Revlon, Kellogg’s, Tesla, ASOS: Why are these four stocks trending?

With US stocks officially entering the bear market recently and with concerns that the next recession is upon us, companies are walking another tightrope.

Consumer goods companies including big multinational brands have employed various measures to protect their profit margins and cushion the impact of skyrocketing inflation and weakening consumption. Even household name brands have not been spared from these factors.

Revlon goes bankrupt

Iconic beauty brand Revlon (NYSE:REV) filed for bankruptcy protection almost two weeks ago as it grappled with a sizable debt, supply chain challenges and rising inflation, it said.

The 90-year old beauty brand is also struggling to keep up with competition from emerging brands. Although Revlon’s president and CEO Debra Perelman said consumer demand for the company’s products remains strong, the group has faced challenges in attracting younger customers.

Younger shoppers tend to prefer makeup lines associated with celebrities like Rihanna and Kylie Jenner, according to The New York Times.

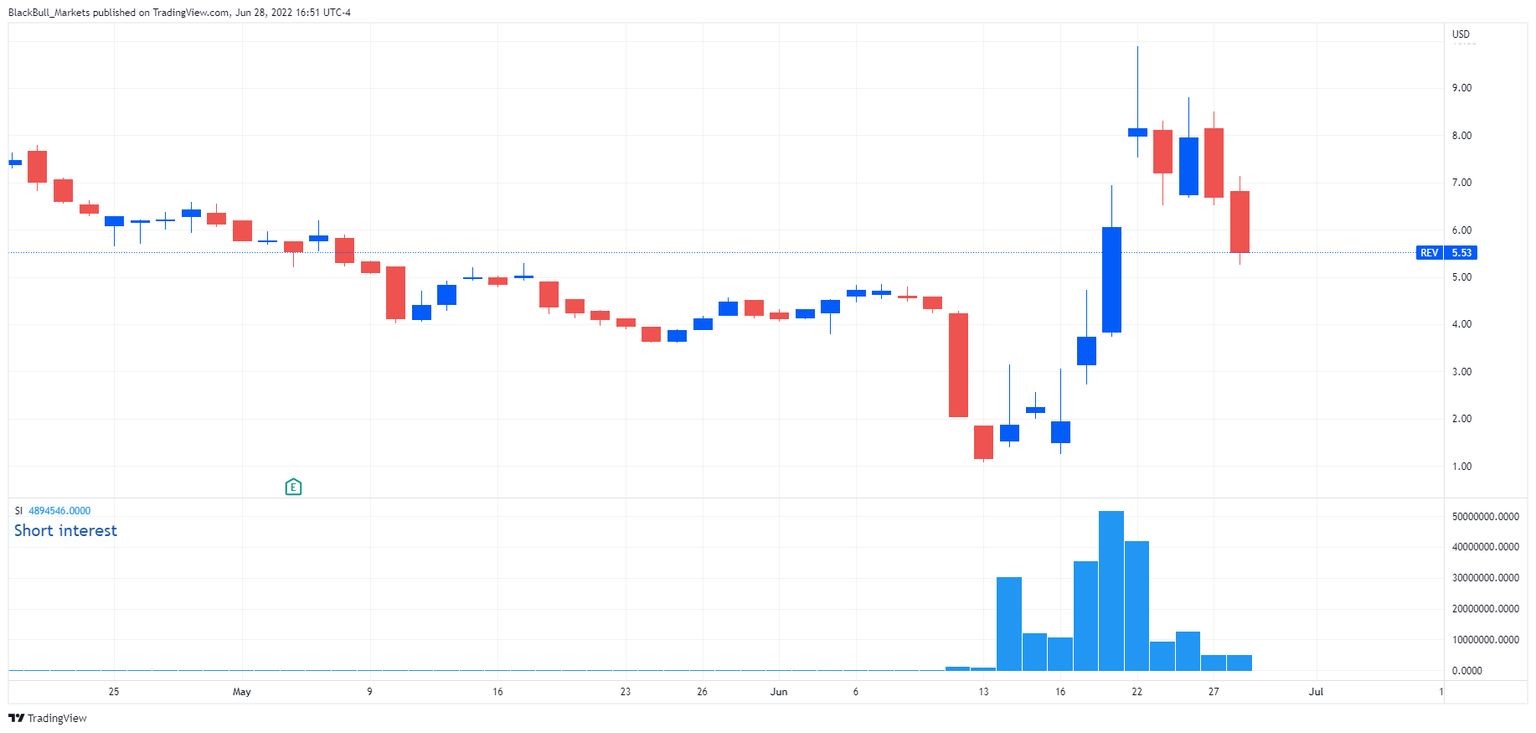

Revlon’s stock fell to an all-time low on June 13, closing at US $1.17, following its bankruptcy announcement. Since then, it appears that REV has become a meme stock, as growing short interest spurred buyers to take notice, and REV now trades above US $5.50.

REV, 1D, with Short interest indicator

Kellogg’s splits into three companies

Kellogg Co. (NYSE:K), another household staple, surprised the markets recently as it announced a three-way split as it overhauls its operations to focus on its snacks business.

The brand, known for its breakfast cereals, Pringles and Pop-Tarts, will separate into three independent publicly listed companies. The company will spin off its cereals and plant-based businesses from its snacks business. The cereal and plant-based units only accounted for about 20% of the group’s net sales in 2021.

Kellogg’s chairman and CEO Steve Cahillane said all three businesses have significant standalone potential and an enhanced focus will allow each unit to better direct their resources towards their own strategic priorities.

The company’s move came as its core cereals business witnessed stagnating sales in the US as people go for different breakfast options, CNBC said, adding that Special K, Froot Loops and Rice Krispies, which had been Kellogg’s foundation, are no longer the company’s growth drivers.

