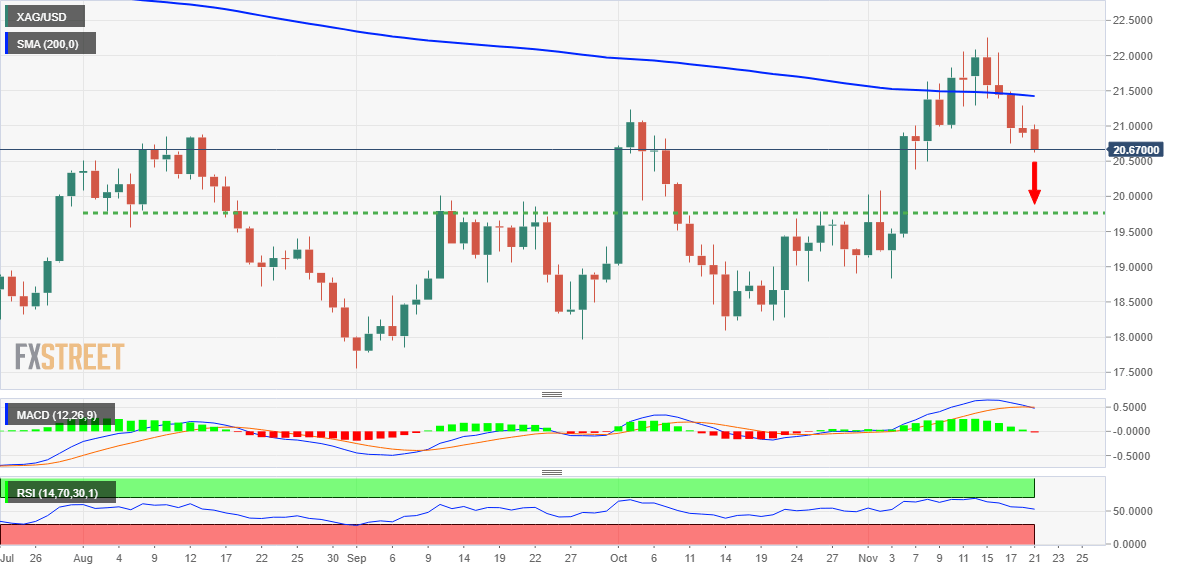

Silver Price Analysis: XAGUSD struggles near two-week low, seems vulnerable below $21.00

- Silver remains under some selling pressure on Monday and drops to a nearly two-week low.

- The mixed technical setup warrants some caution before placing aggressive bearish bets.

- A sustained strength beyond the $22.00 mark is needed to negate near-term negative bias.

Silver comes under some renewed selling pressure on Monday and extends last week's retracement slide from the $22.25 area or its highest level since June 7. The white metal remains depressed through the first half of the European session and is currently placed around the $20.75-$20.70 region or a nearly two-week low.

From a technical perspective, the recent repeated failures to find acceptance above the $22.00 mark favours bearish traders. Furthermore, a subsequent weakness back below the very important 200-day SMA supports prospects for an extension of the corrective decline. That said, oscillators on the daily chart are still holding in the positive territory and warrant some caution.

Hence, any further downfall is more likely to find decent support near the $20.40-$20.35 region. This is followed by the $20.00 psychological mark, which if broken decisively will add credence to the near-term negative outlook. The XAGUSD might then turn vulnerable to test the $19.60 resistance break point before dropping to the $19.15-$19.10 support en route to the $19.00 mark.

On the flip side, attempted recovery might now confront stiff resistance near the $21.00 round figure. Any subsequent move-up is more likely to attract fresh sellers and remain capped near the $21.40-$21.50 area (200 DMA). The latter should act as a pivotal point, which if cleared decisively will negate any near-term negative outlook and shift the bias back in favour of bullish traders.

The upward trajectory might then lift the XAGUSD further beyond the $21.70 intermediate hurdle, towards reclaiming the $22.00 mark. Bulls might eventually aim to challenge the multi-month high, around the $22.25 region.

Silver daily chart

Key levels to watch

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.