Pound Sterling recovers sharply as US Job vacancies come in below estimates

- The Pound Sterling climbs to near 1.3160 against the US Dollar as the Greenback corrects vertically.

- Weak US JOLTS Job Openings data weighs heavily on the US Dollar.

- The BoE’s policy-easing cycle is expected to be shallow for the remainder of the year.

The Pound Sterling (GBP) jumps to near 1.3160 against the US Dollar (USD) in Wednesday’s North American session after falling to near the round-level support of 1.3100. The GBP/USD pair gains strong buying momentum as weak United States (US) JOLTS Job Openings data for July prompted downside risks to labor market. The US Job Openings data showed that fresh job vacancies came in lower at 7.673 million than estimates of 8.1 million and June's reading of 7.91 million, downwardly revised from 8.184 million.

Lower-than-expected US job vacancies report has weighed heavily on the US Dollar. The US Dollar Index (DXY), which tracks the Greenback's value against six major currencies, slumps below 101.40. Downbeat US Job openings data has also prompted expectations for Federal Reserve (Fed) large rate cuts this month. According to the CME FedWatch tool, the likelihood of a 50-basis points (bps) interest rate reduction in September has increased to 47% from 39% after the release of the job vacancies data.

Markets remain fully pricing in that the Fed will pivot to policy normalization this month, but traders were divided about whether the central bank will begin the policy-easing cycle aggressively, with a big interest rate cut, or more gradually.

For more guidance on the interest rate cut path, investors will focus on the US Nonfarm Payrolls (NFP) data for August, which will be published on Friday. The official labor market data will influence market speculation about the size of the Federal Reserve (Fed) interest rate cut in September. If the US NFP data points to a further slowdown in labor demand and higher unemployment, market expectations for the Fed reducing its key borrowing rates by 50 basis points (bps) would increase sharply. In a speech at the latest Jackson Hole (JH) Symposium, Fed Chair Jerome Powell vowed to support the labor market in case it continues to deteriorate. On the contrary, steady or better-than-projected job data would weaken expectations of a big rate cut.

US Dollar PRICE Today

The table below shows the percentage change of US Dollar (USD) against listed major currencies today. US Dollar was the strongest against the Swiss Franc.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.37% | -0.38% | -0.98% | -0.31% | -0.48% | -0.41% | -0.27% | |

| EUR | 0.37% | 0.01% | -0.59% | 0.09% | -0.10% | -0.00% | 0.10% | |

| GBP | 0.38% | -0.01% | -0.59% | 0.08% | -0.10% | 0.01% | 0.07% | |

| JPY | 0.98% | 0.59% | 0.59% | 0.65% | 0.47% | 0.55% | 0.66% | |

| CAD | 0.31% | -0.09% | -0.08% | -0.65% | -0.19% | -0.08% | -0.01% | |

| AUD | 0.48% | 0.10% | 0.10% | -0.47% | 0.19% | 0.09% | 0.20% | |

| NZD | 0.41% | 0.00% | -0.01% | -0.55% | 0.08% | -0.09% | 0.09% | |

| CHF | 0.27% | -0.10% | -0.07% | -0.66% | 0.00% | -0.20% | -0.09% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the US Dollar from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent USD (base)/JPY (quote).

Daily digest market movers: Pound Sterling outperforms US Dollar

- The Pound Sterling outperforms its major peers on Wednesday. The British currency gains strength amid growing speculation that the policy-easing cycle by the Bank of England (BoE) would be shallow in the remainder of this year compared with that of its peer central banks.

- According to money market pricing data, the BoE is expected to cut interest rates by 40 bps in the remaining year, while the European Central Bank (ECB) is projected to cut by 65 bps, Reuters reported. In the same time frame, the Fed is estimated to cut its key borrowing rates by 100 bps, according to the CME FedWatch tool.

- An improving economic outlook in the United Kingdom (UK) and a slower decline in service inflation have supported expectations of the BoE opting for a gradual policy-easing cycle. The UK economy is expected to perform better than initially anticipated due to an expansion in manufacturing as well as the service sector.

- The final estimate for S&P Global/CIPS Composite PMI came in at 53.8 in August, higher than the preliminary release of 53.4. The indicator suggests that the economy grew at the fastest pace since April.

