Silver Price Forecast: XAG/USD rallies to fresh monthly highs, bull’s eye $24.00

- XAG/USD threatens to trade above the $24.00 threshold.

- Falling US T-bond yields underpin the US Dollar, which is weaker across the board.

- September’s FOMC minutes reinforce the beginning of a bond taper process, which could be announced by the November meeting.

Silver (XAG/USD) is advancing during the New York session, up more than one a half percent, trading at $23.46 at the time of writing. The white metal is trading at fresh monthly highs, courtesy of falling US Treasury Bond Yields, with the 10-year benchmark note rate slumping three and a half basis points, sitting at 1.514%, short of breaking the 1.50% threshold.

At the same time, the US Dollar Index, which follows the buck’s performance versus six peers, is down 0.03%, at 93.99, despite positive US macroeconomic data across the docket.

On Wednesday, September’s Federal Reserve minutes showed that the committee agreed that a gradual tapering process that concluded around the middle of next year would likely be appropriate due to the ongoing economic recovery. Furthermore, most members agreed that the bond taper process could commence by mid-November or mid-December.

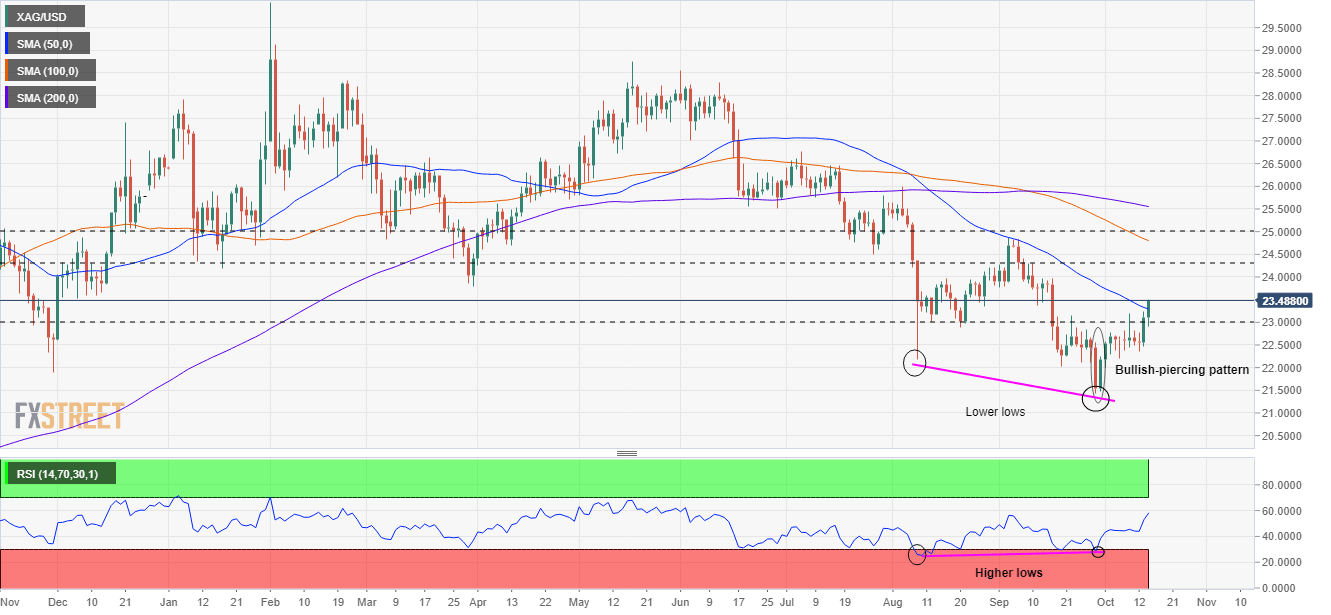

XAG/USD Price Forecast: Technical outlook

Daily chart

Silver is trading above the 50-day moving average (DMA), which lies at $23.29, above the September 13 low at $23.37, which was previous support that turned resistance. Furthermore, momentum indicators like the Relative Strenght Index (RSI) at 58, aiming higher, indicate an upside bias.

For silver buyers to resume the upward trend, they will need a daily close above the latter to confirm the range’s break, opening the door for further upside. In that outcome, the first resistance would be $24.00. A breach above that level could send XAG/USD rallying towards the September 3 high at $24.86, immediately followed by $25.00.

KEY ADDITIONAL LEVELS TO WATCH

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.