Silver Price Analysis: $27.30 confluence hurdle capped intraday uptick for XAG/USD

- Silver struggled to capitalize on its intraday bounce from multi-day lows.

- Mixed oscillators on hourly/daily charts warrant caution for bullish traders.

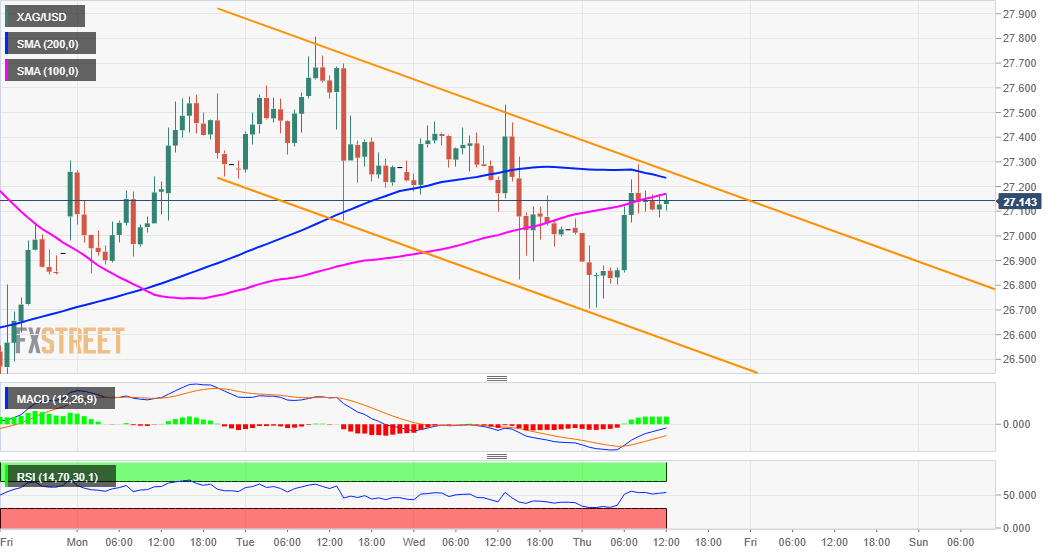

Silver staged a modest intraday bounce from multi-day lows and refreshed daily tops during the early European session, albeit lacked follow-through. The intraday move up stalled near the $27.30 confluence barrier, comprising of 200-hour SMA and the top end of a three-day-old descending trend-channel.

Meanwhile, technical indicators on the daily chart are holding comfortably in the bullish territory. That said, oscillators on intraday charts have been struggling to gain any meaningful positive traction, making it prudent to wait for a move beyond the mentioned support before placing fresh bullish bets.

A sustained strength will also mark a bullish break through the weekly trading range and set the stage for additional gains. The XAG/USD might then accelerate the momentum back towards weekly swing highs, around the $27.80 region, above which bulls are likely to make a fresh attempt to conquer the $28.00 round-figure mark.

On the flip side, immediate support is pegged near the $27.00 mark. Failure to defend the mentioned level might prompt some technical selling and turn the XAG/USD vulnerable to retest the $26.70-65 support zone, or daily swing lows, which is closely followed by the trend-channel support near the $26.50 region.

XAG/USD 1-hourly chart

Technical levels to watch

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.