Silver Price Analysis: XAG/USD attracts some buyers below $23.00, focus on US CPI data

- Silver gains momentum near $22.80 in Monday’s early European session.

- The bullish price of silver remains intact above the key EMA.

- The key resistance level is seen at 23.00; 22.70 acts as an initial support level for the metal.

Silver (XAG/USD) extends its upside above the mid-$22.00s during the early European session on Monday. Traders will keep an eye on the US January Consumer Price Index (CPI) on Tuesday for fresh impetus. If the CPI data confirms the declining inflation trend, it may support the case for rate cuts, which boosts the silver price. XAG/USD currently trades around $22.80, gaining 0.82% on the day.

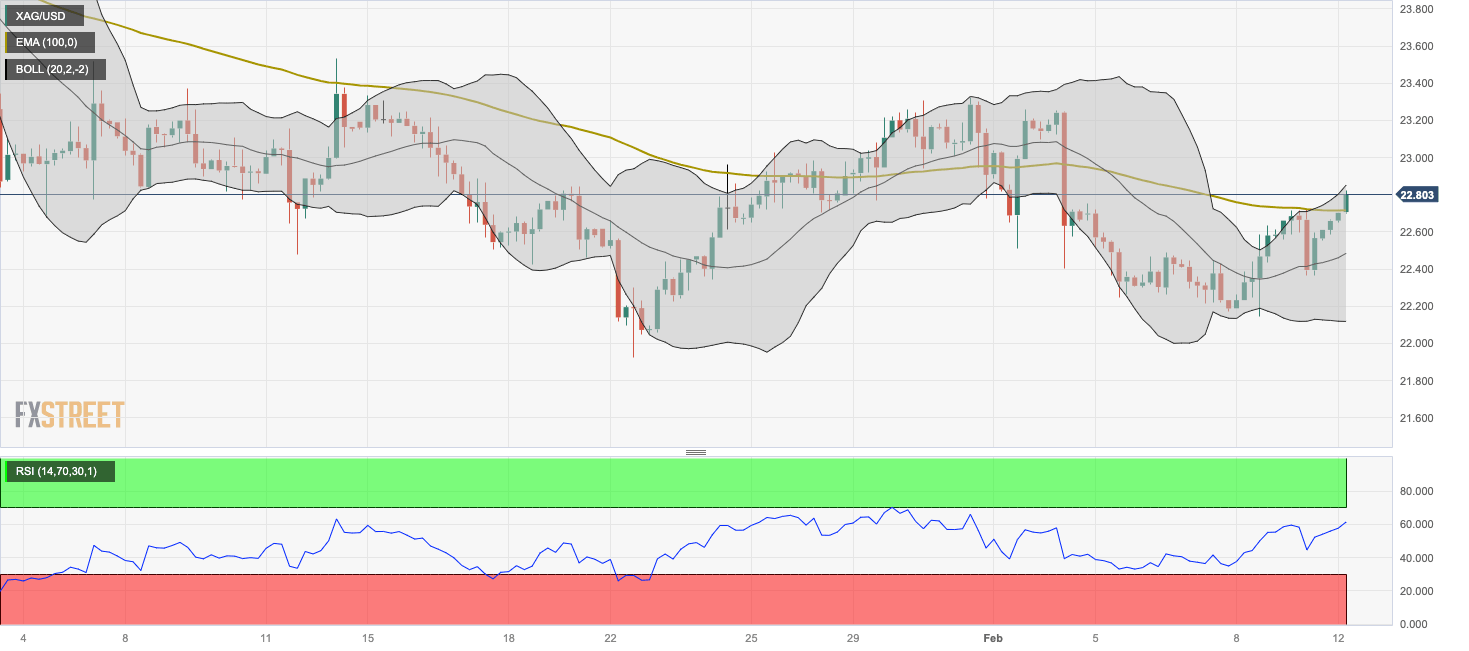

According to the four-hour chart, the silver price resumes its bullish trend as the metal is above the key 100-period Exponential Moving Averages (EMA). The upward momentum is supported by the Relative Strength Index (RSI), which lies above the 50 midlines. The momentum indicator indicates that further upside looks favorable.

A bullish breakout above the upper boundary of Bollinger Band of $22.85 will see a rally to a psychological round mark and a high of January 25 at 23.00. Further north, the next hurdle is located near a high of February 2 at 23.25. The additional upside filter to watch is 23.53 (a high of January 12), followed by 24.09 (a high of January 2).

On the downside, the 100-period EMA at 22.70 acts as an initial support level for the metal. A break below the latter will see a drop to a high of February 6 at 22.48. The next downside target is seen near the lower limit of the Bollinger Band at 22.10 and a low of January 22 at 21.92.

Silver four-hour chart

Author

Lallalit Srijandorn

FXStreet

Lallalit Srijandorn is a Parisian at heart. She has lived in France since 2019 and now becomes a digital entrepreneur based in Paris and Bangkok.