Pound Sterling plummets as two BoE members favor 50 bps interest rate cut

- The Pound Sterling faces pressure against its major peers as all nine BoE MPC members favored a 25-bps reduction in interest rates to 4.5%.

- Soft CPI inflation data in December and weak labor demand in three months ending November boosted BoE dovish bets.

- Investors await the US NFP data, which will influence expectations for the Fed’s monetary policy outlook.

The Pound Sterling (GBP) plummets against its major peers in Thursday's North American session after the Bank of England (BoE) monetary policy meeting in which the central bank reduced interest rates by 25 basis points (bps) to 4.5%. This is the third interest rate cut by the BoE in its current policy-easing cycle, which started at the August 2024 policy meeting and the central bank was widely anticipated to do the same.

Investors anticipated the 25-bps interest rate decision, with an 8-1 vote split. However, the monetary policy report showed that all policymakers agreed to further policy easing, and two of them (Swati Dhingra and Catherine Mann) favored a larger-than-usual 50-bps interest rate reduction. It was surprising for market participants to see policymaker Catherine Mann, an outspoken hawk, supporting a bigger rate cut move.

BoE Governor Andrew Bailey has guided a cautious and gradual rate-cut approach amid projections that inflation could temporarily accelerate to 3.7% in the third quarter of the year due to higher energy prices before falling back again to the 2% target. The BoE has also revised its Gross Domestic Product (GDP) growth forecasts for this year to 0.75%, lower than the 1.5% economic expansion projected in November.

A weak economic outlook has forced market participants to raise dovish bets for the remaining year. Traders are pricing in three more cuts this year against 56-bps interest rate reduction discounted before the policy announcement.

British Pound PRICE Today

The table below shows the percentage change of the British Pound (GBP) against listed major currencies today. The British Pound was the strongest against the New Zealand Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.30% | 0.72% | -0.50% | 0.15% | 0.28% | 0.47% | 0.46% | |

| EUR | -0.30% | 0.42% | -0.80% | -0.14% | -0.02% | 0.18% | 0.15% | |

| GBP | -0.72% | -0.42% | -1.26% | -0.56% | -0.44% | -0.24% | -0.25% | |

| JPY | 0.50% | 0.80% | 1.26% | 0.67% | 0.79% | 0.95% | 0.98% | |

| CAD | -0.15% | 0.14% | 0.56% | -0.67% | 0.13% | 0.32% | 0.32% | |

| AUD | -0.28% | 0.02% | 0.44% | -0.79% | -0.13% | 0.19% | 0.17% | |

| NZD | -0.47% | -0.18% | 0.24% | -0.95% | -0.32% | -0.19% | -0.00% | |

| CHF | -0.46% | -0.15% | 0.25% | -0.98% | -0.32% | -0.17% | 0.00% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the British Pound from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent GBP (base)/USD (quote).

Daily digest market movers: Pound Sterling tumbles against USD ahead of US NFP

- The Pound Sterling tumbles below 1.2400 against the US Dollar (USD) on Thursday. The GBP/USD pair weakens on BoE's dovish decision and a solid recovery in the US Dollar ahead of the United States (US) Nonfarm Payrolls (NFP) data for January, which will be released on Friday.

- The US Dollar Index (DXY), which tracks the Greenback’s value against six major currencies, finds a temporary support near 107.30 after a three-day sell-off and bounces back to near 108.00.

- The official United States (US) employment data is expected to drive market speculation about how long the Federal Reserve (Fed) will hold interest rates at their current levels. Last week, Fed Chair Jerome Powell said that they would make monetary policy adjustments only after seeing “real progress in inflation or at least some weakness in the labor market” after the central bank left interest rates unchanged in the range of 4.25%-4.50%.

- According to the CME FedWatch tool, the Fed is expected to announce its next interest rate cut in June’s policy meeting.

- The US Dollar witnessed a sharp sell-off in the first three trading days of the week as fears of a global trade war receded. Investors expect the trade war to remain between the US and China as the latter retaliated to US President Donald Trump’s imposition of 10% tariffs with 15% levies on Coal and Liquified Natural Gas (LNG) and 10% on Crude Oil, farm equipment and some autos. Meanwhile, President Trump suspended 25% tariff orders on Canada and Mexico for 30 days.

