Silver Price Forecast: XAG/USD continues to soar amid perfect storm conditions

- Silver prices hit fresh 13-year highs on Monday, inching toward $37/oz.

- US Dollar weakness combined with rate cut and trade deal hopes are bolstering XAG/USD bids.

- Industrial demand for Silver is climbing steadily, but overall demand remains weak.

XAG/USD hit another 13-year high to kick off the new trading week, testing above $36.80 per ounce and laying fresh tracks toward $37.00/oz as metals investors bank on a perfect storm of factors to continue pushing Silver prices into their highest bids since early 2012.

The US Dollar (USD) continues to get pummeled across the global FX market, with the US Dollar Index (DXY) stuck near multi-year lows. A weaker Greenback is helping to bolster spot Silver prices, with further support coming from ongoing market hopes for Federal Reserve (Fed) rate cuts sometime this year.

Markets hope for continued rebound in global Silver demand

Industrial demand for Silver climbed through 2024, and investors are banking on a continued upswing in the Silver-hungry tech sector, specifically as green energies continue to eat up more Silver supply. However, overall global Silver demand fell through last year, but Silver bidders expect the upswing in overall Silver demand to continue.

This week’s upcoming US Consumer Price Index (CPI) inflation figures for May will be the next immediate roadblock for Silver bugs: a fresh spark in inflation data will push the Fed even further away from rate cuts that have already been pushed back to September. Ongoing trade talks between the US and China also represent a fly in the ointment. The Trump administration has a poor track record of keeping its cool when trying to come away from the Chinese negotiating table with a win, and global Silver usage relies heavily on burgeoning tech sectors on both sides of the Pacific.

Silver price forecast

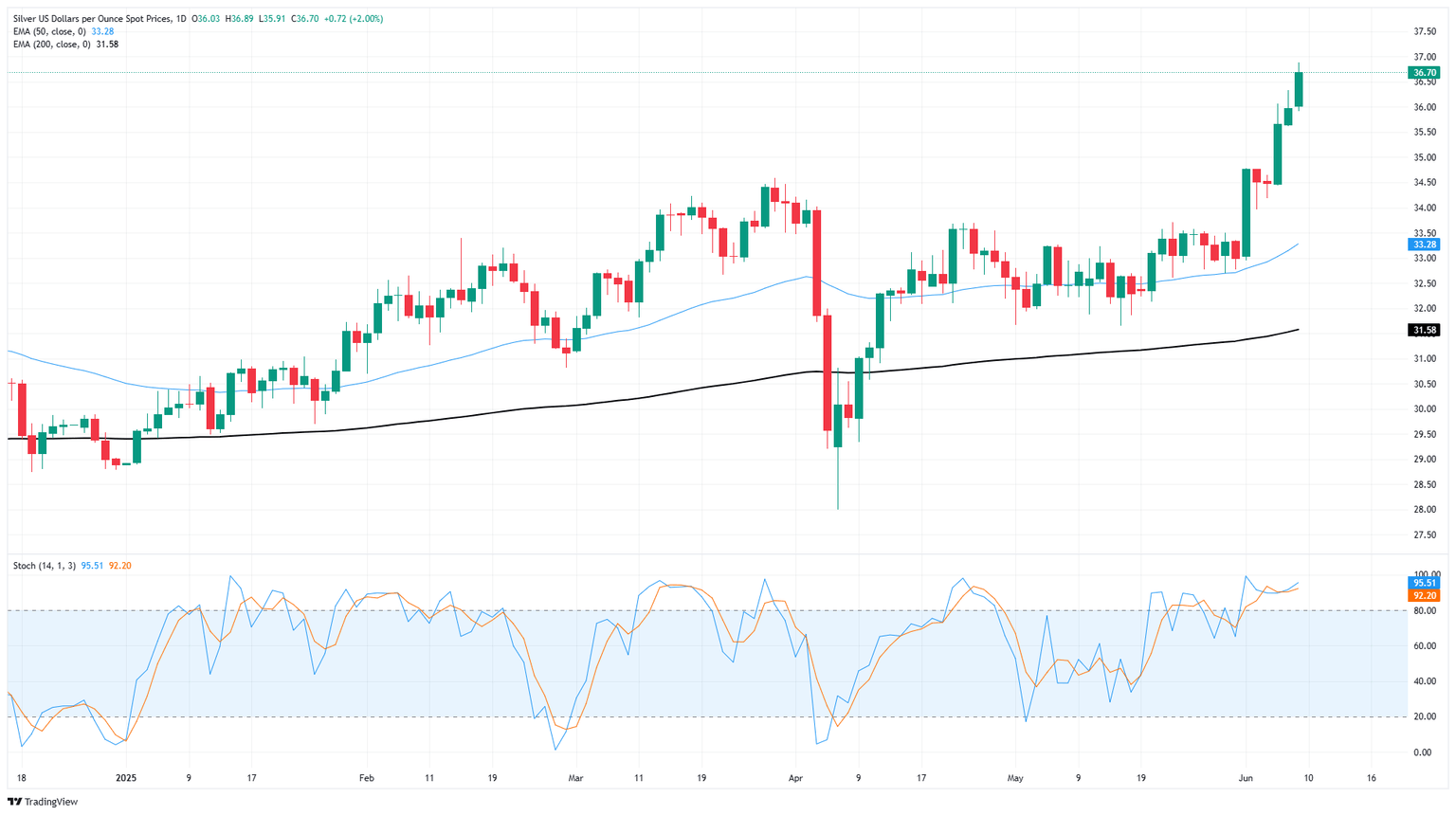

Silver punched in a stellar performance last week, gaining over 9% through last Friday and the white metal is already on pace to add further gains. Spot Silver prices are up nearly 32% bottom-to-top from April’s lows at the $28.00 handle, and it would take a 40% decline to push Silver bids back below the 200-day Exponential Moving Average (EMA) near $26.45/oz.

XAG/USD daily chart

Silver FAQs

Silver is a precious metal highly traded among investors. It has been historically used as a store of value and a medium of exchange. Although less popular than Gold, traders may turn to Silver to diversify their investment portfolio, for its intrinsic value or as a potential hedge during high-inflation periods. Investors can buy physical Silver, in coins or in bars, or trade it through vehicles such as Exchange Traded Funds, which track its price on international markets.

Silver prices can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can make Silver price escalate due to its safe-haven status, although to a lesser extent than Gold's. As a yieldless asset, Silver tends to rise with lower interest rates. Its moves also depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAG/USD). A strong Dollar tends to keep the price of Silver at bay, whereas a weaker Dollar is likely to propel prices up. Other factors such as investment demand, mining supply – Silver is much more abundant than Gold – and recycling rates can also affect prices.

Silver is widely used in industry, particularly in sectors such as electronics or solar energy, as it has one of the highest electric conductivity of all metals – more than Copper and Gold. A surge in demand can increase prices, while a decline tends to lower them. Dynamics in the US, Chinese and Indian economies can also contribute to price swings: for the US and particularly China, their big industrial sectors use Silver in various processes; in India, consumers’ demand for the precious metal for jewellery also plays a key role in setting prices.

Silver prices tend to follow Gold's moves. When Gold prices rise, Silver typically follows suit, as their status as safe-haven assets is similar. The Gold/Silver ratio, which shows the number of ounces of Silver needed to equal the value of one ounce of Gold, may help to determine the relative valuation between both metals. Some investors may consider a high ratio as an indicator that Silver is undervalued, or Gold is overvalued. On the contrary, a low ratio might suggest that Gold is undervalued relative to Silver.

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.