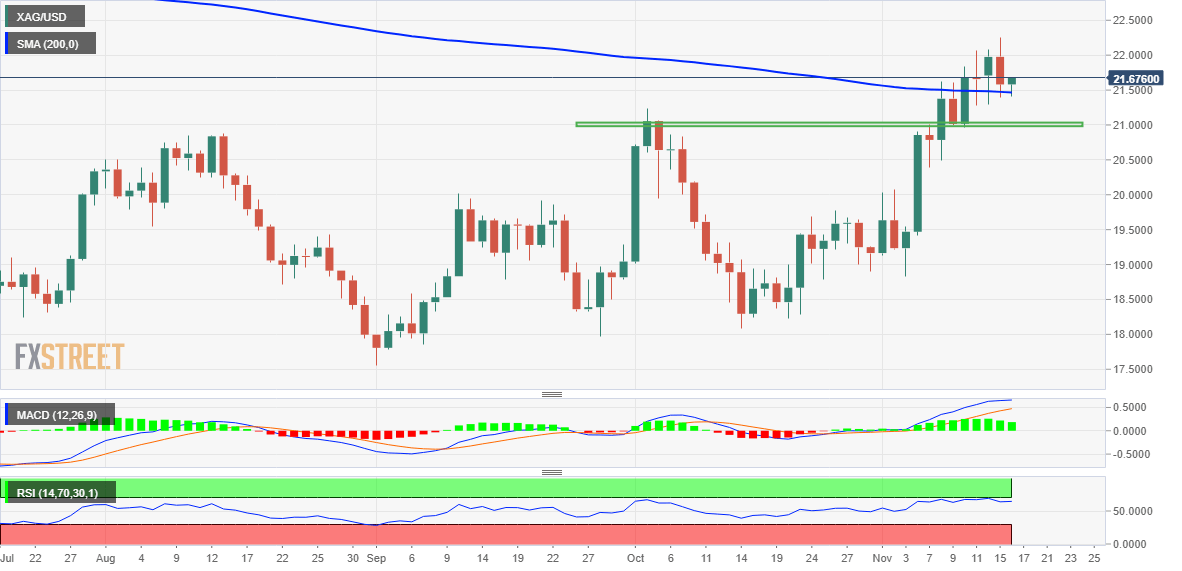

Silver Price Analysis: XAGUSD finds support and attracts some buyers near 200-day SMA

- Silver regains some traction and stalls the overnight pullback from a multi-month high.

- The emergence of fresh buying near the very important 200 DMA favours bullish traders.

- The lack of follow-through buying warrants caution before positioning for further gains.

Silver attracts some buying near the $21.40 region on Wednesday and for now, seems to have stalled the previous day's sharp retracement slide from over a five-month high. The white metal climbs back above the mid-$21.00s during the early European session, though lacks follow-through.

From a technical perspective, the emergence of dip-buying near the very important 200-day SMA favours bullish traders. The positive outlook is reinforced by the fact that oscillators on the daily chart are holding comfortably in bullish territory. That said, the metal's inability to capitalize on the modest intraday uptick warrants some caution before positioning for any further appreciating move.

In the meantime, any subsequent move up beyond the $21.70 horizontal barrier could face resistance near the $22.00 round-figure mark. This is closely followed by the multi-month peak, around the $22.25 region, which if cleared will set the stage for additional gains. The XAGUSD might then accelerate the momentum towards the $22.50-$22.60 supply zone and eventually aim to reclaim the $23.00 mark.

On the flip side, the $21.40-$21.30 area might continue to protect the immediate downside ahead of a strong horizontal resistance breakpoint now turned support near the $21.00 mark. A convincing break below will make the XAGUSD vulnerable to test the next relevant support near the $20.40-$20.35 region. The corrective slide could get extended and drag spot prices towards the $20.00 psychological mark.

Silver daily chart

Key levels to watch

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.