Silver Price Analysis: XAG/USD tests resistance at around $28.70 shy of reclaiming $29.00

- Silver rises 1.32% to $28.57, buoyed by lower US Treasury yields and a weakening dollar.

- XAG/USD shows strong upward trend within $28.00-$28.80 range, up from early May low of $26.02.

- To maintain momentum, silver aims to breach $29.00, targeting YTD high of $29.79 and $30.00.

- Support at $28.00; further supports at 38.2% Fib retracement ($27.70) and 50% Fib ($27.06).

Silver's price moved higher late in the North American session due to lower US Treasury yields and a softer US Dollar. Although the latest inflation figures in the US were higher than expected, the non-yielding metal climbed. The XAG/USD trades at $28.57, gains 1.32%.

XAG/USD Price Analysis: Technical outlook

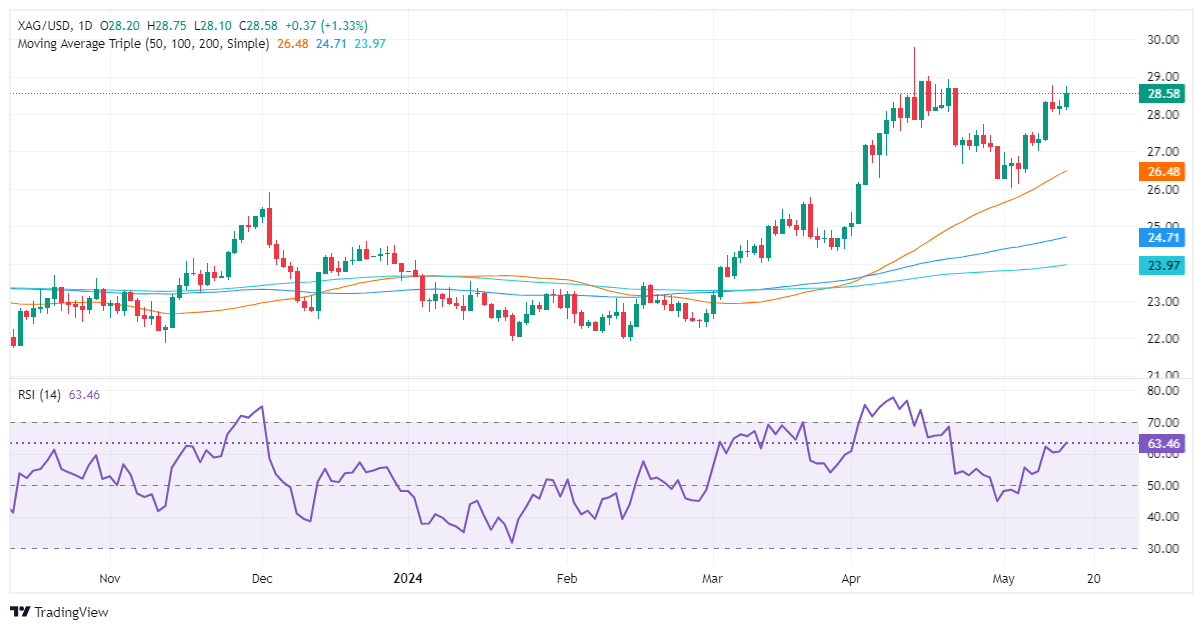

During the last three days, Silver has been seesawing within the $28.00-$28.80 range after registering exponential gains since May 2, which brought the grey metal’s price from around $26.02 to current spot prices.

XAG/USD is upward biased, though is at the brisk of forming a ‘double top.’ Momentum favors buyers, with the Relative Strength Index (RSI) standing at bullish territory.

For a bullish continuation, buyers need to reclaim the $29.00 psychological figure. Once cleared, the next stop would be the year-to-date (YTD) high at $29.79, followed by the $30.00 mark.

Conversely, if sellers stepped in and pushed prices below $28.00, look for further losses. The first demand zone would be the 38.2% Fib retracement at $27.70. A breach of the latter will expose the 50% Fib retracement at $27.06.

XAG/USD Price Action – Daily Chart

Author

Christian Borjon Valencia

FXStreet

Christian Borjon began his career as a retail trader in 2010, mainly focused on technical analysis and strategies around it. He started as a swing trader, as he used to work in another industry unrelated to the financial markets.