Silver Price Analysis: XAG/USD is under increasing bearish pressure below $27.57 support

- Silver building up bearish momentum after breaching $27.57 support level.

- A brighter market mood amid receding geopolitical risks is weighing on Precious metals.

- XAG/USD has scope for further decline, next targets are $26.85 and $26.30.

Silver (XAG/USD) is going through a deep correction on Monday, with precious metals suffering as concerns about an escalation of the Middle East conflict ebb. The lower US Yields have failed to support demand for the pale metal, which has depreciated about 5.7% from Friday’s highs.

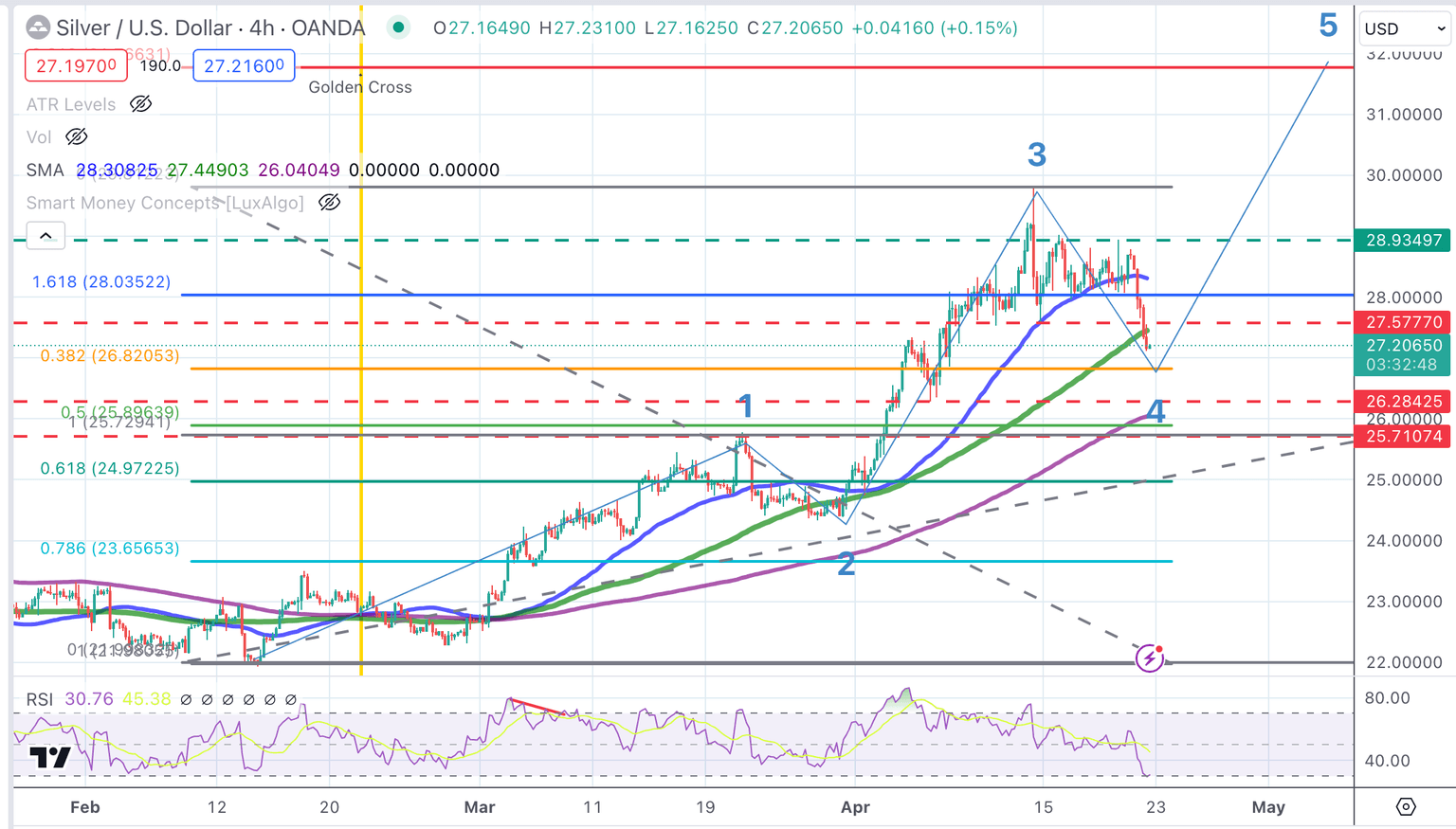

XAG/USD Price Analysis: Technical outlook

Bears gained confidence on Monday after pushing prices below the $27.57 support area. Technical indicators are pointing lower, with the 4h approaching but not yet at oversold levels and price action below the 50 and the 100 SMAS.

Using Elliott wave analysis, the pair seems on the 4th corrective wave of a five-wave bullish cycle. The 38.2% Fibonacci retracement of the mentioned bull run, at $26.85 is a common target for corrections, and close below is the April 5 low, at $26.30.

On the upside, the pair would need to regain the $27.60 previous support level to shift its focus to the $27.95 and Mid-April’s high, at $29.80.

XAG/USD Price Action - 4 Hour Chart

Author

Guillermo Alcala

FXStreet

Graduated in Communication Sciences at the Universidad del Pais Vasco and Universiteit van Amsterdam, Guillermo has been working as financial news editor and copywriter in diverse Forex-related firms, like FXStreet and Kantox.