Rivian Automotive (RIVN) Stock News and Forecast: Is there more downside to come?

- RIVN stock collapses over 13% on Wednesday.

- Rivian announced price hikes for some models on Wednesday.

- Elon Musk took a Twitter swipe at Rivian's margins.

Rivian (RIVN) suffered on Wednesday with the stock closing down over 13% at $53.56. That marks a 70% decline for the stock from its post-IPO high of $179.47 in November. Rivian IPO'd in a blaze of publicity at $78 in November. Even those who got in at that price are now facing heavy losses. We have repeatedly warned here at FXStreet that Rivian was trading on a much too high multiple and represented the peak of the pandemic era retail frenzy. We take no comfort in pointing this out, but our job here is to educate and try to keep readers informed. In this regard, we still feel there are more declines in store for the Rivian stock price. The environment is turning more and more inflationary, so more prices hikes are likely not just for Rivian. Semiconductors and other supply chain issues will again be a feature in 2022 as the Russia-Ukraine crisis continues.

Rivian Stock News

The collapse yesterday was down to Rivian announcing it was raising prices. Electrek then went on to report that Rivian was seeing significant cancellations for orders. Elon Musk chimed in on Twitter, saying, '"Their negative gross margin will be staggering". All in all, not a positive combination.

The high growth part of the EV stock sector was already facing selling pressure following Lucid's (LCID) earnings earlier in the week. Lucid cut production outlook and missed on revenue and saw LCID stock sink 13.8% the next day. Wednesday was actually a positive one for markets with all major indices gaining and the Nasdaq closing nearly 2% higher. Tesla, the sector's big daddy, closed up 1.8% on Wednesday, but most other EV names finished lower. The key here is that most other EV names are high growth and viewed as high risk. Tesla is established. The rest are early-stage investments.

Rivian Stock Forecast

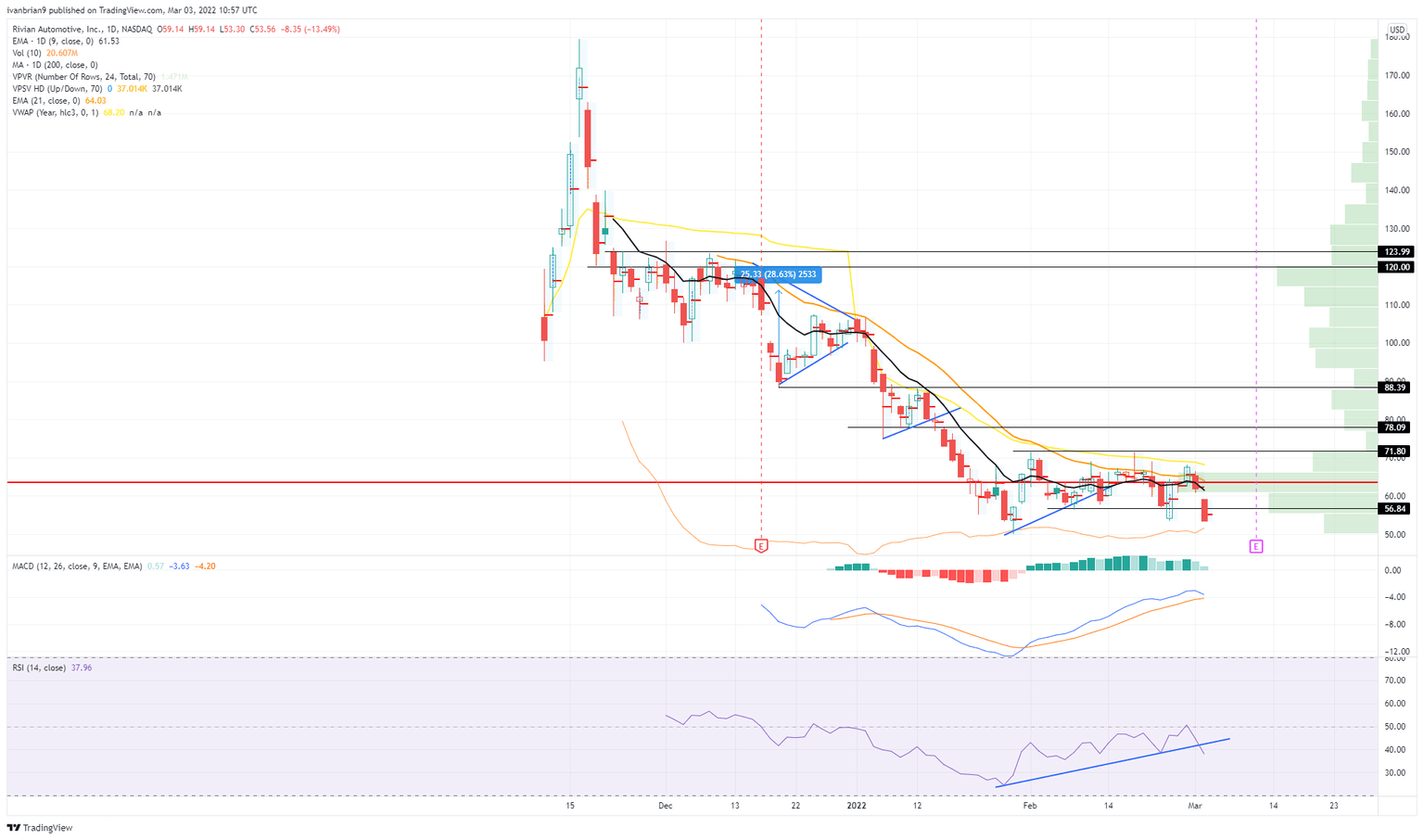

Technically, there is not much support in town apart from the so far record low at $50. This is the low from January and is also a psychological round number target. We realise many of our retail readers will have some investment in the name, and we do not take pleasure in our bearish outlook. The name of the game in trading is profits, and we find it hard to see how RIVN stock can turn around with the macro and geopolitical backdrop. Resistance at $71.80 could see a quick move to $78. Support as mentioned is at $50, and technically there is not much else below that. The Relative Strength Index (RSI) has now broken its uptrend.

Rivian (RIVN) stock chart, daily

Like this article? Help us with some feedback by answering this survey:

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ivan Brian

FXStreet

Ivan Brian started his career with AIB Bank in corporate finance and then worked for seven years at Baxter. He started as a macro analyst before becoming Head of Research and then CFO.