Silver Price Forecast: A near-term correction in the offing?

- Silver prices trade close to the $41.00 mark per ounce on Wednesday.

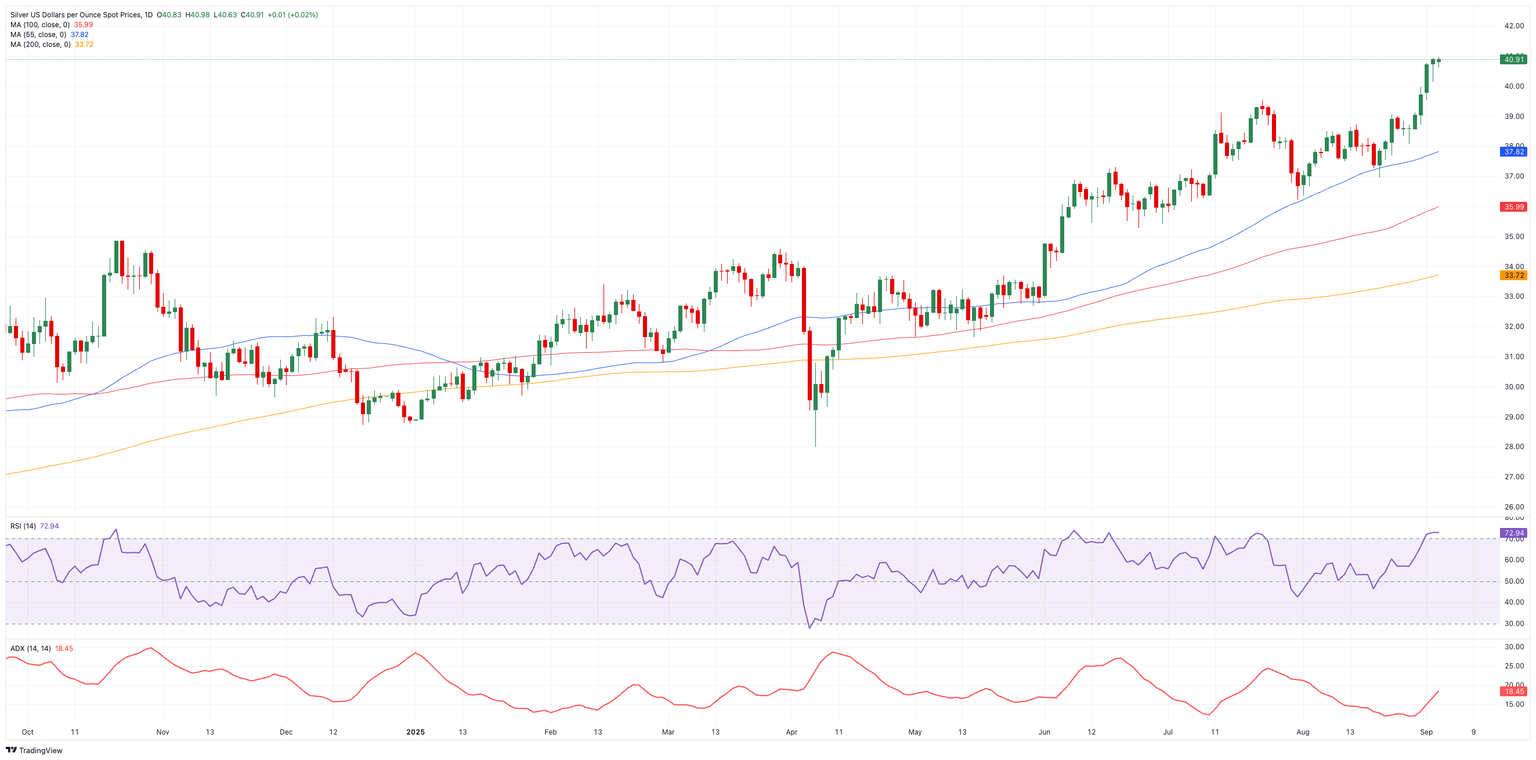

- A technical correction appears likely, with the RSI well in the overbought zone.

- Prospects for further rate cuts by the Federal Reserve underpin the metal.

Prices of Silver advance for the fourth day in a row on Wednesday, trading at shouting distance from the key barrier at $41.00 per ounce.

Fed rate cut bets and a weak Dollar support the rally

The industrial metal manages to maintain its upside trend well in place for yet another day on Wednesday, navigating the area of 14-year tops near $41.00 on the back of modest losses in the US Dollar.

The intense move higher in Silver prices and around precious metals in general is propped up by investors' persistent bets on extra rate cuts by the Federal Reserve in the second half of the year, starting as soon as later this month.

Still around the Fed, President Trump’s attempts to undermine the Fed’s independence via repeated calls for (much) lower interest rates and his recent intentions to fire FOMC Governor Lisa Cook have also given extra wings to Silver in the past few weeks, all against the backdrop of a more politicised Fed lying ahead.

In addition, the resurgence of trade uncertainty, geopolitical effervescence, and increasing inflows into Gold and Silver ETFs have also been bolstering the solid performance of those metals.

Moving forward, investors’ attention is expected to be on the upcoming Nonfarm Payrolls data for August on Friday, which should shed further details on the Fed’s upcoming interest rate decisions.

What about techs?

Next on the upside for Silver comes its 2025 high at $40.97 (September 3). On the other hand, there are minor supports at the weekly troughs of $38.09 (August 27) and $36.97 (August 20), all preceding the late July floor at $36.22 (July 31).

Momentum looks mixed, as the ADX near 18 signals a still juiceless trend, while the RSI near 73 is indicative of overbought conditions, which could in turn spark a technical correction in the not-so-distant future.

Silver FAQs

Silver is a precious metal highly traded among investors. It has been historically used as a store of value and a medium of exchange. Although less popular than Gold, traders may turn to Silver to diversify their investment portfolio, for its intrinsic value or as a potential hedge during high-inflation periods. Investors can buy physical Silver, in coins or in bars, or trade it through vehicles such as Exchange Traded Funds, which track its price on international markets.

Silver prices can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can make Silver price escalate due to its safe-haven status, although to a lesser extent than Gold's. As a yieldless asset, Silver tends to rise with lower interest rates. Its moves also depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAG/USD). A strong Dollar tends to keep the price of Silver at bay, whereas a weaker Dollar is likely to propel prices up. Other factors such as investment demand, mining supply – Silver is much more abundant than Gold – and recycling rates can also affect prices.

Silver is widely used in industry, particularly in sectors such as electronics or solar energy, as it has one of the highest electric conductivity of all metals – more than Copper and Gold. A surge in demand can increase prices, while a decline tends to lower them. Dynamics in the US, Chinese and Indian economies can also contribute to price swings: for the US and particularly China, their big industrial sectors use Silver in various processes; in India, consumers’ demand for the precious metal for jewellery also plays a key role in setting prices.

Silver prices tend to follow Gold's moves. When Gold prices rise, Silver typically follows suit, as their status as safe-haven assets is similar. The Gold/Silver ratio, which shows the number of ounces of Silver needed to equal the value of one ounce of Gold, may help to determine the relative valuation between both metals. Some investors may consider a high ratio as an indicator that Silver is undervalued, or Gold is overvalued. On the contrary, a low ratio might suggest that Gold is undervalued relative to Silver.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.