Kellogg’s stock surged to an over one-month high on Monday, less than a week after its spin-off disclosure.

Tesla loses billions

Silicon Valley-based car giant Tesla (NASDAQ:TSLA), which many consider as a tech company rather than a carmaker, recently acknowledged that it is losing “billions of dollars” from the global battery shortage and supply chain disruptions in China.

Tesla operates a ‘gigafactory’ in Shanghai, which was shuttered for weeks due to the COVID-19 lockdown in the city.

Aside from the disruptions caused by the lockdown, Tesla is also facing challenges in procuring batteries to power its cars. The company recently hiked the prices of its China-made Model Y due to the higher costs of the raw materials included in batteries.

Tesla CEO Elon Musk also revealed that the company’s newest car factories in Texas and Berlin are losing money “because there’s a ton of expense and hardly any output.”

“Getting Berlin and Austin functional and getting Shanghai back in the saddle fully are overwhelmingly our concerns. Everything else is a very small thing basically,” Musk said.

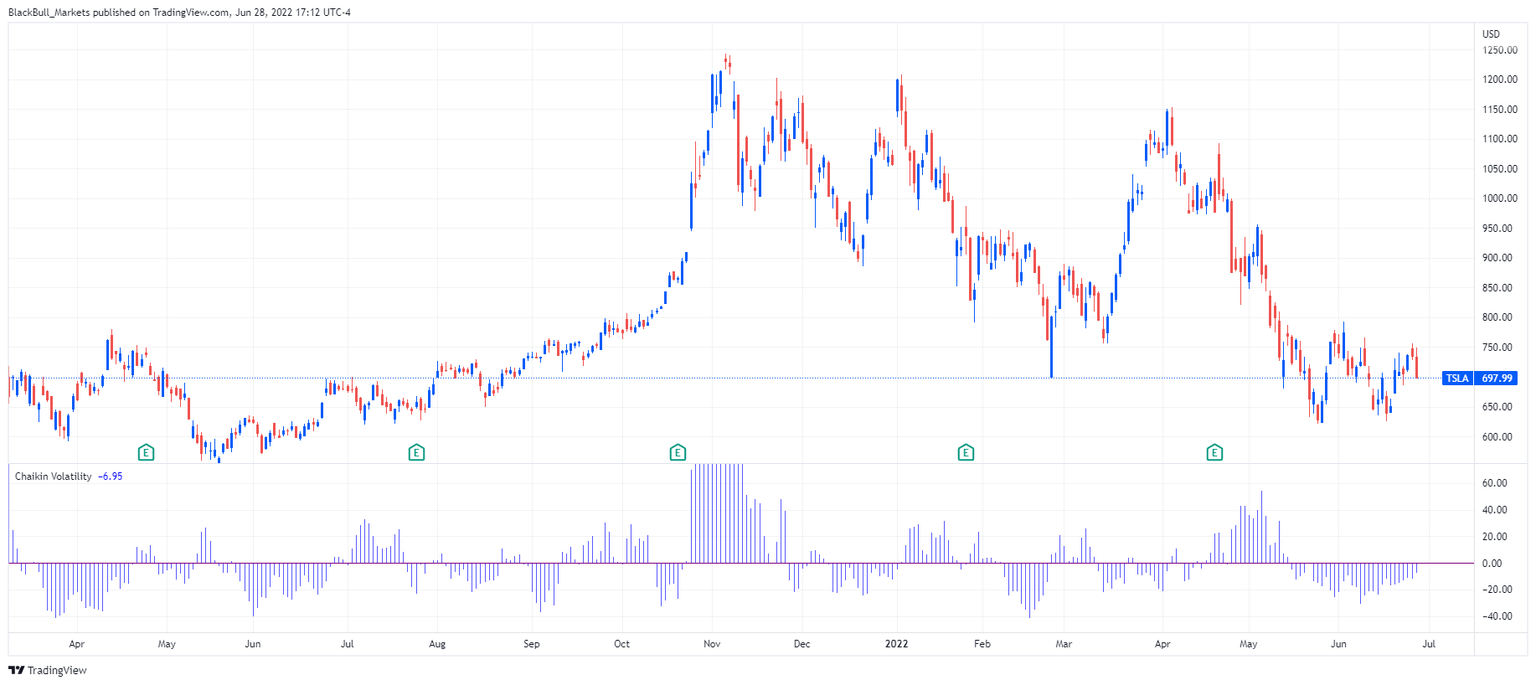

Tesla investors appear to have taken the news in their stride, with TSLA stock price hugging close to US $700 per share, and the Chaikin Volatility Index not indicating any abnormal change in daily price ranges.

TSLA, 1D, with Chaikin's Volatility Index

ASOS trims outlook on inflationary pressures

There is also no escaping the impact of inflation for British fashion and cosmetic retailer ASOS (LON:ASC), which had to lower its full-year revenue outlook, citing “market volatility and an increased returns rate.”

The company now expects its full-year sales to grow between 4% and 7% year over year, down from its previous forecast of between 10% and 15%.

“This inflationary pressure is increasingly impacting our customers shopping behavior. It is too early to tell for how long the current pattern of customer behavior will continue but we are taking swift and decisive steps to minimize the impacts,” ASOS’ Chief Operating Officer Mat Dunn said.

ASOS shares slumped to an over decade low of ~GBX 780.0 on June 16 in London shortly after the company slashed its guidance.

Author

Mark O’Donnell

Blackbull Markets Limited

Mark O’Donnell is a Research Analyst with BlackBull Markets in Auckland, New Zealand.