Pound Sterling trades cautiously ahead of UK Spring Statement

- The Pound Sterling is expected to remain volatile as UK Reeves is scheduled to deliver the Spring Statement on Wednesday.

- Investors will also focus on the UK CPI data for February, which will influence the BoE’s policy outlook.

- US President Trump said that he may exempt a lot of countries from tariffs.

The Pound Sterling (GBP) trades cautiously against its major peers on Tuesday. The British currency struggles as United Kingdom (UK) Chancellor of the Exchequer Rachel Reeves is prepared to unveil the Spring Statement on Wednesday.

It would be interesting to watch how Reeves will promote economic prosperity, given his pledge of no more taxes and the maintenance of fiscal rules.

After the Autumn Budget, Chancellor Reeves told at the Confederation of British Industry (CBI) conference in November that public services have to survive on their own means. Reeves clarified that the government will rely on foreign financing only for investment purposes, not to address day-to-day spending. Also, she confirmed no more tax raises after facing backlash from the corporate sector for increasing employers’ contributions to National Insurance (NI) from 13.8% to 15%. This indicates that Reeves will be forced to cut fiscal spending heavily.

Such a scenario would diminish consumer inflation expectations, prompting expectations of more interest rate cuts by the Bank of England (BoE) in the near term.

On Wednesday, investors will also focus on the UK Consumer Price Index (CPI) data for February, which will influence market expectations for the BoE’s monetary policy outlook. The headline inflation is estimated to decelerate to 2.9% year-over-year (YoY), slower than the 3% increase seen in January. In the same period, the core CPI – which excludes volatile food and energy prices – is estimated to have grown by 3.6% from the prior reading of 3.7%.

British Pound PRICE Today

The table below shows the percentage change of the British Pound (GBP) against listed major currencies today. British Pound was the strongest against the US Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.18% | -0.20% | -0.60% | -0.20% | -0.58% | -0.29% | -0.25% | |

| EUR | 0.18% | -0.03% | -0.49% | -0.03% | -0.40% | -0.14% | -0.07% | |

| GBP | 0.20% | 0.03% | -0.47% | -0.01% | -0.38% | -0.11% | -0.11% | |

| JPY | 0.60% | 0.49% | 0.47% | 0.44% | 0.09% | 0.33% | 0.37% | |

| CAD | 0.20% | 0.03% | 0.00% | -0.44% | -0.34% | -0.10% | -0.10% | |

| AUD | 0.58% | 0.40% | 0.38% | -0.09% | 0.34% | 0.25% | 0.28% | |

| NZD | 0.29% | 0.14% | 0.11% | -0.33% | 0.10% | -0.25% | -0.01% | |

| CHF | 0.25% | 0.07% | 0.11% | -0.37% | 0.10% | -0.28% | 0.00% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the British Pound from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent GBP (base)/USD (quote).

Daily digest market movers: Pound Sterling gains against US Dollar despite Trump tariff fears ease

- The Pound Sterling rises to near 1.2950 against the US Dollar (USD) in North American trading hours on Tuesday. The GBP/USD pair gains as the US Dollar struggles to hold onto Monday’s gains that were driven by strong preliminary United States (US) S&P Global Purchasing Managers Index (PMI) data for March and optimism that tariffs to be unveiled by President Donald Trump on April 2 would be narrower in scope than initially feared.

- The S&P Global reported on Monday that the Service PMI, which accounts for activities in the services sector, came in at 54.3, significantly higher than estimates of 51.2 and the 51.0 reading seen in February. Given that the services sector roughly accounts for two-thirds of the US economy, upbeat data indicates a strong business outlook. The report also showed that the increase in prices paid by employers for business inputs was the highest in nearly two years, prompting expectations of higher inflation in the near term.

- The Manufacturing sector output declined unexpectedly, but sentiment remained robust on expectations that US President Trump’s tariff policies will prompt the appeal of goods produced domestically.

- On Monday, President Trump reiterated that reciprocal tariffs are on track to be unveiled on April 2 but teased that a lot of countries could get exempted from additional levies. His comments improved the US Dollar’s appeal as the impact of the tariff war with fewer nations would be lower on the US economic outlook than initially feared.

