Silver pulls back below $38.50 as bullish momentum fades on firm US Dollar, CPI data

- Silver pulls back below $38.50 as bullish momentum fades near YTD high.

- US Dollar strength weighs on Silver as CPI data reflects persistent inflation, lifting yields.

- Robust Industrial data from China and Europe limits the downside for XAG/USD.

The price of Silver is attempting to recover from Monday’s slump as traders digest fresh economic data from China, the Eurozone, and the United States.

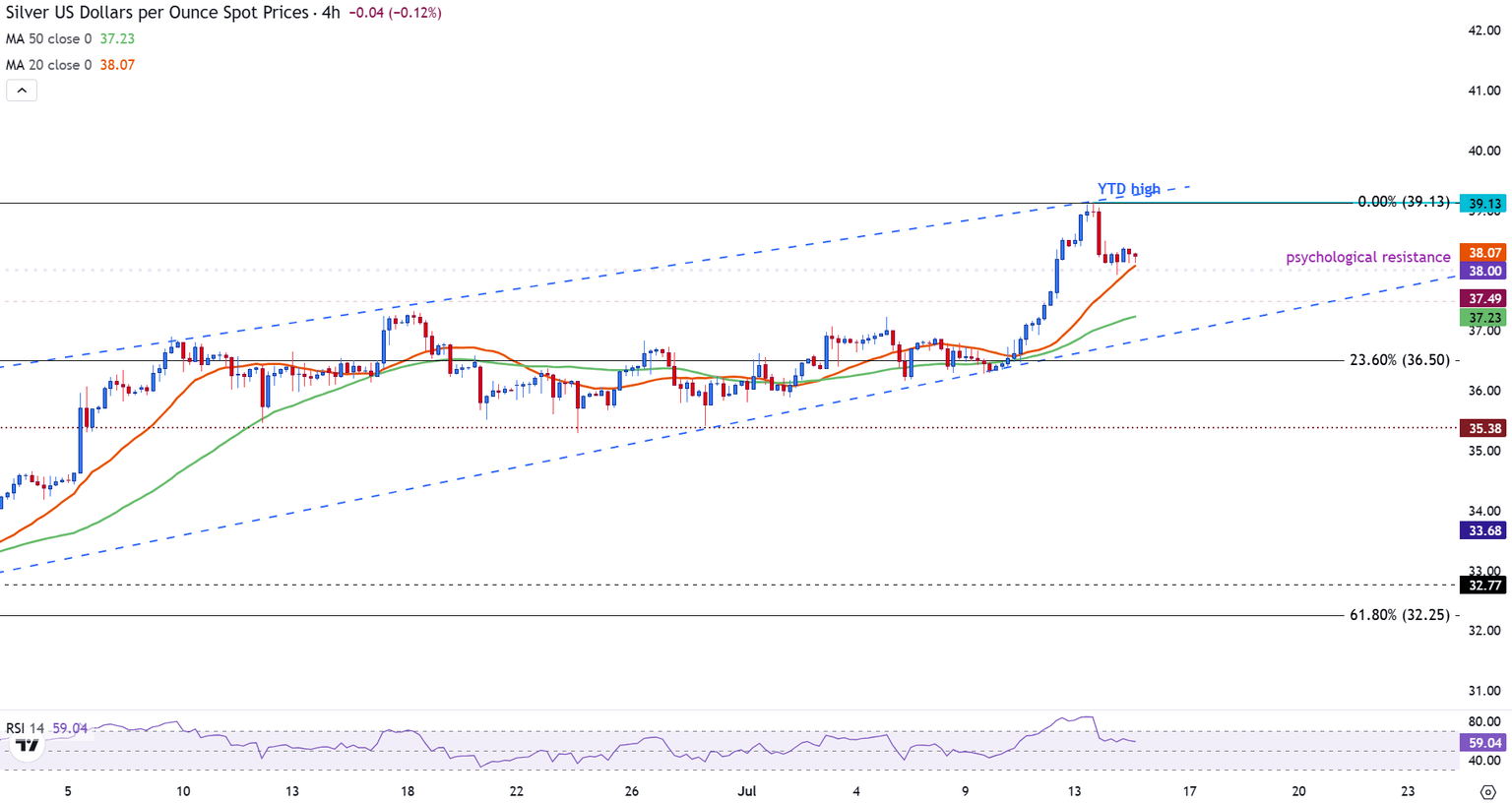

After reaching a new year-to-date high of $39.13 in the previous session, profit-taking at elevated levels pushed XAG/USD back toward the key psychological level of $38.00.

