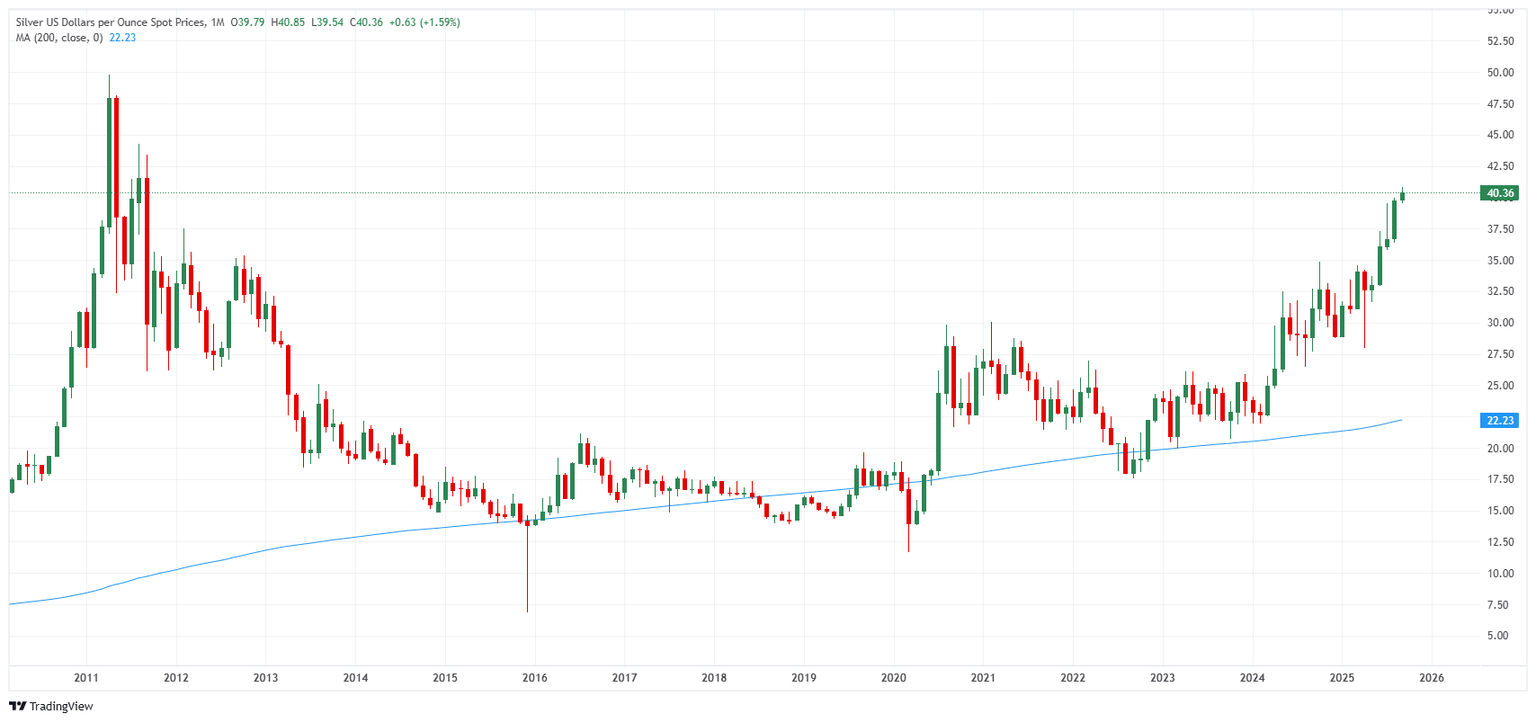

Silver rises above $40: back to the highest level since 2011

The precious metals market has just passed a symbolic milestone. The price of Silver (XAG/USD) has surged above $40 an ounce, reaching its highest level since September 2011. This move is attracting the attention of investors around the world, both for its economic implications and for what it reveals about the current economic climate.

Silver monthly chart. Source: FXStreet

A movement fuelled by interest rates

This surge in Silver prices is primarily due to expectations of lower interest rates in the United States (US). The US Federal Reserve (Fed) is expected to ease monetary policy this autumn, against a backdrop of a slowing job market and inflation that many still consider too high.

Precious metals such as Gold and Silver offer no direct return. When interest rates fall, the opportunity cost of holding these assets decreases, making them even more attractive.

It is this mechanism that is currently fuelling a wave of buying, supported by the conviction that the Fed will soon have its hands free to revive credit and support the economy.

A climate of uncertainty in the United States

The political context adds a further dimension to this dynamic. In the United States, the debate over the Fed's independence has intensified, fuelled by US President Donald Trump's repeated criticism of the monetary institution.

His attacks have cast doubt on the stability of economic policies, boosting demand for safe-haven assets.

In addition, persistent trade tensions and court rulings on US tariffs add to the uncertainty. In this environment, Silver and Gold appear to be reassuring alternatives for investors.

The scarcity effect: A market under pressure

Beyond monetary policy, the Silver market is also underpinned by a particular supply and demand dynamic.

The Silver Institute estimates that 2025 could mark the fifth consecutive year of supply deficit. Industrial demand, particularly in the solar energy and cleantech sectors, continues to grow, while available stocks are eroding.

Silver-backed index funds (ETFs) are seeing massive inflows from investors, notes Bloomberg, further reducing the quantities available on the physical market.

This supply pressure is amplifying price rises, adding a structural factor to a trend already underpinned by macroeconomic conditions.

A sustainable surge?

The question now is whether Silver can extend its rally beyond $40. Some analysts, like those at Morgan Stanley, believe that the upside potential remains significant, thanks to a weaker US Dollar (USD) and sustained demand.

Others point out that this technical threshold represents historic resistance, likely to trigger short-term profit-taking.

Whatever the case, Silver's breakthrough of $40 marks a turning point. In a world where the United States still dominates global monetary and economic dynamics, the Fed's trajectory and the evolution of interest rates will remain the main drivers of the gray metal.

But the Silver equation goes far beyond this. Between its role as a safe-haven asset and its strategic industrial use, Silver is more than ever a barometer of the financial markets' concerns and hopes.

Author

Ghiles Guezout

FXStreet

Ghiles Guezout is a Market Analyst with a strong background in stock market investments, trading, and cryptocurrencies. He combines fundamental and technical analysis skills to identify market opportunities.