Pound Sterling outperforms on prospects of BoE's shallow rate-cut cycle

- The Pound Sterling holds its key support of near 1.3060 against the US Dollar, while the near-term outlook remains uncertain.

- Fed’s Williams expects that the central bank will not be in a rush to cut interest rates quickly.

- Investors await the US CPI and the UK GDP for fresh interest rate outlook.

The Pound Sterling (GBP) outperforms its major peers on Tuesday, with investors focusing on Middle East tensions driving market sentiment. In Tuesday’s Asian session, Iran's Foreign Minister Abbas Araqchi issued a warning to Israel that the nation will face a strong retaliation if it attempts to attack their infrastructure. Though the British currency also carries a negative correlation with the risk-aversion theme, market expectations for the Bank of England's (BoE) shallow policy-easing cycle keep the downside limited.

Market participants expect the BoE to cut interest rates again in one of the two meetings remaining this year. On the contrary, the European Central Bank (ECB) and the Fed are expected to cut their borrowing rates by 25 bps in each of their remaining meetings this year. BoE’s rate cut prospects for November have improved after last week’s comments from Governor Andrew Bailey, which indicated that the central bank could cut interest rates aggressively if price pressures decline further.

The United Kingdom (UK) inflation has remained sticky due to stubborn price pressures in the services sector amid stronger wage growth. UK annual service inflation accelerated to 5.6% in August from 5.2% in July.

This week, investors will pay close attention to the monthly Gross Domestic Product (GDP) and the factory data for August, which will be published on Friday. The data will provide fresh cues about the current economic health.

Daily digest market movers: Pound Sterling aims for firm footing against US Dollar

- The Pound Sterling strives to gain ground near a three-week low of 1.3060 against the US Dollar (USD) in Tuesday's North American session. However, the near-term outlook of the GBP/USD pair remains fragile as the US Dollar clings to gains close to a fresh seven-week high, with the US Dollar Index (DXY) trading around 102.50. The Greenback strengthens as market participants are not pricing in another larger-than-usual 50 basis points (bps) interest rate cut from the Federal Reserve (Fed) in November.

- The Fed started its policy-easing cycle with a 50 bps interest rate cut in September, majorly focusing on reviving labor market strength after gaining confidence that inflation will sustainably return to the bank’s target of 2%.

- Market participants anticipated that the Fed would aggressively extend the rate-cut cycle. However, that speculation was wiped out by upbeat United States (US) Nonfarm Payrolls (NFP) data for September, which showed a robust increase in labor hiring, a lower Unemployment Rate, and an increase in wage growth.

- Despite market speculation for Fed large rate cuts has waned, the central bank is expected to remain on course to ease monetary policy further. Meanwhile, the comments from New York Fed Bank President John Williams, in an interview with Financial Times on Tuesday, have indicated that he favors a 25 bps rate cut ahead and is in no hurry to reduce interest rates quickly as the latest employment data has increased his confidence in consumer spending and economic growth.

- Going forward, investors will focus on the US Consumer Price Index (CPI) data for September, which will be published on Thursday.

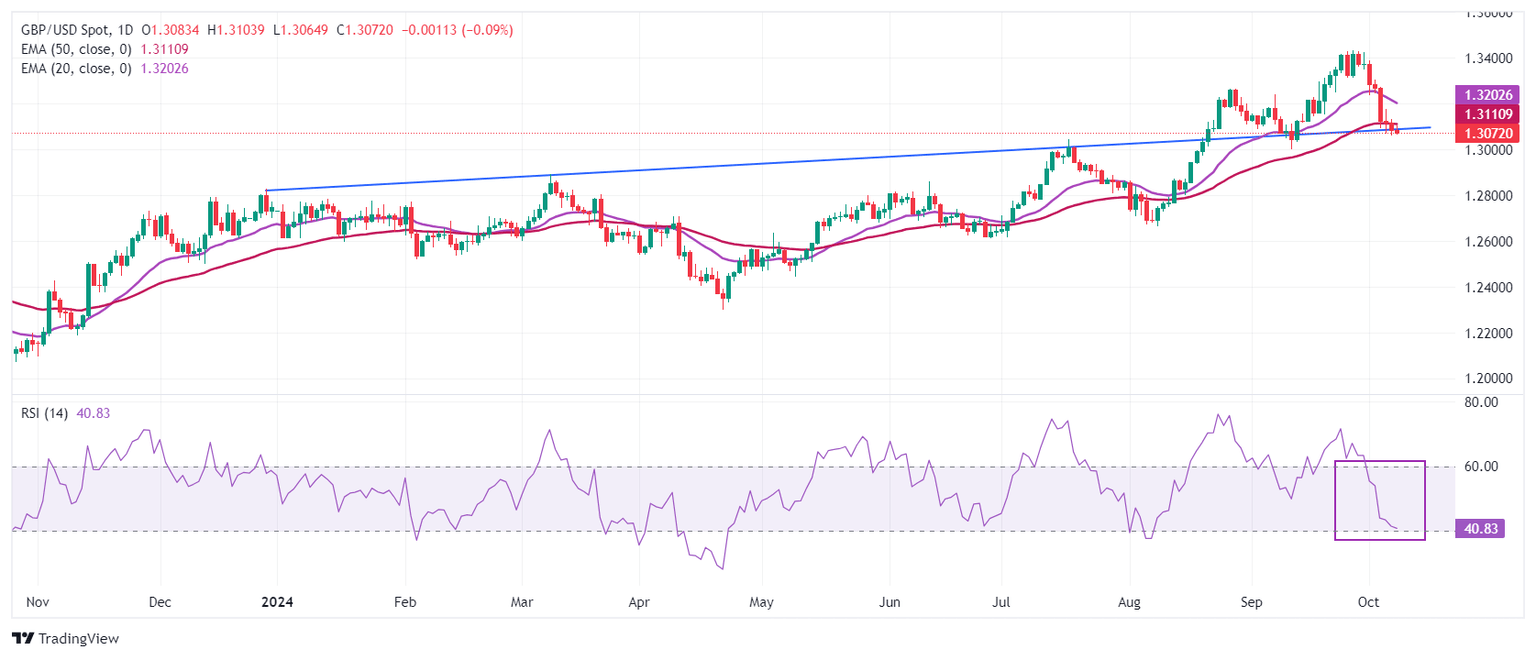

Technical Analysis: Pound Sterling faces pressure near 50-day EMA

The Pound Sterling trades inside Monday’s trading range, with investors focusing on the US CPI data for September. The GBP/USD pair is expected to remain on the backfoot as it fails to hold the 50-day Exponential Moving Average (EMA), which trades around 1.3100. The Cable has weakened after falling below the upward-sloping trendline from the 28 December 2023 high of 1.2827.

The 14-day Relative Strength Index (RSI) declines to near 40.00. More downside would appear if the momentum oscillator falls below the above-mentioned level.

Looking up, the round-level resistance of 1.3100 and the 20-day EMA near 1.3202 will be a major barricade for Pound Sterling bulls. On the downside, the pair would find support near the psychological figure of 1.3000.

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.