Pound Sterling trades on a positive note around 1.2520

GBP/USD Weekly Forecast: Pound Sterling buyers turn cautious as the Fed verdict looms

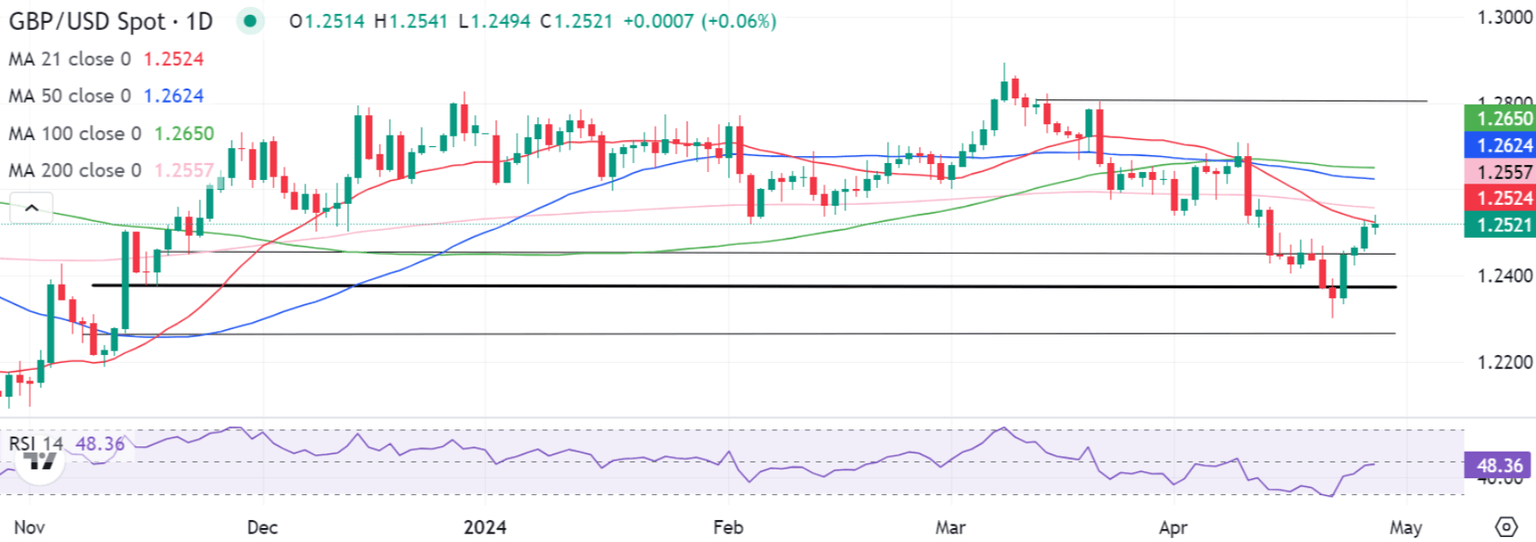

The Pound Sterling (GBP) rebounded firmly against the US Dollar (USD), with the GBP/USD pair snapping two weekly declines in a row.

Pound Sterling witnessed a negative start to the week despite the return of risk appetite on ebbing fears over a wider regional conflict in the Middle East. No official comments from Israel confirming Friday’s Israeli missiles strike on Iran and denial of further retaliatory measures by Iranian authorities calmed markets down. Read more...

GBP/USD holds positive ground above 1.2500 on weaker US Dollar, Fed rate decision looms

The GBP/USD pair holds positive ground near 1.2520 on Monday during the early Asian session. The uptick of the major pair is supported by the softer US Dollar (USD) below the 106.00 psychological mark. Investors will closely monitor the Federal Open Market Committee (FOMC) interest rate decision and Press Conference on Wednesday.

The US Federal Reserve (Fed) is expected to leave the interest rate unchanged in its current 5.25%–5.5% range on Wednesday. The US economy remains strong, and inflation has started to turn higher. On Friday, the US Bureau of Economic Analysis showed the Core Personal Consumption Expenditures (PCE) Price Index rose 2.8% YoY in March. These reports have triggered speculation that the first cut might not come until September. Read more...

Author

FXStreet Team

FXStreet