Pound Sterling gains further as UK elections kick-off, US NFP in focus

- The Pound Sterling performs strongly against the US Dollar as the US labor market loses momentum.

- Investors expect the Fed to begin lowering interest rates in September.

- Economists expect that the Starmer-led Labor Party will gain an absolute majority.

The Pound Sterling (GBP) strengthens against the US Dollar (USD) and rises to near 1.2760 in Thursday’s American session. The GBP/USD jumps higheramid growing speculation that the US Federal Reserve (Fed) will start reducing interest rates from the September meeting.

According to the CME FedWatch tool, 30-day Federal Funds futures pricing data shows that the probability of rate cuts in September has increased to 72.6% from 66% recorded a week ago. Expectations for Fed rate cuts in September strengthened after a few United States (US) economic indicators showed that the labor market strength appears to have started fading and the economic health has become sluggish.

On Wednesday, the US ADP Employment data showed that labor demand in the private sector unexpectedly declined in June as the number of fresh payrolls came in lower at 150K. Market consensus showed slightly higher private payrolls at 160K than May’s reading of 157K, upwardly revised from 152K.

Meanwhile, the US service sector concluded the second quarter on a weak note as the US ISM Services Purchasing Managers’ Index (PMI) witnessed a contraction in June. The ISM Services PMI, the preferred gauge for the service sector activity that accounts for two-thirds of the economy, came in at 48.8. A figure below the 50.0 threshold is seen as a contraction in service activities. The figure was the lowest in four years.

Going forward, the major trigger for the US Dollar will be the US Nonfarm Payrolls (NFP) data for June, which will be published on Friday. The NFP report will indicate the overall labor demand and the current status of wage growth through Average Hourly Earnings data.

Daily digest market movers: Pound Sterling rises against US Dollar as UK Elections kick-off

- The Pound Sterling (GBP) exhibits a weak performance against its major peers, except the US Dollar (USD) and the Swiss Franc (CHF), in Thursday’s London session. The outlook of the British currency appears to be uncertain as market participants turn cautious, with the United Kingdom (UK) public casting votes for parliamentary elections.

- Market expectations show that UK Prime Minister Rishi Sunak-led-Conservative Party will suffer a defeat from the Keir Starmer-led-Labour Party. The latter is expected to win with an absolute majority, and its party will come into power for the first time since 2010.

- Growing speculation that the Labour Party will win at least 326 Members of Parliament (MPs) seats in the House of Commons would be favorable for the near-term outlook of the Pound Sterling. This would allow the British currency to outperform its peers where there is a high risk of political uncertainty in their respective regions.

- On the monetary policy front, investors expect that the Bank of England (BoE) will start reducing interest rates from the August meeting. The UK’s annual headline inflation has returned to the BoE’s target of 2%. Meanwhile, inflation in the service sector remains high due to steady wage growth, refraining policymakers from advocating early rate cuts.

Pound Sterling Price Today:

British Pound PRICE Today

The table below shows the percentage change of British Pound (GBP) against listed major currencies today. British Pound was the strongest against the US Dollar.

| GBP | EUR | USD | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| GBP | -0.04% | 0.05% | -0.21% | -0.04% | -0.14% | -0.17% | -0.03% | |

| EUR | 0.04% | 0.09% | -0.17% | -0.02% | -0.11% | -0.14% | 0.03% | |

| USD | -0.05% | -0.09% | -0.26% | -0.10% | -0.21% | -0.19% | -0.11% | |

| JPY | 0.21% | 0.17% | 0.26% | 0.16% | 0.04% | 0.04% | 0.17% | |

| CAD | 0.04% | 0.02% | 0.10% | -0.16% | -0.11% | -0.10% | 0.01% | |

| AUD | 0.14% | 0.11% | 0.21% | -0.04% | 0.11% | 0.01% | 0.13% | |

| NZD | 0.17% | 0.14% | 0.19% | -0.04% | 0.10% | -0.01% | 0.12% | |

| CHF | 0.03% | -0.03% | 0.11% | -0.17% | -0.01% | -0.13% | -0.12% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the British Pound from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent GBP (base)/USD (quote).

