Silver Price Analysis: XAG/USD retreats as shooting star looms, sellers eye $28.00

- Silver retreats from a three-week high reached at $28.74.

- Momentum favors bulls in the medium term; but shooting star looming paves the way for a retracement.

- Uptrend to resume with buyers clearing $28.74.

Silver prices reversed on Friday amid high US Treasury yields and a stronger US Dollar. The grey metal slipped 0.48% and exchanges hands at around $28.19, at the time of writing.

XAG/USD Price Analysis: Technical outlook

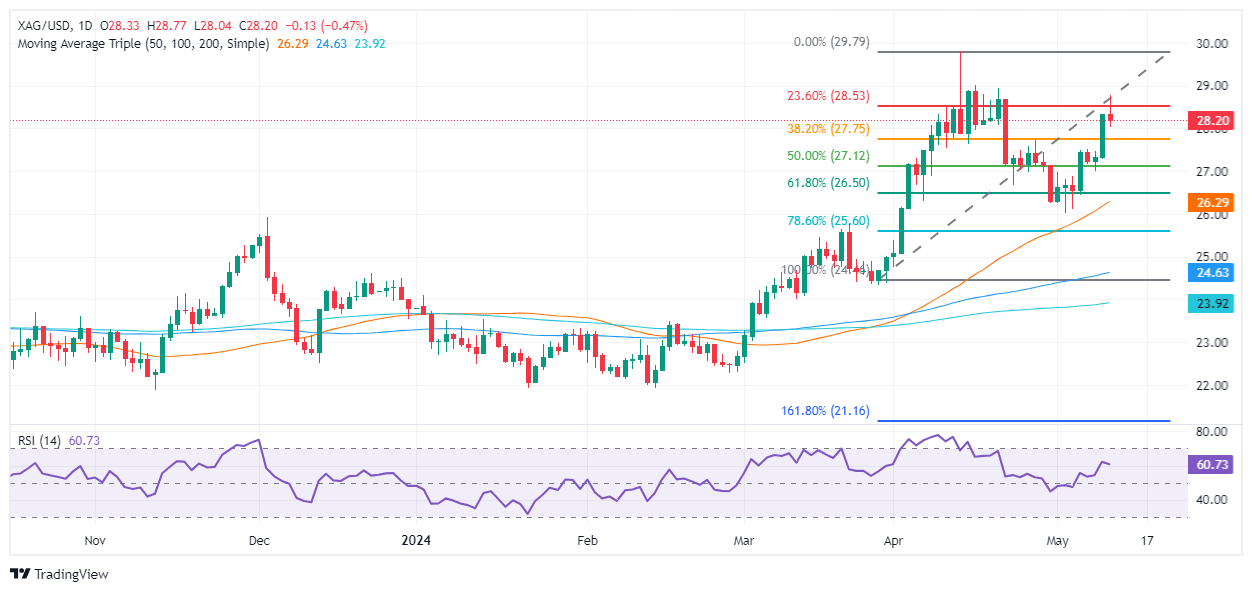

From a technical perspective, Silver is still upward biased, though the formation of a ‘shooting star,’ can pave the way for a pullback. Even though momentum favors bulls, as depicted by the Relative Strength Index (RSI) with readings between 60-70, its slope aims downwards.

Therefore, XAG/USD is bearishly biased in the short term. However, sellers will face solid support levels, like the $28.00 psychological level. Once cleared, the non-yielding metal could dive toward the 38.20% Fib retracement at $27.70, confluence with the April 62 high.

On the other hand, a bullish resumption could occur, if buyers reclaim the current week high of $28.76, followed by the $29.00 mark. A breach of the latter and buyers could challenge the year-to-date (YTD) high at $29.79.

XAG/USD Price Action – Daily Chart

Author

Christian Borjon Valencia

FXStreet

Christian Borjon began his career as a retail trader in 2010, mainly focused on technical analysis and strategies around it. He started as a swing trader, as he used to work in another industry unrelated to the financial markets.