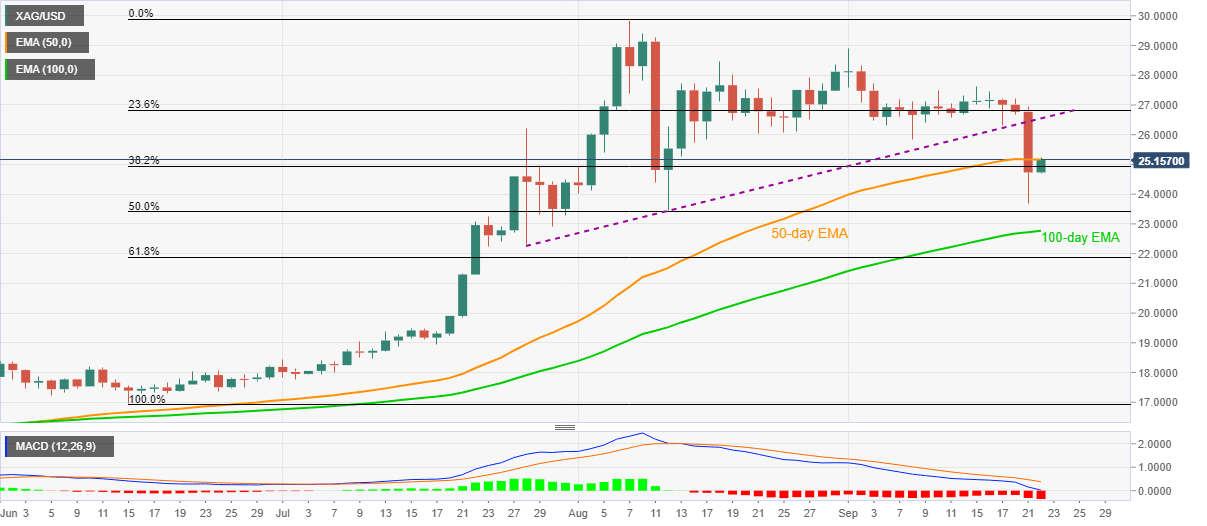

Silver Price Analysis: 50-day EMA probes XAG/USD bounce off multi-day low

- Silver recovers from 14-week low to regain $25.00.

- Sustained break of two-month-old support line keeps sellers hopeful.

- The key Fibonacci retracements, 100-day EMA offer short-term support.

Silver prices take the bids near $25.20, up 1.8% intraday, during Monday’s Asian session. In doing so, the white metal trims the previous day’s losses, the biggest since August 11, which dragged it to the multi-day bottom.

While the downside break of an ascending trend line from July 28 triggered the bullion’s fall, bearish MACD and 50-day EMA seem to restrict silver’s latest recovery moves.

Other than the $25.17 EMA resistance, the September 05 low near $25.85 will also challenge the buyers’ attempt to regain the status beyond an upward sloping trend line, previous support, around $26.55.

On the flip side, 50% and 61.8% Fibonacci retracements of the metal’s run-up between June and August, respectively around $23.40 and $21.85, will be the key levels on the bears’ radars.

Also acting as downside support for silver traders could be the 100-day EMA level of $22.76 and lows marked during late-July near $22.30/25.

Silver daily chart

Trend: Bearish

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.