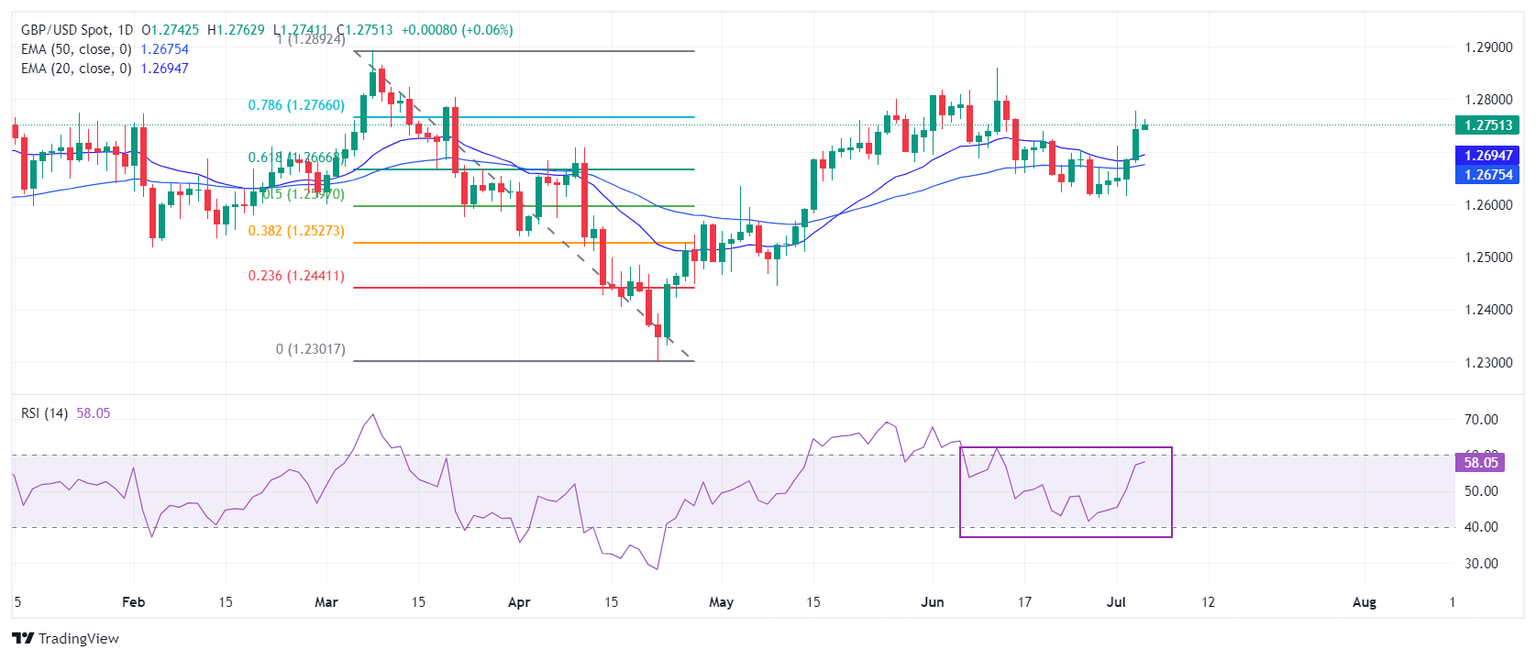

Technical Analysis: Pound Sterling climbs to near 78.6% Fibo retracement

The Pound Sterling strengthens against the US Dollar after stabilizing above the round-level support of 1.2700. The GBP/USD pair moves higher to near the 78.6% Fibonacci retracement at 1.2770, plotted from the March 8 high of 1.2900 to the April 22 low at 1.2300.

The Cable rises above the 20-day and 50-day Exponential Moving Averages (EMAs) near 1.2695 and 1.2675, respectively, suggesting that the near-term outlook is bullish.

The 14-day Relative Strength Index (RSI) rises to nearly 60.00. A decisive break above it would shift momentum towards the upside.

Economic Indicator

ISM Services PMI

The Institute for Supply Management (ISM) Services Purchasing Managers Index (PMI), released on a monthly basis, is a leading indicator gauging business activity in the US services sector, which makes up most of the economy. The indicator is obtained from a survey of supply executives across the US based on information they have collected within their respective organizations. Survey responses reflect the change, if any, in the current month compared to the previous month. A reading above 50 indicates that the services economy is generally expanding, a bullish sign for the US Dollar (USD). A reading below 50 signals that services sector activity is generally declining, which is seen as bearish for USD.

Read more.Last release: Wed Jul 03, 2024 14:00

Frequency: Monthly

Actual: 48.8

Consensus: 52.5

Previous: 53.8

Source: Institute for Supply Management

The Institute for Supply Management’s (ISM) Services Purchasing Managers Index (PMI) reveals the current conditions in the US service sector, which has historically been a large GDP contributor. A print above 50 shows expansion in the service sector’s economic activity. Stronger-than-expected readings usually help the USD gather strength against its rivals. In addition to the headline PMI, the Employment Index and the Prices Paid Index numbers are also watched closely by investors as they provide useful insights regarding the state of the labour market and inflation.

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.