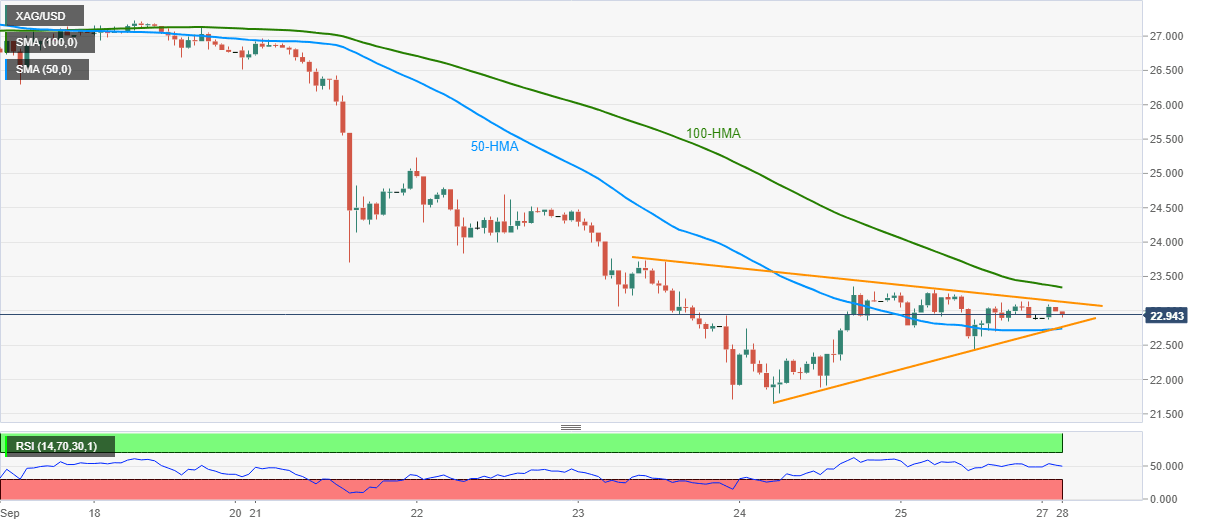

Silver Price Analysis: XAG/USD bears attack $23.00 inside short-term triangle

- Silver trims early-Asian gains while taking a U-turn from $23.08.

- A three-day-old triangle formation restricts the bullion’s moves.

- 100 and 50-HMA are additional filters to watch amid near-term bearish bias.

Silver prices decline to $22.90 as markets in Tokyo open for Monday’s trading. The white metal earlier surged to $23.08 but failed to keep the gains inside a triangle drawn from last Wednesday.

Considering the commodity’s latest pullback, a confluence of 50-HMA and the support line of the mentioned triangle near $22.70/75 can limit additional downside.

Also acting as near-term key support could be $22.40 that holds the gate for silver’s further weakness towards the monthly low of $21.65.

Alternatively, an upside clearance of the mentioned triangle’s resistance line, at $23.13 now, needs validation from the 100-HMA level of $23.33 to aim for September 22 low near $23.85.

Should there be a clear upside past-$23.85, last Tuesday’s high around $25.25 can lure the bulls.

Silver hourly chart

Trend: Pullback expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.