Silver's daily bullish cycle is well under way

- Precious metals are supported as the US dollar gives background to rival currencies.

- The stagflation theme is alive and well for the precious metals hedge.

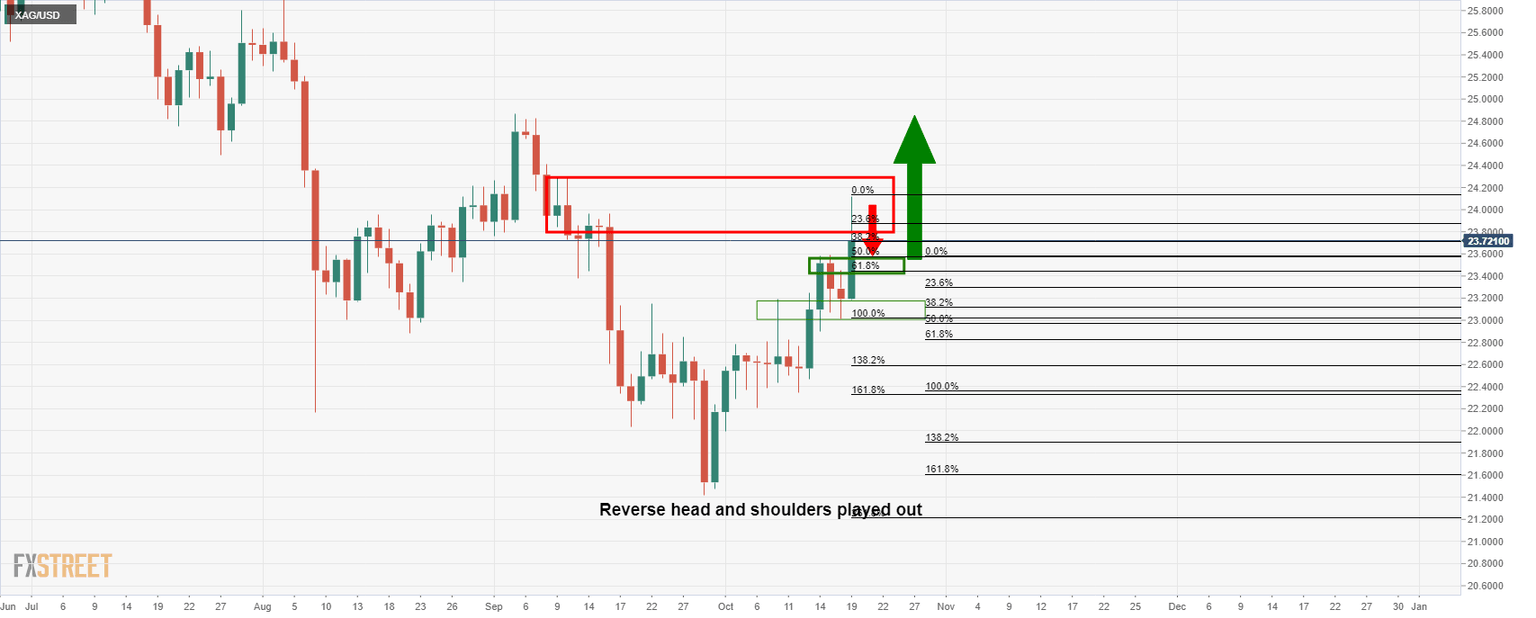

- Silver prices are in a bullish cycle since bursting out from the Reverse Head and Shoulders formation.

The price of silver is firm on Tuesday as the US dollar gives back some ground while rival currencies play catch up due to their central banks taking part in the lift-off theme. At the time of writing, XAU/USD is trading at $23.7590, rising 2.44% on the day and travelling from a low of $23.1882 to a high of $24.1237.

The US dollar has struggled against its rivals on Tuesday in a bout of profit-taking that had otherwise benefitted by expectations of sooner-than-previously expected interest rate hikes. Additionally, US yields have appeared to stabilize on which has likely reduced demand for the greenback.

''Market pricing for Fed hikes is far too hawkish,'' analysts at TD Securities argued. ''The aggressive bear flattening trend in the US yield curve highlights the market's intense focus on pricing the Fed's exit. However, market pricing for Fed hikes fails to consider that a rise in inflation tied to a potential energy shock and lingering supply chain shortages would be unlikely to elicit a Fed response,'' the analysts said.

USD's rival currencies catching up

Moreover, currencies, including the Great British pound and the New Zealand dollar, are benefiting from rising interest rate increase expectations. The Bank of England has been sounding the inflation warnings and its intention to act while NZ's inflation report came in super hot this week also. As a result, the British pound rallied 0.60% to $1.3810 as money markets priced in a cumulative 35 basis points in rate hikes by the end of the year and the New Zealand dollar has gained 0.95% to $0.7152 after data on Monday showed the fastest consumer-price inflation in more than a decade.

Additionally, there has been a rise in short-term bond yields, with short-dated yields climbing comparatively more than in the United States, exposing the US dollar to profit-taking this week. This in turn has helped precious metals to stabilise and recover come ground with silver leading the way.

Silver technical analysis

The price is silver has rallied from the daily head and shoulders set-up and in a classic breakout scenario, the price corrected to old resistance before the next push higher. At this juncture, the price is meeting the resistance of the old structure and would be expected to retrace to restest old resistance near 23.60 and where it meets a 61.8% Fibonacci retracement level. From there, a fresh bullish impulse could emerge.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.