Key levels

LevelPriceSignificance

Immediate Resistance 5,960 Recent swing highs—break confirms further upside

Secondary Resistances 5,969 / 5,981 / 6,000 Fibonacci & prior pivots from May 14 & 15

Immediate Support 5,926.75 61.8% retrace of May 13 gap, held twice

Secondary Supports 5,904 / 5,870 23.6% retrace of broader channel & lower channel base

Bullish scenario

- Clear 5,960 Breakout:

- A sustained trade above 5,960 with follow-through volume would target the next confluence zone at 5,969 (50% Fib of the mini-swing), then 5,981 (78.6% Fib) and psychological 6,000.

- Above 6,000, the upper pitch of the Andrews' channel nears 6,038–6,045 and 6,064 (127–161.8% extensions).

- Channel Continuation:

- As long as price remains within the rising cyan channel, buyers can lean into pullbacks toward its mid-line (currently ~5,925) and expect higher highs into opex Friday.

Bearish scenario

- Rejection at 5,960–5,969:

- Failure to clear 5,960 on a closing basis risks a swing down to 5,943 (23.6% Fib of the May 13 rally) and a retest of VWAP mid-line.

- A break below 5,926.75 would open 5,904 (38.2% Fib) and channel base support at ~5,870.

- Loss of VWAP / Major Support:

- If sellers drive price beneath the VWAP band, look for accelerated selling toward 5,845 (0% Fib of the gap) and the lower rail of the broader up-channel near 5,815.

Projection into week's close

- Bullish Bias: Given strong gap support and repeated holds above 5,926.75, the path of least resistance is higher.

- Watch Volume: Confirmation of follow-through on a break above 5,960 is critical; a lack of volume increases the odds of a retest of VWAP and lowers channel support.

- End-of-Week Target: If bulls prevail, 5,981–6,000 will likely be a magnet by Friday's settlement, especially into month-end positioning flows.

Trading Strategy Ideas

- Long Entry: On clear 5,960 breakout with 1–2-bar retest; stop under 5,940; targets 5,981 & 6,000.

- Short Entry: If 5,960 is rejected and VWAP mid-line breaks, stop above 5,969; targets 5,904 & 5,870.

Author

Denis Joeli Fatiaki

Independent Analyst

Denis Joeli Fatiaki possesses over a decade of extensive experience as a multi-asset trader and Market Strategist.