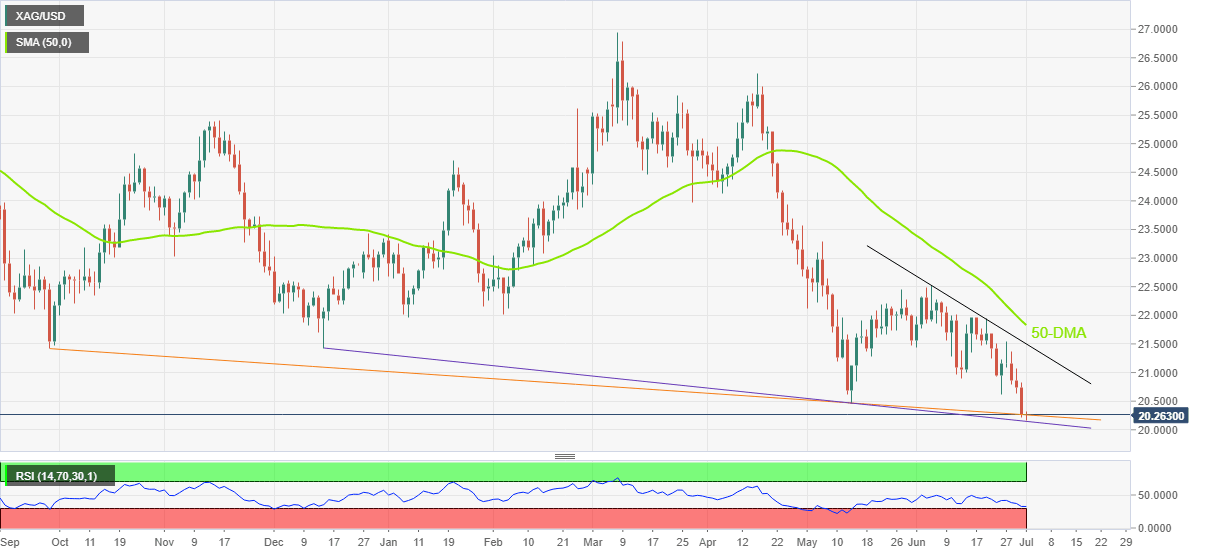

Silver Price Analysis: XAG/USD renews two-year low near $20.20, further downside appears difficult

- Silver seesaws around the lowest levels since July 2020 during the four-day downtrend, sidelined of late.

- Oversold RSI, key support lines from 2021 challenge bears.

Silver Price (XAG/USD) dropped to the lowest levels in two years before portraying the latest inaction at around $20.30 during Friday’s Asian session. In doing so, the bright metal remains on the back foot for the fourth consecutive day.

However, the oversold RSI (14) line joins downward sloping support lines from September and December 2021, respectively around $20.30 and $20.15, to restrict the quote’s further downside.

The same suggests the short-covering move targeting the mid-June low near $20.90.

However, a downward sloping resistance line from June 06, at $21.50 by the press time, precedes the 50-DMA hurdle of $21.85 to challenge the XAG/USD buyers.

In a case where the bullion prices rally beyond $21.85, June’s peak of $22.51 will be in focus.

Alternatively, the $20.00 psychological magnet will act as an extra filter to the south, other than the aforementioned support lines around $20.30 and $20.15.

During the quote’s weakness past $20.00, the year 2019 high near $19.65 could test the silver sellers before directing them to a 2021 peak surrounding $18.85.

Overall, silver prices remain bearish but a short-term rebound can’t be ruled out.

Silver: Daily chart

Trend: Corrective pullback expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.