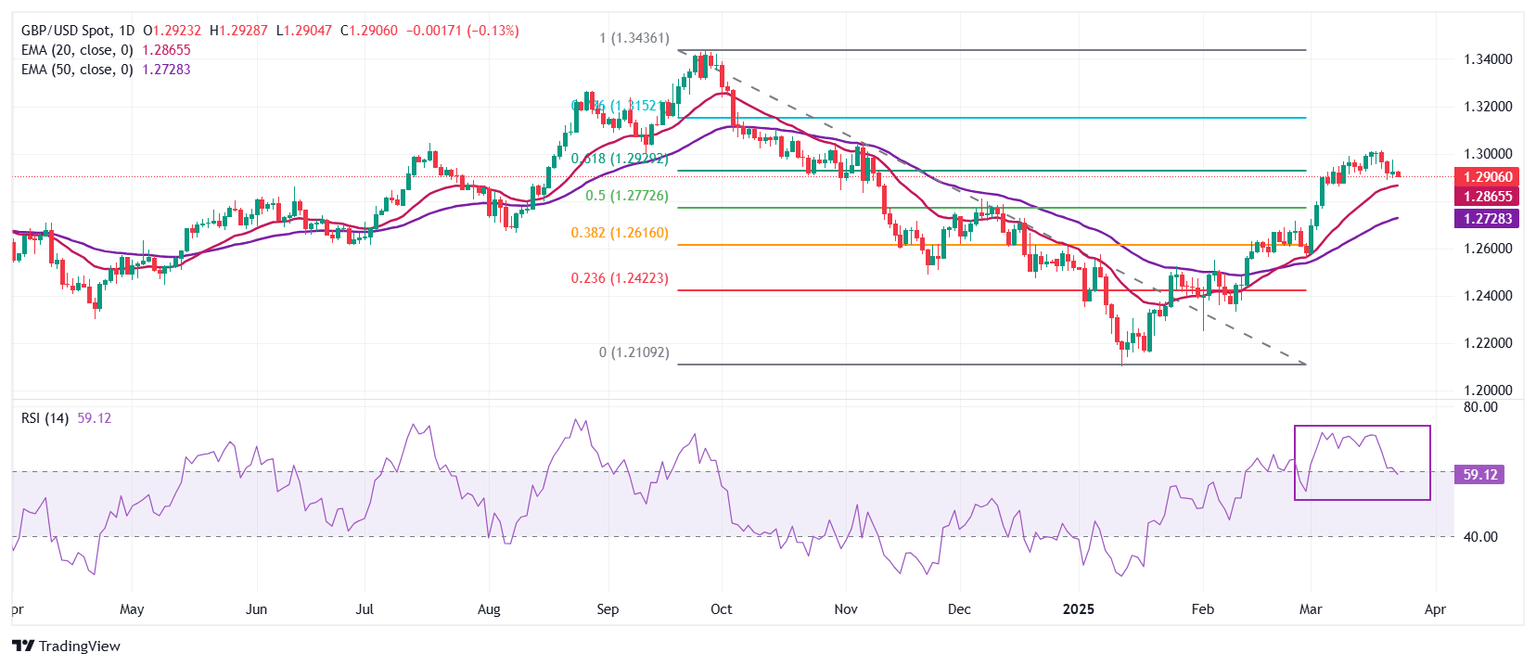

Technical Analysis: Pound Sterling holds key 20-day EMA

The Pound Sterling moves higher to near 1.2945 against the US Dollar on Tuesday. The GBP/USD pair manages to hold the 61.8% Fibonacci retracement, plotted from the late-September high to mid-January low, at 1.2930.

Advancing 20-day and 50-day Exponential Moving Averages (EMAs) near 1.2865 and 1.2728, respectively, suggest that the overall trend is still bullish.

The 14-day Relative Strength Index (RSI) cools down to near 60.00 after turning overbought above 70.00 last week. Should a fresh bullish momentum come into action if the RSI holds above 60.00.

Looking down, the 50% Fibonacci retracement at 1.2770 and the 38.2% Fibonacci retracement at 1.2615 will act as key support zones for the pair. On the upside, the October 15 high of 1.3100 will act as a key resistance zone.

Economic Indicator

S&P Global Services PMI

The S&P Global Services Purchasing Managers Index (PMI), released on a monthly basis, is a leading indicator gauging business activity in the US services sector. As the services sector dominates a large part of the economy, the Services PMI is an important indicator gauging the state of overall economic conditions. The data is derived from surveys of senior executives at private-sector companies from the services sector. Survey responses reflect the change, if any, in the current month compared to the previous month and can anticipate changing trends in official data series such as Gross Domestic Product (GDP), industrial production, employment and inflation. A reading above 50 indicates that the services economy is generally expanding, a bullish sign for the US Dollar (USD). Meanwhile, a reading below 50 signals that activity among service providers is generally declining, which is seen as bearish for USD.

Read more.Last release: Mon Mar 24, 2025 13:45 (Prel)

Frequency: Monthly

Actual: 54.3

Consensus: 51.2

Previous: 51

Source: S&P Global

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.