Rio Tinto Limited Elliott Wave technical forecast [Video]

![Rio Tinto Limited Elliott Wave technical forecast [Video]](https://editorial.fxstreet.com/images/TechnicalAnalysis/ChartPatterns/Chartism/stock-market-ticker-board-black-17803444_XtraLarge.jpg)

ASX: RIO Elliott Wave technical analysis

Our Elliott Wave analysis today focuses on RIO TINTO LIMITED - RIO, listed on the Australian Stock Exchange (ASX).

We foresee RIO potentially continuing to decline with wave 2 (grey), followed by wave 3 (grey) which may see a subsequent upward push.

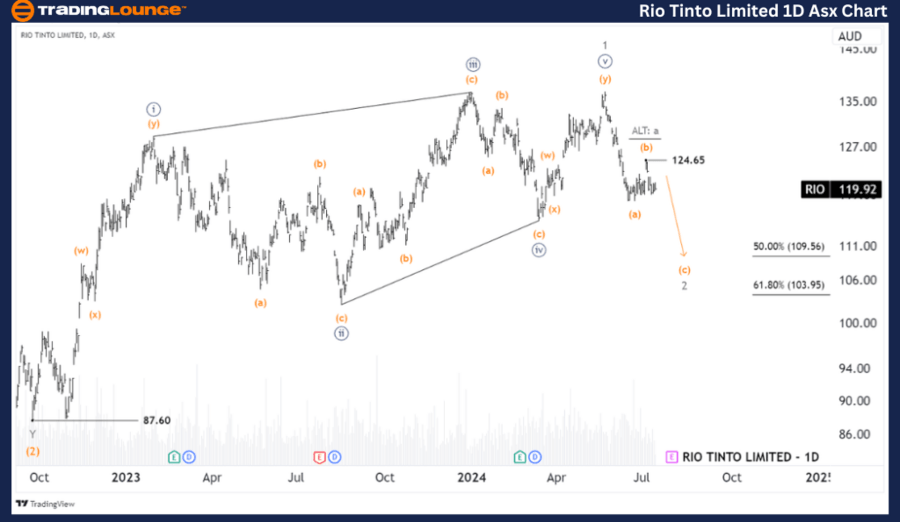

ASX: RIO one-day chart (semilog scale) analysis

-

Function: Major trend (Minor degree, grey).

-

Mode: Motive.

-

Structure: Impulse.

-

Position: Wave (c) - orange of Wave 2 - grey.

-

Details: Wave (b) - orange seems to have peaked at 124.65, with wave (c) - orange now moving lower. To maintain this outlook, the price must stay below 124.65.

-

Invalidation point: 87.60.

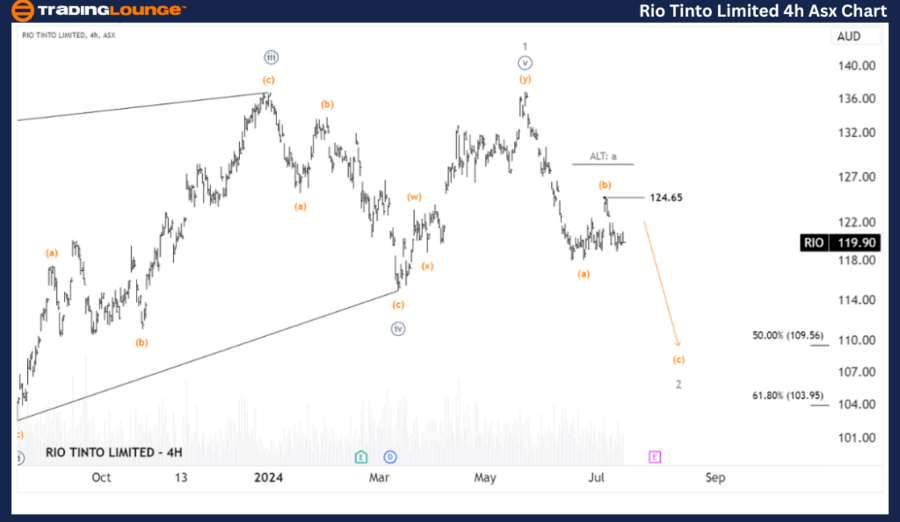

ASX: RIO four-hour chart

-

Function: Counter trend (Minute degree, navy).

-

Mode: Corrective.

-

Structure: Zigzag.

-

Position: Wave (c) - orange of Wave 2 - grey.

-

Details: Wave 2 - grey is likely to push lower, subdividing into wave (b) - orange which has peaked at 124.65. Now, wave (c) - orange is expected to decline further, with a target price of 109.56, provided the price remains below 124.65.

-

Invalidation point: 124.36.

Our analysis of ASX: RIO TINTO LIMITED - RIO provides insights into current market trends and strategies to capitalize on them effectively. We specify key price points that serve as validation or invalidation signals for our wave count, thereby enhancing confidence in our perspective. By combining these elements, we aim to offer a professional and objective view of market trends.

Rio Tinto Limited Elliott Wave technical forecast [Video]

Author

Peter Mathers

TradingLounge

Peter Mathers started actively trading in 1982. He began his career at Hoei and Shoin, a Japanese futures trading company.