Silver Price Analysis: XAG/USD bulls look to seize control, move beyond 200-hour SMA awaited

- Silver attracts some dip-buying on Wednesday and spikes to a multi-day high.

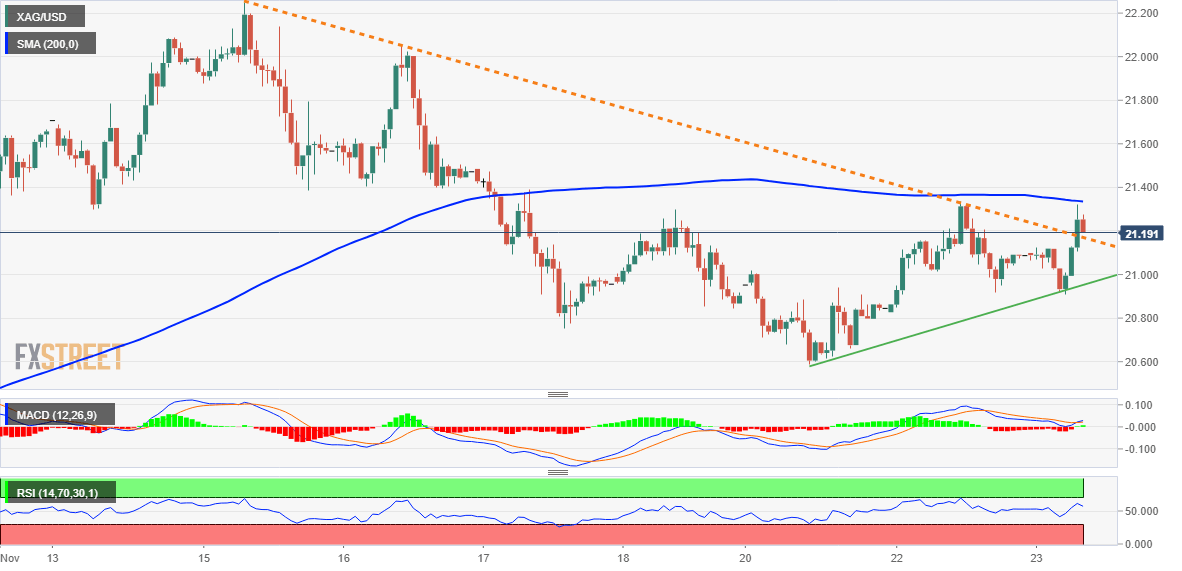

- The move confirms a breakout through a one-week-old descending trend line.

- A sustained break below the $21.00 mark is needed to negate the positive bias.

Silver reverses an intraday dip to sub-$21.00 levels and surges to a four-day high during the early European session on Wednesday. The white metal is currently trading around the $21.25-$21.30 region, up over 0.80% for the day, with bulls now awaiting a sustained move beyond the 200-hour SMA before placing fresh bets.

From a technical perspective, the momentum confirms a breakout through a one-week-old descending trend-line resistance. Meanwhile, oscillators on the daily chart are holding in the bullish territory and have just started gaining positive traction on hourly charts. This, in turn, supports prospects for an extension of the recovery from a nearly two-week low, around the $20.60-$20.55 area touched on Monday.

Some follow-through buying beyond the $21.35 region (200-hour SMA) will reaffirm the constructive outlook and lift the XAG/USD towards the $21.75-$21.80 resistance zone. This is followed by the $22.00 mark and over a five-month high, around the $22.25 area, which if cleared will set the stage for a move towards the $22.50-$22.60 supply zone. Spot prices could eventually reclaim the $23.00 round figure.

On the flip side, the $21.00-$20.90 area might continue to protect the immediate downside. The said support represents an ascending trend-line extending from the weekly low touched on Monday. A convincing break below will negate the positive set-up and shift the near-term bias in favour of bearish traders. The XAG/USD might then slide to the $20.60-$20.55 area (weekly low) and the $20.00 psychological mark.

Silver 1-hour chart

Key levels to watch

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.