Silver Price Analysis: XAG/USD bulls take a breather amid slightly overbought RSI

- Silver pulls back from a nearly one-year peak touched earlier this Wednesday.

- The technical setup still favours bulls and supports prospects for further gains.

- Any further slide is likely to support near the $24.40-30 resistance breakpoint.

Silver retreats from the $25.10-$25.15 area, or a nearly one-year high touched this Wednesday and erodes a part of the previous day's strong gains. The white metal remains depressed through the early North American session and is currently placed near the lower end of its daily range, around the $24.85-$24.80 region.

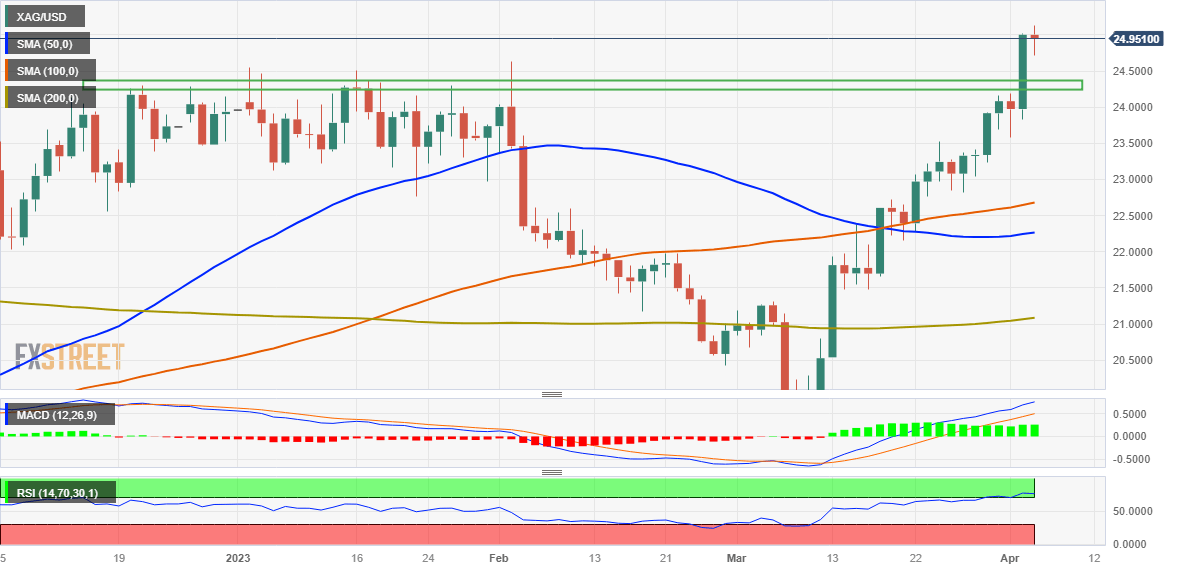

From a technical perspective, the overnight sustained move and acceptance above the $24.30-$24.40 strong horizontal barrier was seen as a fresh trigger for the XAG/USD bulls. A subsequent strength beyond the previous YTD peak, around the $24.65 zone, might have already set the stage for an extension of the recent strong upward trajectory witnessed over the past month or so.

The positive outlook is reinforced by the fact that the XAG/USD is holding comfortably above technically significant Simple Moving Averages (SMAs) - 50, 100 and 200-day SMAs. That said, Relative Strength Index (RSI) on the daily chart is flashing overbought conditions and makes it prudent to wait for some near-term consolidation or a modest pullback before placing fresh bullish bets.

In the meantime, any meaningful pullback is likely to attract fresh buyers and remain limited near the $24.40-$24.30 resistance breakpoint, now turned support. This should now act as a pivotal point, which if broken decisively might prompt some technical selling and make the XAG/USD vulnerable to weaken below the $24.00 mark, towards testing the weekly low, around the $23.60-$23.55 area.

Silver daily chart

Key levels to watch

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.