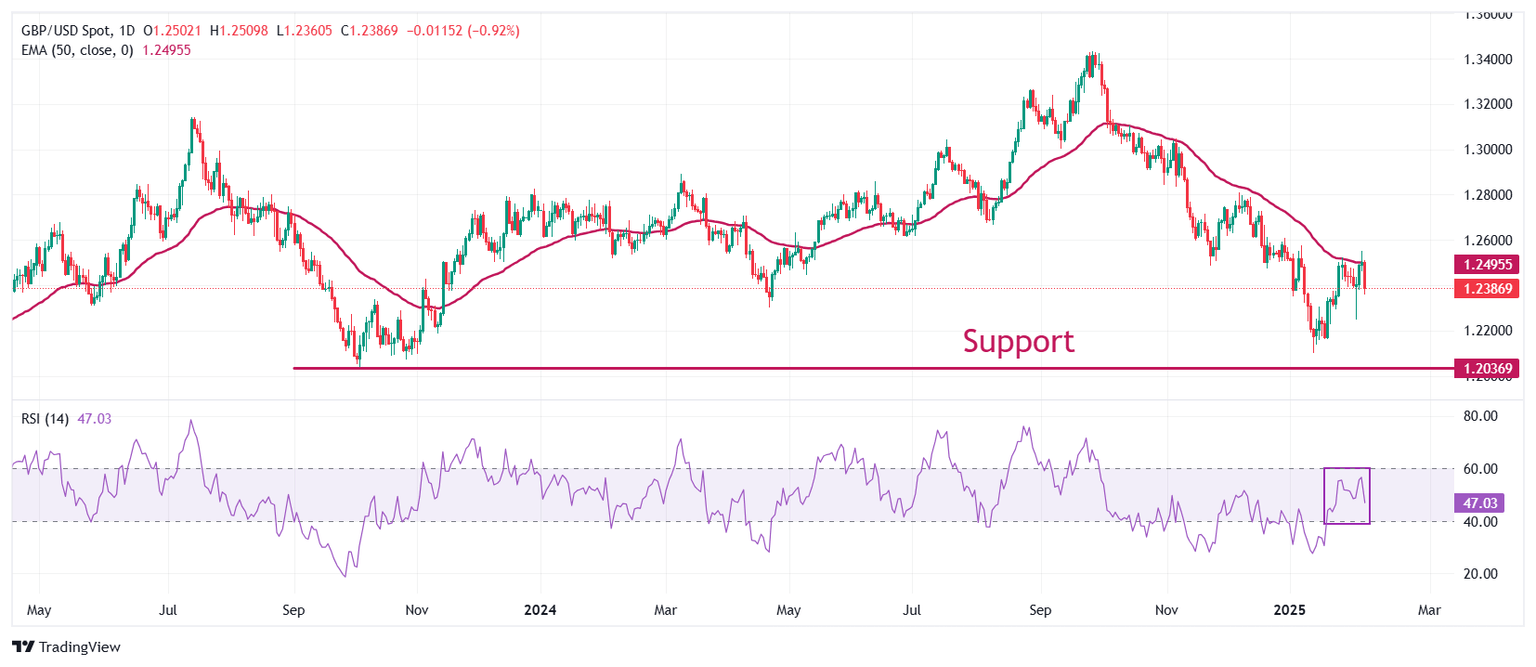

Technical Analysis: Pound Sterling slips below 1.2400

The Pound Sterling dips below the key support of 1.2400 against the US Dollar. The GBP/USD resumed its downside journey after an upside retracement move to near the 50-day Exponential Moving Average (EMA) around 1.2500

The 14-day Relative Strength Index (RSI) oscillates inside the 40.00-60.00 range, suggesting a sideways trend.

Looking down, the January 13 low of 1.2100 and the October 2023 low of 1.2050 will act as key support zones for the pair. On the upside, the December 30 high of 1.2607 will act as key resistance.

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.