Silver Price Analysis: XAG/USD struggles near YTD lows, remains vulnerable

- Silver witnessed fresh selling on Wednesday and drifted back closer to YTD lows.

- The set-up favours bearish traders and supports prospects for additional losses.

- Bears might wait for a break below the $22.00 mark before placing fresh bets.

Silver struggled to capitalize on the overnight bounce from the vicinity of YTD lows, instead met with some fresh supply on Wednesday. The commodity remained depressed heading into the North American session and was last seen trading around the $22.25-20 region, down nearly 1% for the day.

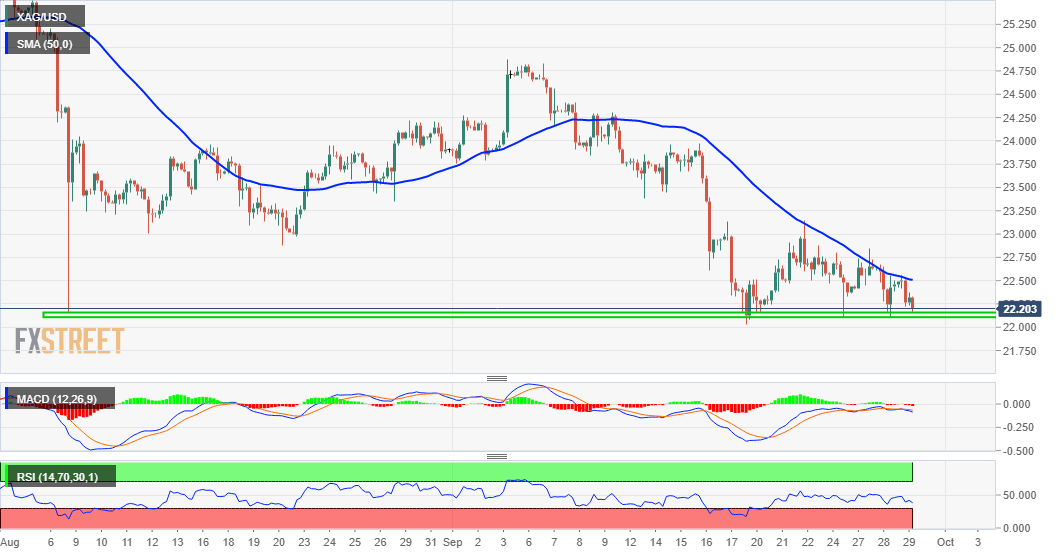

Looking at the technical picture, attempted recoveries have repeated failed near the downward sloping 50-period SMA resistance on the 4-hour chart. However, the XAG/USD, so far, has shown some resilience near the $22.00 round figure, which should now act as a key pivotal point for traders.

Meanwhile, technical indicators on the daily chart are holding deep in the bearish territory and are still far from being in the oversold zone. This, in turn, supports prospects for an eventual break below the $22.00 handle and an extension of over three-week-old downward trajectory.

The XAG/USD might then accelerate the slide towards challenging September 2020 swing lows support, around the $21.65 region, before dropping to the $21.00 round-figure mark.

On the flip side, the 50-period SMA on the 4-hour chart, currently around mid-$22.00s might continue to act as a strong resistance. This is followed by the $22.80 supply zone, above which the XAG/USD could surpass the $23.00 mark and test the next relevant hurdle near the $23.15 area.

Silver 4-hour chart

Technical levels to watch

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.