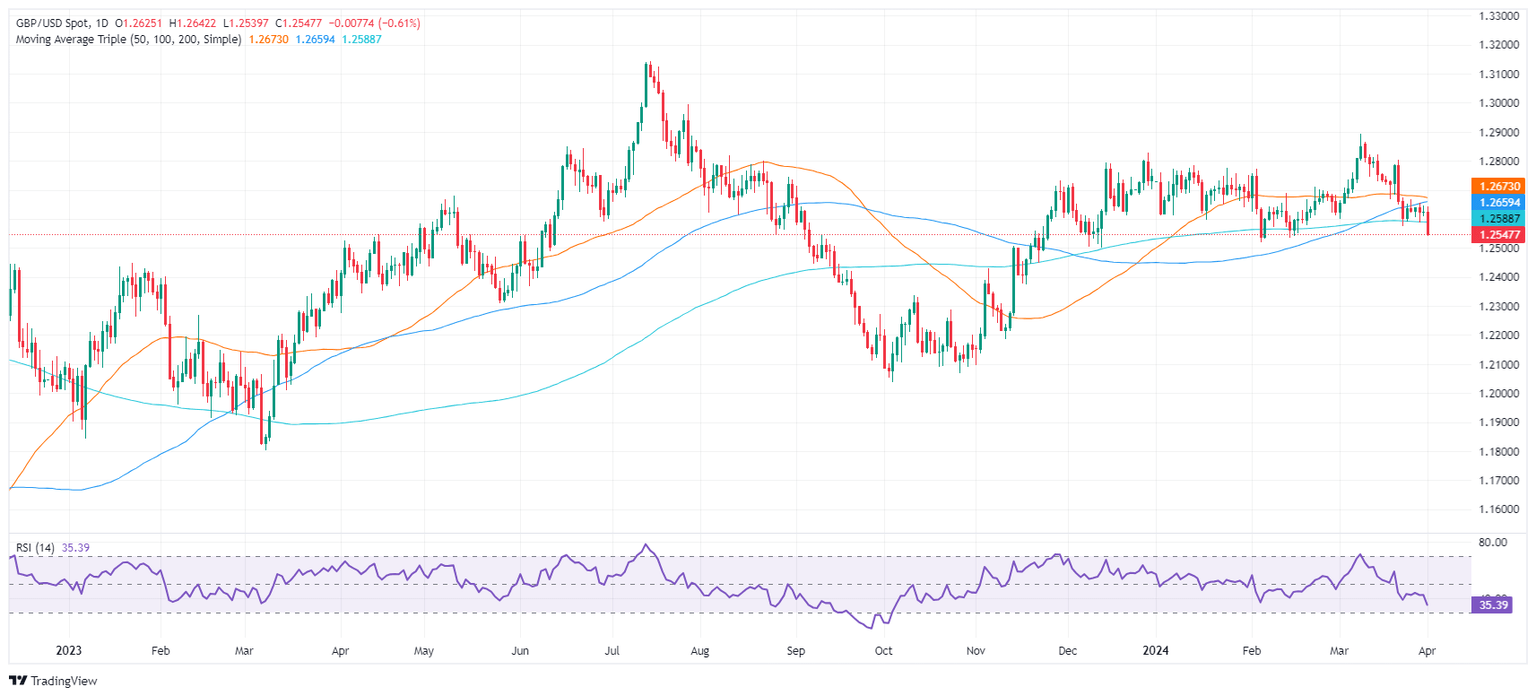

Pound Sterling struggles to gain ground near 1.2545

GBP/USD remains on the defensive below 1.2550 amid firmer US Dollar, upbeat US PMI data

The GBP/USD pair remains on the defensive around 1.2545 during the early Asian session on Tuesday. The US Dollar Index (DXY) rises above the 105.00 mark, and the US Treasury bond yields edges higher sharply overnight following the upbeat US ISM data, which creates a headwind for the GBP/USD pair.

The US ISM Manufacturing PMI data unexpectedly expanded in March, with the index rising to 50.3 from 47.8 in February, stronger than the expectation of 48.4. The reading registered the highest level since September 2022, and it is the first time manufacturing activity has expanded since October 2022. A reading above 50 indicates that the manufacturing economy is generally expanding, while a reading below 50 signals that factory activity is generally declining. In response to the stronger-than-expected data, the US Dollar (USD) attracts some buyers across the board. Read more...

GBP/USD drops after strong US ISM Manufacturing PMI data

The Pound Sterling slumps in the mid-North American session, as robust US economic data could dent the Federal Reserve’s intentions to cut rates. That underpinned the Greenback while US Treasury yields skyrocketed, a headwind for Cable. The GBP/USD trades at 1.2587, down 0.57%.

A holiday in Europe keeps the financial markets closed. Across the Atlantic, data from the Institute for Supply Management (ISM) revealed that business activity in the US expanded in March for the first time since September 2022, suggesting the economy's resilience. The Manufacturing Purchasing Managers' Index (PMI) reached 50.3, surpassing the consensus of 48.4 and improving upon February's 47.8. Furthermore, the report highlighted an increase in the Prices Paid Index, which was its highest point since August 2022. Given the economy's better-than-expected performance, this resurgence in pricing pressures might hinder the Federal Reserve's inclination to soften its monetary policy. Read more...

Author

FXStreet Team

FXStreet