Silver Price Analysis: XAG/USD pares the first daily gains in six near $21.00

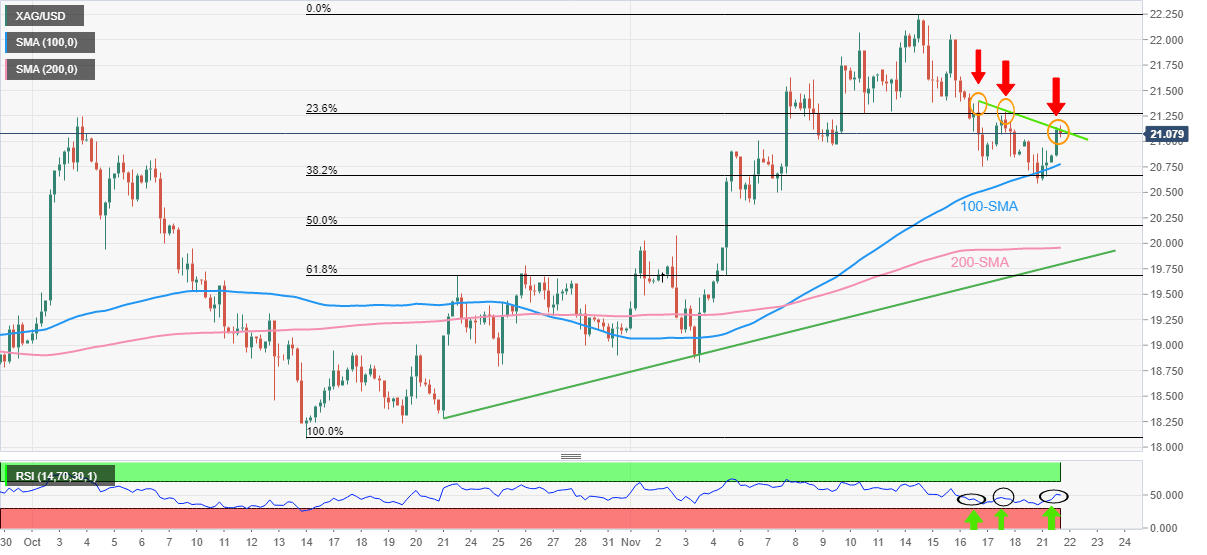

- Silver price fades bounce off 100-SMA, retreats from three-day-old resistance line.

- Bearish RSI divergence keeps sellers hopeful to aim for 200-SMA.

- Monthly support line adds to the downside filters, buyers need validation from $21.30.

Silver price (XAG/USD) retreats from intraday high as sellers approach $21.00 during early Tuesday morning in Europe.

In doing so, the bright metal eases from a downward sloping trend line from Thursday while consolidating the first daily gains in six.

It’s worth noting that the lower high formation in the last three days join higher high on the Relative Strength Index (RSI) placed at 14, which in turn portrays a hidden bearish divergence and suggests further downside of the metal.

That said, the 100-SMA level surrounding $20.80 acts as immediate support ahead of directing the XAG/USD bears toward the $20.00 psychological magnet.

In a case where silver sellers keep the reins past $20.00, the 200-SMA and one-month-old ascending trend line, respectively near $19.95 and $19.80, could challenge the bearish bias for the metal.

Alternatively, sustained trading beyond the aforementioned resistance line, close to $21.15 at the latest, could tease the XAG/USD buyers.

Even so, October’s peak and 23.6% Fibonacci retracement level of the metal’s upside between October and November, near $21.30, could challenge the silver bulls before directing them to the monthly high of $22.25.

Silver: Four-hour chart

Trend: Further weakness expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.