Rigetti Computing Inc. (RGTI) Elliott Wave analysis [Video]

![Rigetti Computing Inc. (RGTI) Elliott Wave analysis [Video]](https://editorial.fxsstatic.com/images/i/windows-01_XtraLarge.jpg)

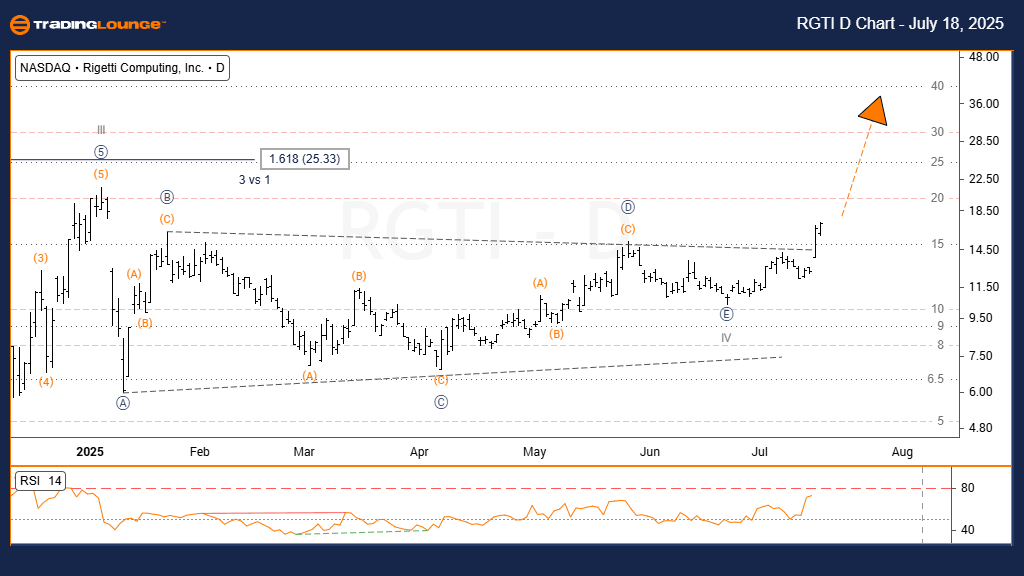

Rigetti Computing Inc. (RGTI) Elliott Wave analysis – Daily chart

-

Function: Trend.

-

Mode: Motive.

-

Structure: Impulsive.

-

Position: Wave V.

-

Direction: Uptrend.

Analysis

On the daily chart, Rigetti Computing Inc. (RGTI) has broken out from a running triangle pattern, indicating the initiation of Wave V. This move follows a consolidation phase that completed Wave IV. The breakout is accompanied by a rise in momentum and volume—key indicators that support a sustained bullish continuation.

Price is now expected to trend higher, with resistance levels projected between $35 and $45, aligning with the expected move post-triangle breakout. Traders should monitor for follow-through buying to confirm the bullish structure remains intact.

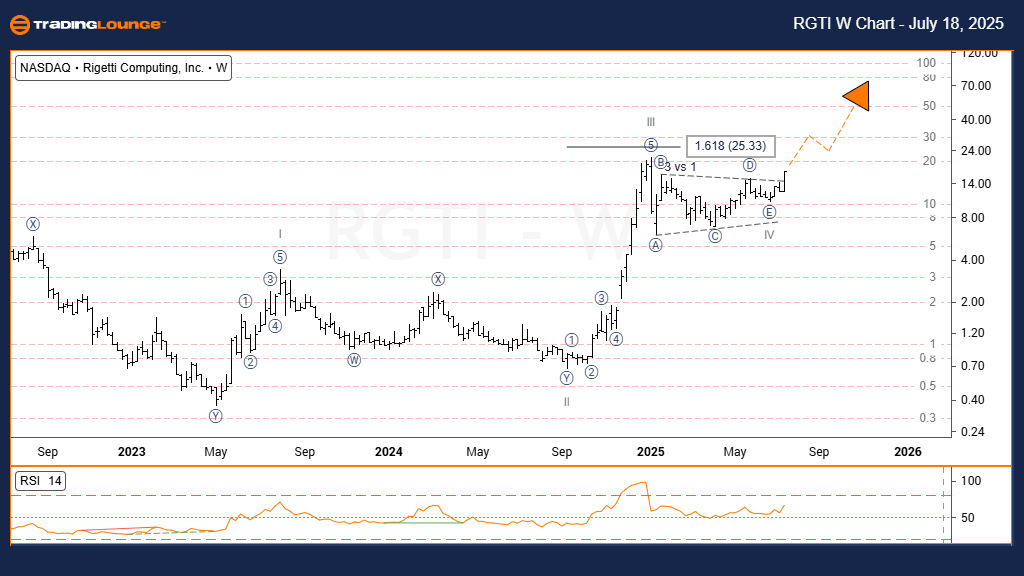

Rigetti Computing Inc. (RGTI) Elliott Wave technical analysis – Weekly chart

-

Function: Trend.

-

Mode: Motive.

-

Structure: Impulsive.

-

Position: Wave V.

-

Direction: Uptrend.

Analysis

The weekly chart reinforces the bullish view, showing that Wave IV completed as a contracting triangle, in line with Elliott Wave alternation principles (as Wave II was a sharp move). The early July breakout above the triangle boundary marks the beginning of Wave V, which is now in progress.

Targets

- Initial resistance around $40

- Potential extension to $65, based on a 1.618 Fibonacci projection of Wave I from the Wave IV low

This structure remains valid as long as the price stays above the Wave IV low.

Rigetti Computing Inc. (RGTI) Elliott Wave analysis [Video]

Author

Peter Mathers

TradingLounge

Peter Mathers started actively trading in 1982. He began his career at Hoei and Shoin, a Japanese futures trading company.