Silver Price Analysis: XAG/USD retreats from multi-day top, technical setup favours bulls

- Silver struggles to capitalize on its modest intraday gains beyond the $24.00 mark.

- The technical set-up favours bullish traders and supports prospects for further gains.

- A convincing break below the $23.00 mark is needed to negate the positive outlook.

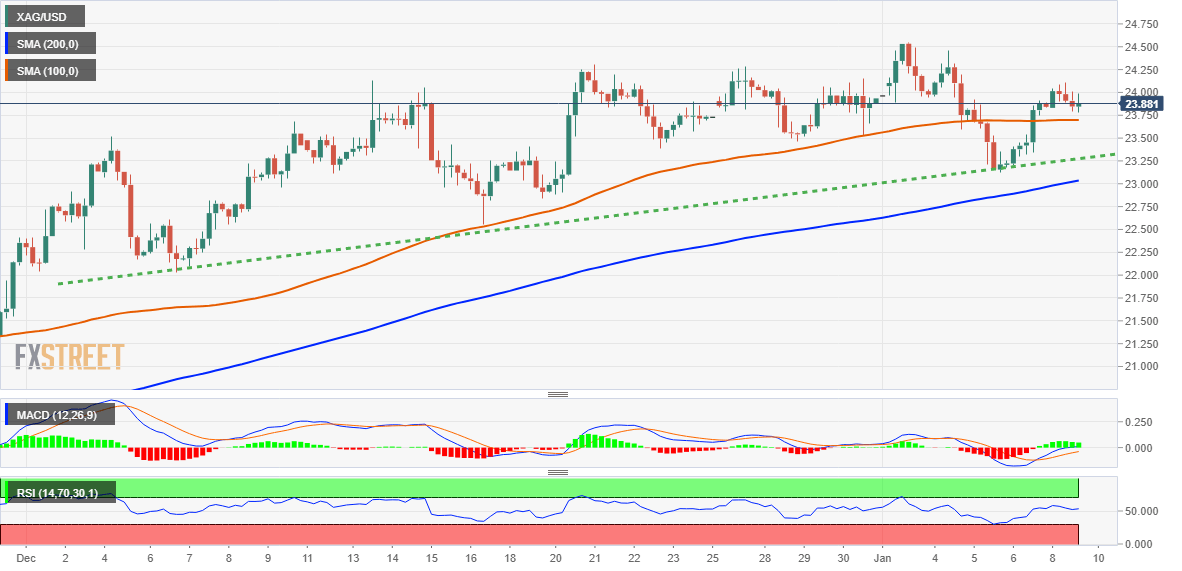

Silver builds on Friday's goodish rebound from the vicinity of the $23.00 mark and gains some follow-through traction on the first day of a new week. The white metal, however, struggles to find acceptance above the $24.00 round figure and retreats from a three-day high touched during the first half of the European session.

The XAG/USD, meanwhile, manages to defend the 100-period SMA on the 4-hour chart, around the $23.70 area, and the technical set-up still seems tilted in favour of bullish traders. The outlook is reinforced by positive oscillators on daily/hourly charts. That said, it will still be prudent to wait for a sustained strength beyond the $24.00 mark before positioning for any further appreciating move.

The XAG/USD might then aim to surpass an intermediate hurdle near the $24.25 region, which is followed by the multi-month high, around the $24.50-$24.55 region touched last week. Some follow-through buying beyond the latter will be seen as a fresh trigger for bullish traders and lift spot prices further towards reclaiming the $25.00 psychological mark for the first time since April 2022.

On the flip side, the $23.20-$23.10 area now seems to have emerged as immediate support ahead of the $23.00 round figure. A convincing break below could drag the XAG/USD towards the $22.60-$22.55 region en route to the next relevant support near the $22.10-$22.00 horizontal zone. Failure to defend the latter will mark a breakdown and set the stage for a further near-term depreciating move.

Silver 4-hour chart

Key levels to watch

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.