Silver Price Analysis: XAG/USD stays defensive at two-month low near $23.00, advocates further downside

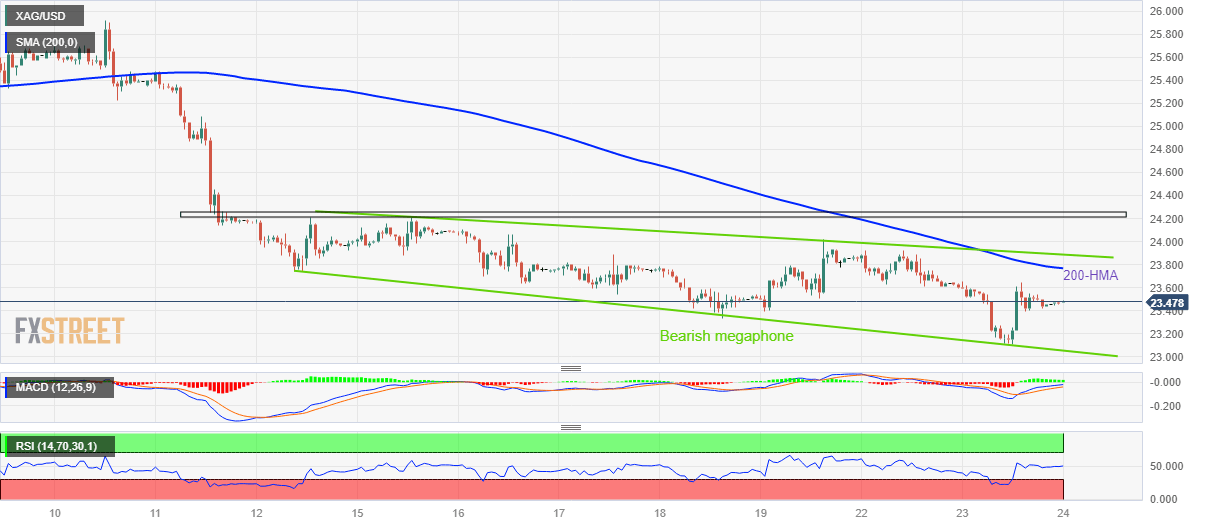

- Silver Price remains sidelined within “Bearish Megaphone” after refreshing multi-day low.

- Steady RSI, sustained trading below 200-HMA and trend-widening formation keep XAG/USD bears hopeful.

- Silver price recovery remains elusive below $24.25; bears may witness a bumpy road ahead.

Silver Price (XAG/USD) remains sidelined around $23.45 amid a sluggish Asian session on Wednesday, after falling to the fresh low in two months the previous day. That said, RSI (14) line’s bounce off the oversold territory and the bullish MACD signals seem to defend the XAG/USD’s latest corrective bounce off the multi-day bottom.

Even so, the bright metal remains on the seller’s radar as it portrays a “Bearish Megaphone” trend-widening chart pattern while connecting levels marked since May 12. Additionally, the Silver Price’s sustained trading below the 200-Hour Simple Moving Average (HMA) keeps the XAG/USD sellers hopeful.

It’s worth noting, however, that the latest trough of $23.11 and the bottom line of the stated megaphone, close to $23.05, quickly followed by the $23.00 round figure, may test the Silver sellers.

Following that, the bullion can drop to the late February swing high of around $22.00, with the $22.70 and $22.20 likely offering intermediate halts during the anticipated fall.

Alternatively, XAG/USD recovery may aim for the 200-HMA hurdle, near $23.75 by the press time. Following that, the stated chart formation’s top line, close to $23.90, as well as the $24.00 round figure may prod the Silver buyers.

In a case where the Silver Price remains firmer past $24.00, a fortnight-old horizontal resistance near $24.25, will act as the last defense of the XAG/USD bears.

Silver price: Hourly chart

Trend: Further downside expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.