At the time of writing, Silver continues to trade within an ascending channel, with price action sensitive to shifts in risk sentiment and the near-term direction of the US Dollar.

US Dollar strength weighs on Silver as CPI data support yields

The June Consumer Price Index (CPI) showed that headline CPI rose 2.7% (YoY), in line with expectations, while core CPI came in at 2.9%, slightly lower than the 3% consensus but still well above the Fed’s 2% target.

The lack of faster disinflation has tempered expectations for a September rate cut, with Fed funds futures now pricing in a 59% probability, slightly lower than prior to the release.

The market reaction reflects a repricing of interest rate expectations, with Treasury yields firming and the US Dollar advancing. Despite encouraging industrial figures from China and the Eurozone, the US economy remains comparatively resilient, making the Greenback more attractive relative to other major currencies.

Robust Industrial data from China and Europe limits the downside for Silver

During the Asian session, China’s Q2 Gross Domestic Product (GDP) came in at 5.2% (YoY), slightly above expectations of 5.1% but down from 5.4% in the same quarter last year. On a quarterly basis, GDP grew 1.1%, beating the 0.9% forecast. However, more importantly for Silver, Industrial Production surged by 6.8% annually, up from 5.8%, signaling robust factory activity.

Since Silver is widely used in electronics, solar panels, and industrial manufacturing, it is highly sensitive to global production trends.

Adding to the momentum, Eurozone industrial production also surprised to the upside in May. Output rose 1.7% (MoM) versus a 0.9% estimate, while annual production jumped 3.7% (vs. 2.9% forecast), marking a sharp recovery from April’s contraction. This broad improvement in global industrial performance strengthens the case for continued physical demand for Silver across both Europe and Asia.

Silver pulls back below $38.50 as bullish momentum fades near YTD high

After rising to a fresh year-to-date high of $39.13 on Monday, Silver faced selling pressure that capped the rally. By Tuesday, XAG/USD had retreated toward the $38.00 psychological level, though price action remains confined within a rising channel on the 4-hour chart.

Key support is seen at the psychological level of $38.00 and the 50-period Simple Moving Average (SMA) at $37.23, while resistance remains at the YTD high of $39.13.

Silver 4-hour chart

The Relative Strength Index (RSI) has eased to 58, reflecting a loss of momentum without signaling oversold conditions. Unless bulls reclaim control above $38.50, Silver risks slipping toward $36.50, where the next significant support zone is located.

Silver FAQs

Silver is a precious metal highly traded among investors. It has been historically used as a store of value and a medium of exchange. Although less popular than Gold, traders may turn to Silver to diversify their investment portfolio, for its intrinsic value or as a potential hedge during high-inflation periods. Investors can buy physical Silver, in coins or in bars, or trade it through vehicles such as Exchange Traded Funds, which track its price on international markets.

Silver prices can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can make Silver price escalate due to its safe-haven status, although to a lesser extent than Gold's. As a yieldless asset, Silver tends to rise with lower interest rates. Its moves also depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAG/USD). A strong Dollar tends to keep the price of Silver at bay, whereas a weaker Dollar is likely to propel prices up. Other factors such as investment demand, mining supply – Silver is much more abundant than Gold – and recycling rates can also affect prices.

Silver is widely used in industry, particularly in sectors such as electronics or solar energy, as it has one of the highest electric conductivity of all metals – more than Copper and Gold. A surge in demand can increase prices, while a decline tends to lower them. Dynamics in the US, Chinese and Indian economies can also contribute to price swings: for the US and particularly China, their big industrial sectors use Silver in various processes; in India, consumers’ demand for the precious metal for jewellery also plays a key role in setting prices.

Silver prices tend to follow Gold's moves. When Gold prices rise, Silver typically follows suit, as their status as safe-haven assets is similar. The Gold/Silver ratio, which shows the number of ounces of Silver needed to equal the value of one ounce of Gold, may help to determine the relative valuation between both metals. Some investors may consider a high ratio as an indicator that Silver is undervalued, or Gold is overvalued. On the contrary, a low ratio might suggest that Gold is undervalued relative to Silver.

Author

Tammy Da Costa, CFTe®

FXStreet

Tammy is an economist and market analyst with a deep passion for financial markets, particularly commodities and geopolitics.