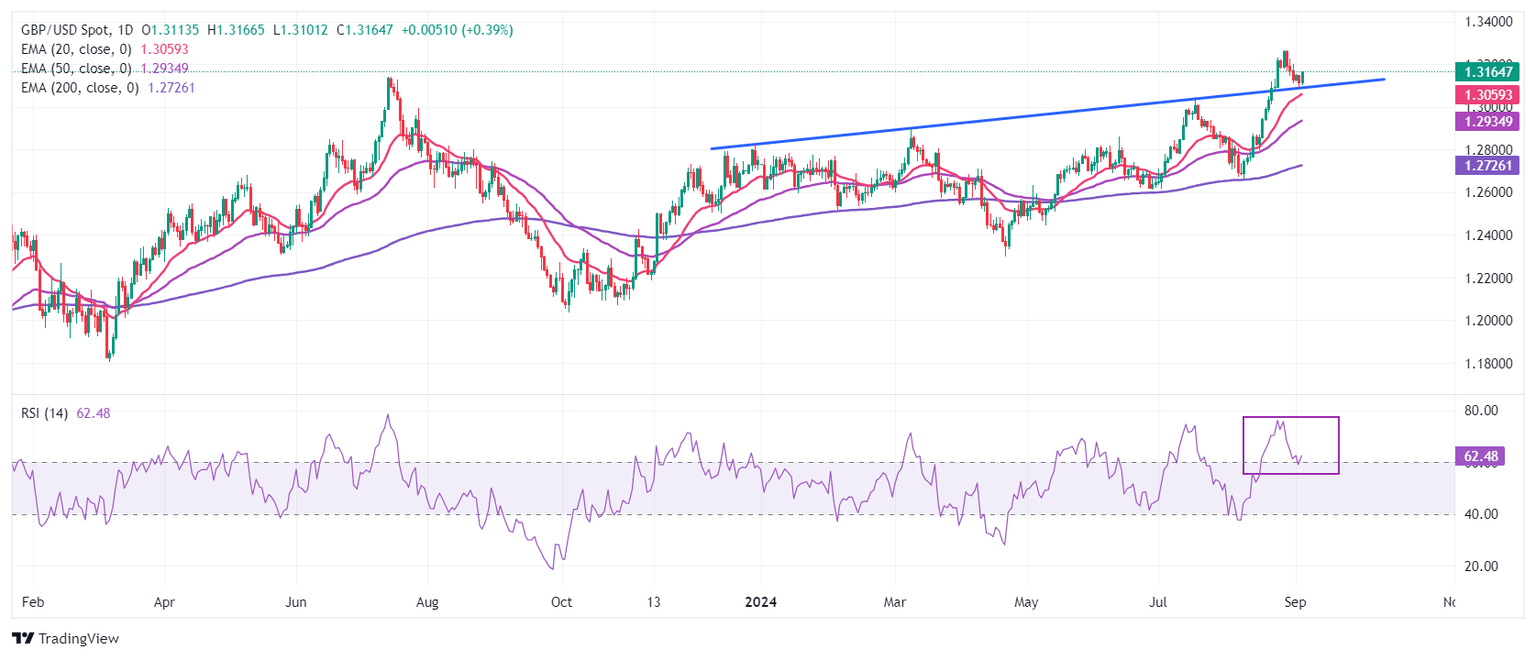

Technical Analysis: Pound Sterling recovers from 1.3100

The Pound Sterling bounces back after posting a fresh weekly low of around 1.3090 against the US Dollar. The GBP/USD pair strengthens after discovering a strong buying interest near the breakout region of an upward-sloping trendline plotted from 28 December 2023 high of 1.2828 on a daily time frame.

Upward-sloping short-to-long-term Exponential Moving Averages (EMAs) suggest a strong bullish trend.

The 14-day Relative Strength Index (RSI) rebounds from 60.00, suggesting a resumption in the bullish momentum.

If bullish momentum resumes, the Cable is expected to rise towards the psychological resistance of 1.3500 and the February 4, 2022, high of 1.3640 after breaking above a fresh two-and-a-half-year high of 1.3266. On the downside, the psychological level of 1.3000 will be the crucial support for the Pound Sterling bulls.

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.